The market is reshaped by immersive audio technologies, the surge in streaming video, and the integration of artificial intelligence into soundbar systems. Object-based audio formats such as Dolby Atmos and DTS X create three-dimensional soundscapes that surpass traditional surrounding sound experiences. Affordable options for Dolby Atmos soundbars, priced under USD 250, are making high-quality audio more accessible, prompting manufacturers to balance affordability with differentiation strategies. Advanced AI-driven audio processing can isolate dialogue, music, and sound effects on a scene-by-scene basis in real time. With HDMI 2.2 enabling higher bandwidth and Enhanced Audio Return Channel (eARC) supporting high-bitrate audio, consumers can enjoy pristine sound with minimal latency. Next-generation audio frameworks, including Dolby AC-4, MPEG-H, and DTS-UHD, allow metadata-driven rendering for greater playback flexibility. Market research indicates that over 60% of soundbar owners also use their devices to listen to music, highlighting the growing multifunctionality of these products.

The 5-channel soundbar segment accounted for USD 950 million in 2024 and is projected to reach USD 2.33 billion by 2034. These systems deliver true surround sound using left, right, center, and two rear channels, providing superior spatial audio for movies, gaming, and music. As consumers increasingly prioritize immersive audio experiences at home, 5-channel setups are gaining preference over 2- and 3-channel systems.

The tabletop segment generated USD 1.35 billion, capturing a 47.1% share in 2024. Tabletop soundbars are easy to install without tools or drilling, appealing to users who frequently rearrange rooms or live in rented spaces. Their convenience and user-friendly design make them particularly popular with mainstream consumers seeking quick, hassle-free solutions.

U.S. Soundbars Market was valued at USD 2.44 billion in 2024 and is expected to grow at a CAGR of 9.1% from 2025 to 2034. Rising disposable incomes and evolving lifestyles are driving home entertainment spending. Consumer expenditure surveys indicate steady year-over-year growth in spending on entertainment products, reflecting a willingness to invest in premium audio devices for enhanced streaming and gaming experiences.

Key players in the North America Soundbars Market include Denon, LG, Samsung, Polk Audio, Yamaha, Bowers & Wilkins, Bose, Klipsch, JBL, VIZIO, Sonos, Sony, Southern Audio Services, Definitive Technology, and Harman Kardon. Companies are strengthening their positions by developing AI-integrated and object-based audio soundbars, expanding retail and e-commerce distribution channels, and launching cost-effective models for mainstream adoption. Partnerships with streaming platforms and home entertainment brands enhance brand visibility, while continuous innovation in Dolby Atmos, DTS: X, and eARC-enabled products improves product differentiation. Firms also invest in marketing campaigns targeting music and gaming enthusiasts, and in R&D for compact, tabletop solutions to meet urban consumer needs. Strategic pricing, extended warranties, and bundled offerings further increase market share and customer loyalty.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this North America Soundbars market report include:- Bose

- Bowers & Wilkins

- Definitive Technology

- Denon

- Harman Kardon

- JBL

- Klipsch

- LG

- Polk Audio

- Samsung

- Sonos

- Sony

- Southern Audio Services

- VIZIO

- Yamaha

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

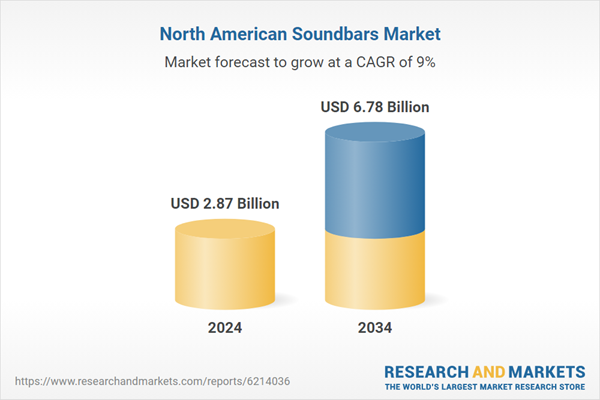

| Estimated Market Value ( USD | $ 2.87 Billion |

| Forecasted Market Value ( USD | $ 6.78 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 16 |