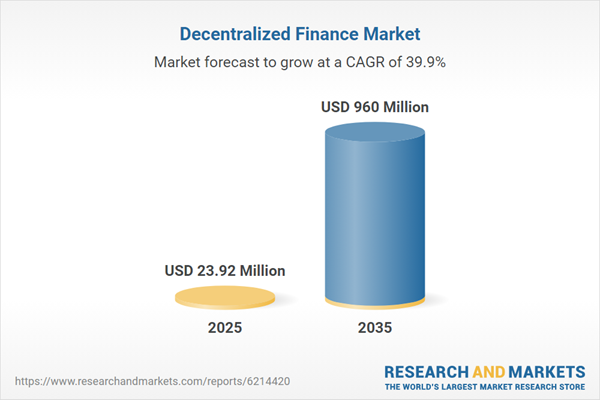

DECENTRALIZED FINANCE MARKET: GROWTH AND TRENDS

At present, approximately 1.7 billion individuals around the globe lack access to financial services, with 1.1 billion of these individuals having mobile phone access. This highlights the transformative combination of finance and blockchain technology. It's important to note that decentralized finance is set to revolutionize the financial sector by enhancing accessibility.Some key benefits of decentralized finance include reduced transaction costs by removing intermediaries, giving users complete control over their assets, and providing 24/7 access to financial services. Moreover, decentralized finance has improved operations by offering deeper insights and more effective solutions to critical challenges in various sectors such as investment banking, insurance, real estate, and supply chain management.

The decentralized finance market is becoming an essential element in the global movement toward innovation and digital transformation aimed at democratizing access to financial services. Natural language processing and blockchain technology are crucial in realizing the full potential of decentralized finance. DeFi facilitates peer-to-peer payments within its systems, enabling users to lend, borrow, trade, and earn interest without relying on conventional financial entities like banks.

Furthermore, innovations such as decentralized autonomous organizations (DAOs) are transforming governance models within various DeFi platforms, encouraging decisions driven by the community. As a result, with ongoing technological progress and an increase in investors, the decentralized finance market is expected to experience significant growth during the forecast period.

DECENTRALIZED FINANCE MARKET: KEY SEGMENTS

Market Share by Type of Component

Based on type of component, the global decentralized finance market is segmented into blockchain technology, decentralized applications and smart contracts in decentralized finance. According to our estimates, currently, the decentralized applications segment captures the majority share of the market.Additionally, this segment is anticipated to grow at a comparatively higher CAGR during the forecast period. Key factors contributing to this leading position include their practical applications and user engagement across different sectors, especially in finance, gaming, and social media.

Market Share by Type of Application

Based on type of application, the decentralized finance market is segmented into asset management, compliance and identity, data analytics, gaming and payments. According to our estimates, currently, the gaming segment captures the majority of the market. Additionally, this segment is anticipated to grow at a comparatively higher CAGR during the forecast period.This can be attributed to various factors including the emergence of play-to-earn models, which enable players to generate real-world value through in-game activities and assets like NFTs.

Market Share by Type of Industry Served

Based on type of industry served, the decentralized finance market is segmented into BFSI, automotive, media & entertainment, retail & E-commerce and others. According to our estimates, currently, BFSI market segment captures the majority share of the market. Additionally, this segment is anticipated to grow at a comparatively higher CAGR during the forecast period.This can be attributed to the essential demand for transparency, efficiency, and accessibility within the sector. DeFi technologies remove intermediaries, which greatly lowers transaction costs and processing times, making it particularly attractive in financial services.

Market Share by Type of Enterprise

Based on type of enterprise, the decentralized finance market is segmented into large and small and medium enterprise. According to our estimates, currently, large enterprise segment captures the majority share of the market. Additionally, this segment is anticipated to grow at a comparatively higher CAGR during the forecast period.This growth can be attributed to their ability to invest in cutting-edge decentralized finance technologies, leverage considerable resources, enhance economies of scale, and stimulate business expansion.

Market Share by Geographical Regions

Based on geographical regions, the decentralized finance market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. However, the market in Asia is expected to grow at a higher CAGR during the forecast period.This growth can be linked to swift technological developments, governmental initiatives aimed at enhancing financial inclusion, and a significant unbanked population in search of accessible financial services. Moreover, countries such as Singapore, Japan, and South Korea are emerging as prominent centers for blockchain innovation, creating a favorable environment for the adoption of cryptocurrencies in the DeFi space.

DECENTRALIZED FINANCE MARKET: RESEARCH COVERAGE

The report on the decentralized finance market features insights on various sections, including:- Market Sizing and Opportunity Analysis: An in-depth analysis of the decentralized finance market, focusing on key market segments, including [A] type of component, [B] type of application, [C] type of industry served, [D] type of enterprise, and [E] geographical regions

- Competitive Landscape: A comprehensive analysis of the companies engaged in the decentralized finance market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the Decentralized finance market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] decentralized finance portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in Decentralized finance industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the decentralized finance domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the decentralized finance market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter’s Five Forces Analysis: An analysis of five competitive forces prevailing in the decentralized finance market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the decentralized finance market.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in decentralized finance market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with the Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aave

- Accenture

- Badger DAO

- Balancer

- Compound Labs

- Curve Finance

- Deloitte

- Hashflow

- IBM

- MakerDAO

- MetaMask

- RisingMax

- Suffescom Solutions

- SushiSwap

- Synthetix

- Uniswap

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | December 2025 |

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 23.92 Million |

| Forecasted Market Value ( USD | $ 960 Million |

| Compound Annual Growth Rate | 39.8% |

| Regions Covered | Global |