The consistent growth of this market is fueled by continuous technological innovation, the surging demand for biopharmaceuticals, and an increasing number of organ transplants across the region. Biomedical refrigerators and freezers are critical for maintaining vaccines, medicines, and biological samples under precise temperature conditions to ensure their safety and effectiveness. The rising prevalence of chronic diseases such as diabetes is further boosting the demand for reliable storage systems for biologics, including insulin. This demand highlights the importance of advanced biomedical storage systems in healthcare infrastructure. Additionally, the aging population in North America is a key factor driving market expansion. Individuals aged 65 years and older are more susceptible to chronic illnesses that often require ongoing treatment involving temperature-sensitive medications and biologics. With this demographic expected to increase from 17% to 23% of the total population, the demand for specialized biomedical refrigeration and freezing solutions is set to grow substantially over the coming decade.

The blood bank refrigerators segment was valued at USD 239 million in 2024 and is projected to reach USD 409.7 million by 2034, expanding at a CAGR of 5.6%. These units are essential for storing blood and its components, such as plasma and platelets, at stable and controlled temperatures. They ensure the quality and usability of blood supplies, making them indispensable in hospitals and transfusion facilities. Within the North American market, blood bank refrigerators represent the fastest-growing category, driven by the increasing demand for safe and reliable storage solutions in healthcare centers and laboratories.

The diagnostic centers segment held a 36.8% share in 2024. Diagnostic laboratories rely heavily on biomedical refrigerators and freezers to preserve biological materials and reagents used in various tests. The growing need for accurate diagnostic testing and secure sample storage is fueling the dominance of this segment. Proper storage conditions are crucial for maintaining the integrity of biological materials such as tissues, blood, and genetic samples, ensuring reliable test results and enhancing clinical efficiency.

United States North America Biomedical Refrigerators and Freezers Market held a 91.1% share in 2024. This dominance is supported by the growing use of biopharmaceuticals and the rising number of organ transplants. Biomedical refrigeration systems are vital in preserving temperature-sensitive materials, including organs, tissues, vaccines, and advanced therapeutic products. The rising frequency of transplant surgeries and the expansion of biopharmaceutical applications are driving the adoption of high-performance biomedical storage systems, contributing significantly to market growth across the country.

Leading companies operating in the North America Biomedical Refrigerators and Freezers Market include PHC, So-Low Environmental Equipment, Lab Research Products, Thermo Fisher Scientific, Follett Products, Stirling Ultracold, Helmer Scientific, Aegis Scientific, B Medical Systems, NuAire, Powers Scientific, Eppendorf, Azbil, and Migali Scientific. Companies in the North America Biomedical Refrigerators and Freezers Market are focusing on technological advancement, product innovation, and strategic partnerships to strengthen their market position. Many are investing in energy-efficient and temperature-stable refrigeration systems equipped with advanced digital monitoring and control features. Manufacturers are also emphasizing product reliability and compliance with stringent medical standards to meet hospital and laboratory requirements. Strategic collaborations with healthcare providers and research institutions are helping expand distribution networks and increase brand presence.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this North America Biomedical Refrigerators and Freezers market report include:- Aegis Scientific

- Azbil

- B Medical Systems

- Eppendorf

- Follett Products

- Helmer Scientific

- Lab Research Products

- Migali Scientific

- NuAire

- PHC

- Powers Scientific

- So-Low Environmental Equipment

- Stirling Ultracold

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | November 2025 |

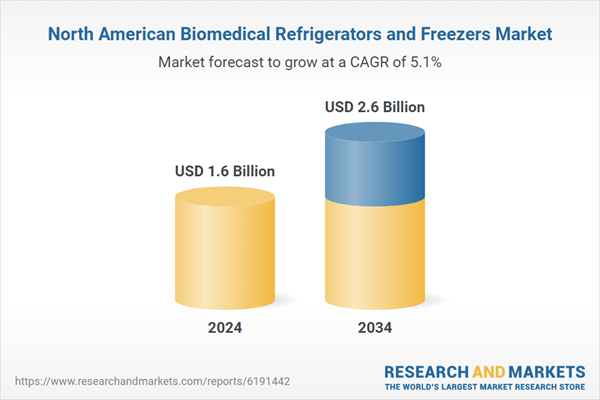

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.6 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 14 |