The rising demand for hydrogen fuel cell vehicles, along with stringent safety regulations, is accelerating the growth of the automotive hydrogen sensors industry. These sensors are critical components designed to detect hydrogen leaks, monitor fuel cell performance, and ensure the overall safety of vehicles powered by hydrogen technology. The market features multiple sensing technologies such as electrochemical, catalytic combustion, thermal conductivity, and metal oxide semiconductor sensors, each catering to distinct automotive requirements. The ongoing development of hydrogen fueling networks is fueling the adoption of hydrogen sensors not only in vehicles but also across the broader hydrogen supply chain. Increasing investments in hydrogen-powered transport, particularly in commercial vehicles, are further driving market expansion. Although the COVID-19 pandemic initially disrupted production and delayed R&D projects due to supply chain constraints and reduced industrial activity, it ultimately acted as a catalyst for policy initiatives supporting hydrogen energy and safety advancements, leading to renewed momentum in market recovery and technological innovation.

The electrochemical sensors category captured a 35% share in 2024 and is expected to grow at a CAGR of 10.2% from 2025 to 2034. This segment continues to dominate due to its high precision, sensitivity, and fast response, which are essential in safety-critical automotive systems. Electrochemical sensors operate by using platinum-based electrodes within an electrolyte that produce electrical signals directly proportional to the hydrogen concentration in the environment. They are capable of detecting hydrogen concentrations as low as 1 ppm within seconds, making them ideal for monitoring applications that require accuracy and reliability.

The solid-state sensors segment held a 59% share and is projected to witness a robust CAGR of 14% during 2025-2034. Their dominance is attributed to their durability, compact design, and maintenance-free operation, which align with modern automotive preferences for reliable and long-lasting components. These sensors leverage MEMS and thin-film semiconductor technologies to create micro-scale sensing elements integrated with advanced signal processing and communication features. This approach enhances the robustness and efficiency of hydrogen detection in fuel cell and emission monitoring systems.

Asia-Pacific Automotive Hydrogen Sensors Market held a 51.6% share and is forecasted to grow at a 13% CAGR through 2034. Regional growth is primarily supported by large-scale public investment in hydrogen infrastructure, strong policy backing for zero-emission mobility, and rapid commercialization of hydrogen-powered vehicles. The region’s strategic focus on hydrogen fuel adoption is expected to sustain its leadership position throughout the forecast period.

Key Automotive Hydrogen Sensors Market participants include Honeywell, Bosch, Amphenol Sensors, Continental, Infineon Technologies, Sensata Technologies, New Cosmos Electric, Figaro Engineering, Nissha FIS, and Sensirion. Companies active in the Automotive Hydrogen Sensors Market are implementing innovation-driven strategies to strengthen their global presence. They are heavily investing in research and development to create miniaturized, energy-efficient, and cost-effective sensor solutions tailored for hydrogen-powered vehicles. Strategic collaborations between automotive OEMs and sensor manufacturers are accelerating product development cycles and improving technology integration within fuel cell systems. Firms are also expanding their regional distribution networks and manufacturing capacities to meet the growing demand across emerging hydrogen economies.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Automotive Hydrogen Sensors market report include:- Bosch

- Continental

- Figaro Engineering

- Honeywell

- Nissha FIS

- Sensata Technologies

- Sensirion

- Amphenol Sensors

- Infineon Technologies

- New Cosmos Electric

- TE Connectivity

- Vitesco Technologies

- Custom Sensors Solutions

- NexTech Materials

- NGK Spark Plug

- Nuvoton Technology

- UST Umweltsensortechnik

- UTC Fuel Cells

- Winsen Sensor

- Xensor Integration

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

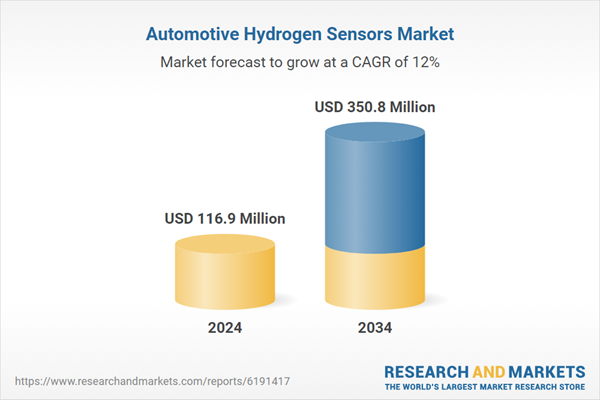

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 116.9 Million |

| Forecasted Market Value ( USD | $ 350.8 Million |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |