The market expansion is fueled by increasingly complex regulatory frameworks across industries and jurisdictions, driving a strong need for legal expertise. Organizations are compelled to invest heavily in legal counsel, compliance programs, and risk management to address enforcement actions, penalties, and regulatory expectations. The rise in cross-border transactions, international investments, and the globalization of corporations is intensifying demand for sophisticated legal support. Businesses operating across multiple jurisdictions require assistance in compliance, market entry, tax structuring, intellectual property, and dispute resolution. Companies are also expanding in-house legal departments to handle growing regulatory requirements across areas such as privacy, anti-corruption, environmental regulations, and industry-specific compliance, creating sustained demand for legal professionals to develop programs, conduct investigations, manage risks, and meet regulatory standards.

The corporate and commercial services segment was valued at USD 330 billion in 2024 and projected to reach USD 620 billion by 2034 at a CAGR of 6.7%. Growth is driven by globalization, rising foreign direct investment, and an increase in in-house legal expertise, fueling demand for complex M&A, governance, restructuring, and capital markets services.

The large firms segment held a 41% share in 2024 and is projected to grow at a CAGR of 6.9% from 2025 to 2034. These firms specialize in intricate corporate, regulatory, and litigation matters, leveraging scale, global presence, strong branding, technology adoption, and high-value services to maintain competitiveness and profitability, despite the rise of alternative legal service providers handling routine work.

U.S. Legal Services Market held 86% share and generated USD 331 billion in 2024. U.S. organizations are increasingly shifting routine legal work in-house while investing in compliance, risk management, and technology, driving demand for specialized advisory services at higher value levels. The region’s focus on regulatory adherence and complex corporate transactions continues to underpin the demand for premium legal expertise.

Key players operating in the Global Legal Services Market include Clifford Chance, PwC, Ernst & Young (E&Y), KPMG, Baker & McKenzie, DLA Piper, Latham & Watkins, Deloitte, and Kirkland & Ellis. Firms in the Legal Services Market focus on expanding global reach by establishing offices in multiple jurisdictions and leveraging cross-border expertise. Many are investing in technology-driven solutions, including AI-assisted legal research, document automation, and data analytics, to improve efficiency and client service. Strategic partnerships and alliances with consultancy firms, technology providers, and alternative legal service providers allow them to offer integrated, end-to-end solutions. Firms are also concentrating on niche areas such as compliance, risk management, intellectual property, and complex M&A to differentiate themselves. Talent development and retention programs ensure the availability of specialized professionals, while thought leadership initiatives, marketing campaigns, and brand positioning enhance visibility and credibility.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Legal Services market report include:- Allen & Overy / Shearman (A&O Shearman)

- Baker & McKenzie

- Clifford Chance LLP

- DLA Piper

- Freshfields Bruckhaus Deringer

- Hogan Lovells

- Jones Day

- Kirkland & Ellis LLP

- Latham & Watkins LLP

- Linklaters LLP

- Skadden, Arps, Slate, Meagher & Flom LLP

- White & Case LLP

- Eversheds Sutherland

- Herbert Smith Freehills

- Kim & Chang

- Mori Hamada & Matsumoto

- Nishimura & Asahi

- Pinsent Masons

- Simmons & Simmons

- Contract PodAI

- Evisort

- Fenwick & West

- Harvey AI

- Ironclad

- Lexion

- Quinn Emanuel Urquhart & Sullivan

- Wilson Sonsini Goodrich & Rosati

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 240 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

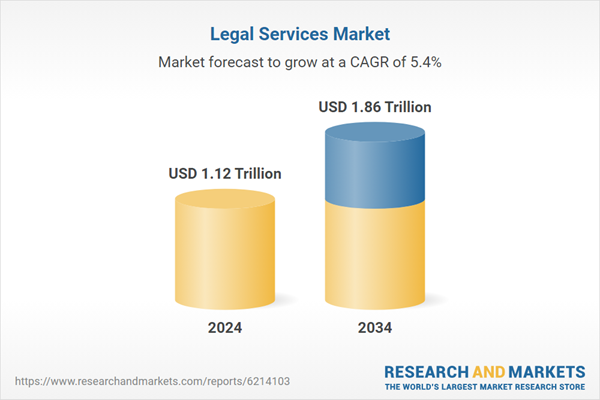

| Estimated Market Value ( USD | $ 1.12 Trillion |

| Forecasted Market Value ( USD | $ 1.86 Trillion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |