The market continues to expand as the share of individuals aged 65 and above increases worldwide, establishing a lasting demand for tailored nutritional solutions. As aging populations grow across both mature and emerging economies, the need for protein sources that support muscle maintenance, mobility, and overall vitality becomes more pressing. Rising cases of malnutrition and sarcopenia - driven by reduced appetite, chronic health conditions, and physiological decline - are reinforcing reliance on specialized dietary interventions. Protein hydrolysates are becoming foundational in geriatric nutrition due to their rapid absorption and superior digestibility compared with intact proteins. Older adults often face weaker digestive function, diminished enzymatic activity, and slower nutrient assimilation, making traditional protein formats difficult to tolerate. Hydrolyzed proteins, therefore, play a vital role in preventing muscle loss, supporting recovery, and helping older individuals maintain functional independence, which ensures sustained demand for advanced therapeutic formulations.

The animal-based segment generated USD 288 million in 2024 and is expected to grow at a CAGR of 7.3% through 2034. Animal-derived hydrolysates continue to hold a dominant position because of their strong amino acid composition and high digestibility, which are essential in elderly-focused nutrition. Their use remains widespread in clinical environments, eldercare nutrition programs, and specialized therapeutic preparations aimed at muscle preservation and metabolic support. Ongoing improvements in hydrolysis efficiency and flavor development are contributing to greater acceptance among older consumers.

The hospital pharmacies segment generated USD 148 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Hospital pharmacies maintain a consistent role in distributing hydrolysate-based clinical nutrition for aging patients who require enhanced dietary support, faster recovery, or easily digestible formulations due to medical limitations. These products are integrated into chronic care management, postoperative nutrition strategies, and inpatient feeding programs, providing reliable access to medically supervised formulations as healthcare systems adapt to aging populations.

North America Geriatric Nutrition Protein Hydrolysates Market held USD 144 million in 2024. Growth in the region remains steady due to the expanding older population, strong clinical nutrition infrastructure, and substantial healthcare spending. Hydrolyzed proteins are widely utilized in managing age-related muscle loss, improving recovery outcomes, and reducing malnutrition in eldercare and medical facilities. Demand for powdered, beverage-based, and senior-targeted nutritional products continues to rise as consumers prioritize healthy aging, while advances in formulation technologies and home-based nutritional care broaden the adoption of these products.

Key companies in the Global Geriatric Nutrition Protein Hydrolysates Market include Arla Foods Ingredients, Kerry Group, Fonterra Co-operative Group, Nestlé Health Science, Royal FrieslandCampina N.V., and others. To strengthen their presence, companies are focusing on specialized formulation development tailored to older adults’ digestive and metabolic needs, emphasizing high bioavailability and improved tolerability. Many are increasing investments in clinical research to validate the efficacy of hydrolysates in preventing muscle loss and enhancing recovery outcomes, which supports medical adoption and regulatory credibility. Expansion of partnerships with hospitals, eldercare networks, and nutritional clinics is helping brands secure consistent demand channels. Companies are also reformulating products with cleaner labels, enhanced flavor profiles, and user-friendly formats such as ready-to-drink options to improve acceptance among seniors.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Geriatric Nutrition Protein Hydrolysates market report include:- Arla Foods Ingredients

- Mead Johnson Nutrition

- Merck KGaA

- Fonterra Co-operative Group

- Agropur Cooperative

- Milk Specialties Global

- Tatua Co-operative Dairy Company

- Royal FrieslandCampina N.V.

- Hilmar Cheese Company

- Kerry Group

- DuPont (Danisco)

- Nestlé Health Science

- Rousselot

- Gelita AG

- Evonik Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

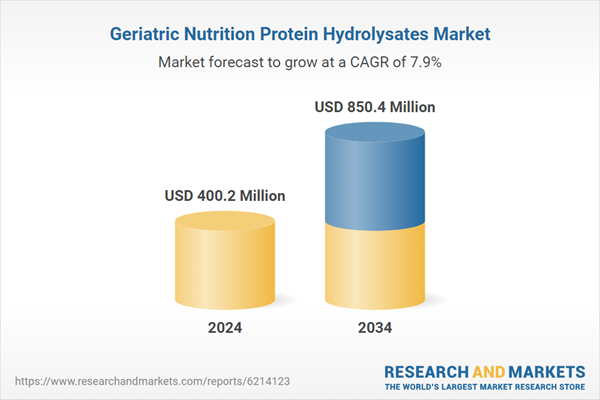

| Estimated Market Value ( USD | $ 400.2 Million |

| Forecasted Market Value ( USD | $ 850.4 Million |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |