Green ammonia is rapidly emerging as a cornerstone of the global energy transition, playing a critical role in energy-chemical value chains by enabling hydrogen storage, coupling with renewable energy, and serving as a zero-carbon fuel for hard-to-decarbonize sectors such as shipping. Its strategic importance lies in leveraging existing ammonia infrastructure to accelerate scale-up while meeting decarbonization targets. Market growth is propelled by supportive policy frameworks, climate neutrality goals, and certification schemes for green energy. Technological advancements, particularly in electrolysis-based hydrogen production powered by renewables, are improving cost efficiency and operational performance. Corporate commitments from energy majors, fertilizer producers, and maritime operators are further driving investment, positioning green ammonia as a key element of long-term sustainability strategies. Regional trends indicate Asia-Pacific leading in renewable capacity and export projects, while Europe benefits from regulatory support and established green hydrogen corridors.

The alkaline water electrolysis (AWE) segment held a 55.3% share in 2024 and is expected to grow at a CAGR of 60.3% through 2034. AWE remains the most cost-effective and mature technology for large-scale renewable energy-linked projects. Proton exchange membrane (PEM) electrolysis offers operational flexibility and rapid response to variable renewable electricity, making it ideal for grid-tied and hybrid energy systems.

The fertilizer production segment held a 44.2% share in 2024 and is projected to grow at a CAGR of 56.2% by 2034. Fermentation-based approaches are well-established for producing bio-platform chemicals, offering high selectivity, mild operating conditions, and efficient production of complex molecules at scale.

North America Green Ammonia Market accounted for a 25.9% share in 2024. The region is emerging as a key production hub due to abundant renewable energy resources, supportive policies, and existing ammonia infrastructure that facilitates rapid adoption of low-carbon alternatives.

Major companies in the Global Green Ammonia Market include Yara International, Siemens Energy, BASF SE, Air Products Inc., Haldor Topsoe, MAN Energy Solutions, Starfire Energy, Technip Energies NV, ThyssenKrupp AG, Nel ASA (Hydrogenics), Hydrogenics, Kapsom, Hiringa Energy, and Uniper ENGIE. Market players are strengthening their position by investing in R&D to improve electrolysis efficiency and reduce production costs. They are forming strategic partnerships with renewable energy providers and industrial consumers to secure long-term offtake agreements. Companies are also exploring modular and large-scale production facilities to optimize logistics and infrastructure utilization. Integration of digital monitoring and advanced control systems is enhancing operational performance and reliability. Additionally, mergers, acquisitions, and joint ventures are being employed to expand geographic footprint, accelerate commercialization, and capture growing demand in both established and emerging green ammonia markets.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Green Ammonia market report include:- Siemens Energy

- ThyssenKrupp AG

- Nel ASA (Hydrogenics)

- Yara International

- Haldor Topsoe

- Air Products Inc

- BASF SE

- Hiringa Energy

- Hydrogenics

- Kapsom

- MAN Energy Solutions

- Starfire Energy

- Technip Energies NV

- Uniper ENGIE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

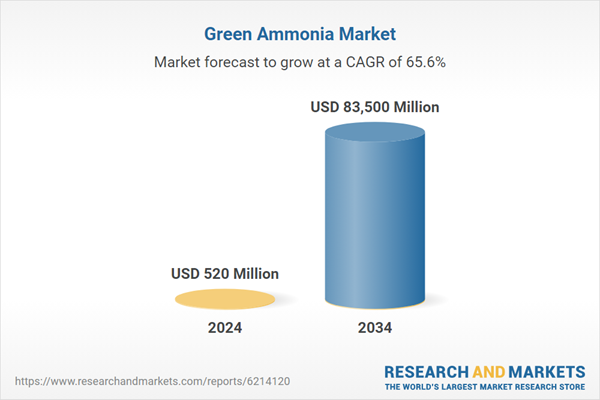

| Estimated Market Value ( USD | $ 520 Million |

| Forecasted Market Value ( USD | $ 83500 Million |

| Compound Annual Growth Rate | 65.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |