This consistent growth is driven by several factors, including the rising incidence of infectious and chronic diseases, increasing adoption of precision and personalized healthcare solutions, enhanced government support and healthcare expenditure, and an expanding elderly population. Molecular diagnostics involves analyzing biomarkers in the genome and proteome, such as DNA, RNA, and proteins, to detect and monitor diseases accurately. It is extensively applied for diagnosing genetic disorders, infectious conditions, and cancer due to its precision and effectiveness. Government programs promoting early disease detection and personalized treatment are accelerating the adoption of advanced diagnostic technologies. Increased healthcare funding supports hospitals and laboratories in investing in high-throughput diagnostic platforms and training skilled personnel, further boosting the market.

The polymerase chain reaction (PCR) segment held 70.4% share in 2024. PCR is a fundamental molecular diagnostic technique that amplifies small DNA or RNA sequences, allowing highly sensitive and specific detection of genetic material from pathogens or biomarkers. Variants such as conventional PCR, real-time PCR, and digital PCR provide various levels of accuracy and precision.

The infectious disease diagnostics segment held the largest share at 71.8% in 2024. This segment focuses on detecting pathogens using molecular techniques like PCR, next-generation sequencing (NGS), and microarrays, identifying genetic material responsible for a wide range of infections. High disease prevalence in densely populated regions of China contributes to this segment’s dominance.

The hospitals and clinics segment held a 45.9% share in 2024. Hospitals play a critical role due to their advanced infrastructure, skilled workforce, and access to cutting-edge diagnostic equipment. Their ability to handle complex, high-throughput diagnostic procedures makes them ideal for implementing molecular diagnostic technologies, particularly with increasing rates of chronic diseases and cancer driving patient admissions.

Key players in China Molecular Diagnostics Market include Abbott Laboratories, Biomerieux, Bio-Rad Laboratories, Illumina, Hologic, Qiagen, Sysmex Corporation, Thermo Fisher Scientific, Becton Dickinson and Company, Agilent Technologies, Siemens Healthineers, F. Hoffmann-La Roche, QuidelOrtho Corporation, Biocartis, Pilot Gene, and Rainsure Bio. Companies operating in China Molecular Diagnostics Market are focusing on strategic initiatives to strengthen their presence. They are investing in advanced diagnostic technologies and expanding their product portfolios to meet rising clinical demands. Collaborations and partnerships with local laboratories and hospitals are common to improve market penetration. Firms are also enhancing distribution networks and providing comprehensive training programs for healthcare professionals to ensure efficient adoption of molecular diagnostic tools.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this China Molecular Diagnostics market report include:- Abbott Laboratories

- Agilent Technologies

- Becton, Dickinson- and Company

- Biocartis

- Biomerieux

- Bio-Rad Laboratories

- Danaher Corporation

- F. Hoffmann-La Roche

- Hologic

- Illumina

- Qiagen

- QuidelOrtho Corporation

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific

- Rainsure Bio

- Pilot Gene

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | November 2025 |

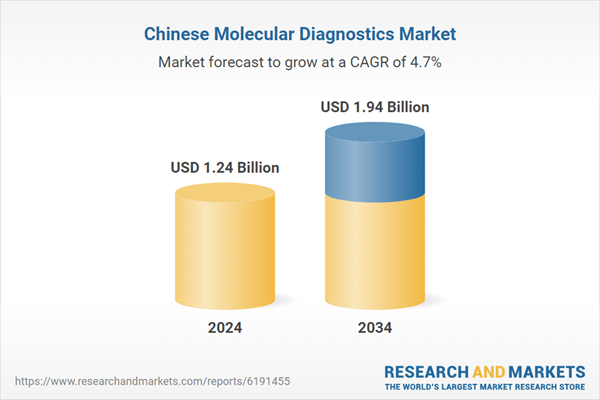

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.24 Billion |

| Forecasted Market Value ( USD | $ 1.94 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | China |

| No. of Companies Mentioned | 18 |