Rapid expansion of AI and machine learning workloads across the region is prompting substantial investment in large-scale data center infrastructure. Hyperscale cloud operators are increasingly turning to modular platforms to support facilities requiring power capacities of 50-100 MW and to manage rack densities reaching 20-30 kW. These modular electrical and mechanical systems enable operators to expand capacity in phases, improving capital efficiency. China and India are emerging as major contributors to this shift, supported by surging data consumption and digitalization across finance, e-commerce, and telecommunications. The growing expectation that data centers must be operational within 6-9 months has pushed demand toward modular solutions, which speed deployment by enabling off-site manufacturing while site preparation occurs simultaneously. Scalable designs also allow data center developers to commission initial capacity and add more as utilization increases, reducing unnecessary investment and minimizing stranded assets.

The electrical systems segment held a 53% share in 2024 and is projected to grow at a 20% CAGR through 2034. Electrical systems form the core of modular facilities by ensuring stable, efficient power delivery and continuous operation through redundant backup architecture. Rising rack densities and the shift toward advanced power distribution technologies are strengthening demand for modular UPS platforms, which represent the largest sub-segment. Intelligent PDUs, updated switchgear, and new-generation generator systems further support increasingly complex electrical topologies.

The small modular systems segment will grow at a 22.8% CAGR from 2025 to 2034. They are gaining traction among enterprise users, colocation operators, and distributed edge networks, particularly across tier-2 and tier-3 cities. Their integrated electrical and mechanical structures streamline deployment and enable completion within 3-6 months, making them appealing for scalable regional build-outs.

China Modular Data Center Electrical & Mechanical Equipment Market accounted for a 20% share in 2024, equating to USD 625.5 million. Growth in the country is driven by widespread internet usage, surging cloud adoption, and national digitalization programs. Strong demand from large cloud operators and policy measures encouraging data center development across interior regions continue to reinforce China’s position as a major market force.

Leading companies active in the Asia-Pacific Modular Data Center Electrical & Mechanical Equipment Market include Vertiv, Eaton Corporation, ABB, Huawei Technologies, Schneider Electric, General Electric Company, Delta Electronics, Siemens, Rittal, and Legrand. Companies competing in the Asia-Pacific Modular Data Center Electrical & Mechanical Equipment Market are focusing on strategies that strengthen their regional presence and improve technological competitiveness. Many are expanding modular manufacturing capabilities and establishing localized production hubs to accelerate delivery schedules for operators with aggressive timelines. Firms are enhancing product portfolios by integrating high-efficiency power systems, advanced cooling technologies, and intelligent monitoring platforms to support dense AI-driven workloads. Strategic collaborations with cloud providers, colocation companies, and government-backed digital infrastructure programs help broaden market access.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Asia-Pacific Modular Data Center Electrical and Mechanical Equipment market report include:- ABB

- Eaton Corporation

- GE Vernova

- Legrand

- Panduit

- Rittal

- Schneider Electric

- Siemens

- Stulz

- Vertiv

- Daikin Industries

- Delta Electronics

- Emerson Electric

- Fuji Electric

- Hitachi

- Huawei Technologies

- Mitsubishi Electric

- nVent Electric

- Panasonic Corporation

- Toshiba

- Anhui Coolnet Data Power

- Hefei Coolnet Power

- NTT Data Corporation

- QTS Data Centers

- Shanghai Cooltech Power

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 355 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

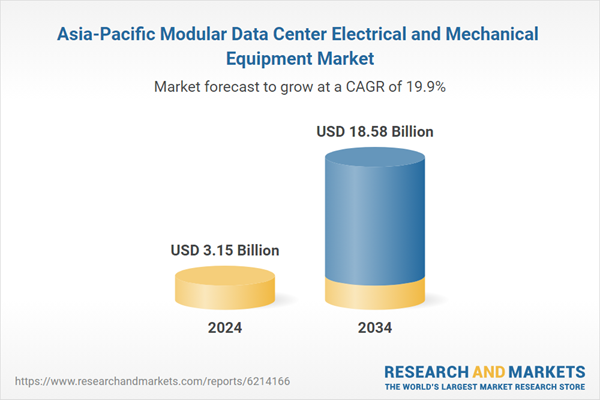

| Estimated Market Value ( USD | $ 3.15 Billion |

| Forecasted Market Value ( USD | $ 18.58 Billion |

| Compound Annual Growth Rate | 19.9% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 25 |