The sector is undergoing transformative changes driven by evolving environmental regulations, shifting consumer expectations, and technological innovations. Packaging companies are adapting to a complex regulatory landscape, with stricter requirements on recyclability, waste management, and chemical safety. Simultaneously, smart and connected packaging is emerging, enabled by Internet of Things (IoT) technologies, allowing packages to communicate real-time information across the supply chain. Raw material suppliers produce flexible substrates, conductive inks, and sensor-compatible materials that maintain traditional packaging functionality while integrating digital features. Brands are increasingly leveraging these innovations to deliver interactive experiences, enhance product visibility, and reinforce sustainability commitments, all while maintaining cost efficiency and scalability across global retail and e-commerce channels.

In 2024, the corrugated boxes and containers segment generated USD 64.3 billion and is expected to grow at a CAGR of 9.7% through 2034. Its popularity stems from versatility, cost-effectiveness, and applicability across retail and online commerce. Corrugated materials are highly recyclable and biodegradable, supporting sustainability goals and meeting consumer preferences. Advances in printing and die-cutting technologies allow brands to create personalized, eye-catching packaging with strong shelf appeal.

The paper and paperboard segment generated USD 63.8 billion in 2024. Paper-based packaging is valued for its recyclability and biodegradability, aligning with both regulatory requirements and eco-conscious consumer behavior. Its adaptability across folding cartons, rigid boxes, and display-ready packaging makes it ideal for a wide range of products, including food, cosmetics, electronics, and apparel.

U.S. Retail Packaging and Display Boxes for Consumer Products Market reached USD 22.3 billion in 2024. Growth is driven by the country’s robust retail and e-commerce infrastructure, along with consumer demand for sustainable and personalized packaging. Regulatory support combined with heightened consumer awareness is prompting manufacturers to focus on recyclable and compostable formats, enhancing both brand reputation and environmental compliance.

Key players in the Global Retail Packaging and Display Boxes for Consumer Products Market include Graphic Packaging International, Stora Enso, DS Smith, Amcor, Mondi Group, Bennett Packaging, BW Packaging Systems, Weedon Direct, Sonoco Products Company, Karl Knauer Group, Georgia-Pacific, Barry-Wehmiller Corporation, Ashtonne Packaging, Smurfit Westrock, and International Paper Company. Companies are strengthening their presence through strategies such as expanding sustainable product lines, investing in advanced printing and die-cutting technologies, and improving supply chain efficiency. Strategic partnerships and acquisitions help broaden geographic reach and customer base. Firms are also focusing on innovation in smart and interactive packaging, developing eco-friendly and cost-effective materials, and enhancing brand customization options.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Retail Packaging and Display Boxes for Consumer Products market report include:- Amcor

- Ashtonne Packaging

- Barry-Wehmiller Corporation

- Bennett Packaging

- BW Packaging Systems

- DS Smith

- Georgia-Pacific

- Graphic Packaging International

- International Paper Company

- Karl Knauer Group

- Mondi Group

- Smurfit Westrock

- Sonoco Products Company

- Stora Enso

- Weedon Direct

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

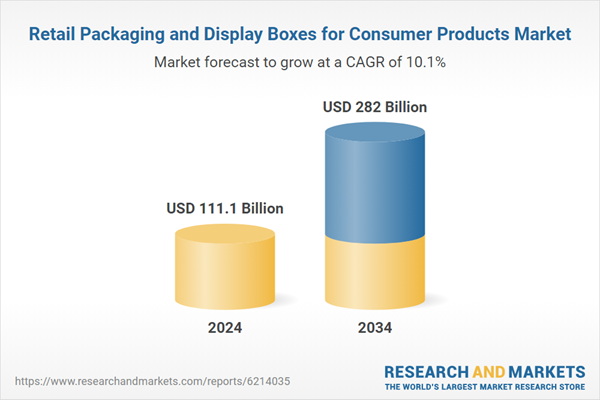

| Estimated Market Value ( USD | $ 111.1 Billion |

| Forecasted Market Value ( USD | $ 282 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |