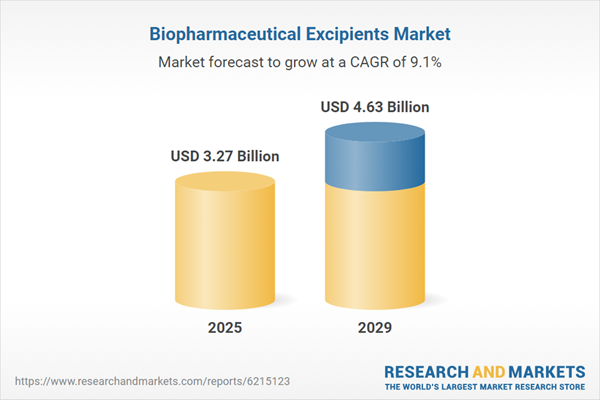

The biopharmaceutical excipients market size is expected to see strong growth in the next few years. It will grow to $4.63 billion in 2029 at a compound annual growth rate (CAGR) of 9.1%. The growth in the forecast period can be driven by growing investment in biopharmaceutical research, rising adoption of personalized medicine, increasing outsourcing to contract manufacturing organizations, expansion of global cold chain infrastructure, and growing focus on advanced formulation development. Major trends in the forecast period include advancements in excipient compatibility testing, innovations in drug delivery technologies, developments in sustainable excipient manufacturing, research and development in novel stabilizers, and advancements in analytical characterization methods.

The increasing demand for vaccine development is expected to drive the growth of the biopharmaceutical excipients market. Vaccine development involves creating and formulating immunizations to prevent infectious diseases and improve public health. High-quality excipients are essential in ensuring the stability, efficacy, and safety of vaccines. The rising demand for vaccines is driven by global efforts to prevent infectious diseases, strengthen public health systems, and accelerate research for faster, more effective immunization solutions. Biopharmaceutical excipients play a critical role in vaccine formulations by stabilizing antigens, enhancing solubility, and maintaining integrity during storage and distribution. For example, in 2025, the Centers for Disease Control and Prevention (CDC) reported that adolescent vaccination coverage for key vaccines, such as tetanus, diphtheria, and acellular pertussis, increased from 89.9% in 2022 to 91.3% in 2024. Coverage for the meningococcal conjugate vaccine rose from 88.6% to 90.1%, and human papillomavirus vaccine coverage grew significantly from 76% to 92.6% over the same period. This surge in immunization coverage is driving the demand for vaccine development and, consequently, the growth of the biopharmaceutical excipients market.

Companies in the biopharmaceutical excipients market are focusing on technological innovations, such as ultra-high purity surfactants, to improve protein stability, prevent degradation, and support regulatory compliance in injectable formulations. These surfactants are specially refined surface-active agents with minimal impurities and consistent composition, ensuring stability, safety, and performance in sensitive biopharmaceutical formulations. For example, in September 2025, Evonik Industries AG, a Germany-based chemicals company, launched MaxiPure Polysorbate 80 for injectable and biopharmaceutical applications. This excipient is engineered with over 98% oleic acid content, exceptional clarity, and full compliance with the European Pharmacopoeia, United States Pharmacopoeia, Japanese Pharmacopoeia, and Chinese Pharmacopoeia standards. It addresses challenges in protein stability, prevents oxidative degradation, enables consistent solubilization of hydrophobic active ingredients, and enhances formulation reliability. By integrating this excipient, Evonik helps pharmaceutical companies develop complex biologics and injectable therapies more efficiently while ensuring safety and regulatory compliance.

In May 2025, Roquette Frères, a France-based provider of pharmaceutical excipients, acquired International Flavors & Fragrances (IFF) Pharma Solutions for an undisclosed amount. This acquisition strengthens Roquette's portfolio of pharmaceutical excipients by integrating IFF Pharma Solutions' expertise and innovative products. The move enhances Roquette's ability to deliver high-value drug delivery solutions and support the development of advanced pharmaceutical formulations worldwide. IFF Pharma Solutions, a U.S.-based company, specializes in pharmaceutical excipients and functional ingredients that aid in drug formulation and delivery within the biopharmaceutical industry.

Major companies operating in the biopharmaceutical excipients market are The Archer-Daniels-Midland Company, BASF SE, The Dow Chemical Company, Mitsubishi Chemical Group Corporation, Novo Nordisk A/S, Associated British Foods plc, Merck KGaA, Asahi Kasei Corporation, Evonik Industries AG, Kerry Group plc, Wacker Chemie AG, Clariant AG, Shin-Etsu Chemical Co. Ltd., Roquette Frères, IMCD Group N.V., Croda International Plc, Ashland Global Holdings Inc., NOF Corporation, Colorcon Limited, J. Rettenmaier & Söhne GmbH + Co. KG, Spectrum Chemical Manufacturing Corporation, BioSpectra Inc., Sigachi Industries Limited, DFE Pharma, FUJIFILM Toyama Chemical Co. Ltd, Kirsch Pharma GmbH, Meggle Group GmbH, InVitria Inc., BOC Sciences Inc.

North America was the largest region in the biopharmaceutical excipients market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in biopharmaceutical excipients report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the biopharmaceutical excipients market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the consequent trade frictions in spring 2025 are severely impacting the pharmaceutical companies contend with tariffs on APIs, glass vials, and lab equipment inputs with few alternative sources. Generic drug makers, operating on razor-thin margins, are especially vulnerable, with some reducing production of low-profit medicines. Biotech firms face delays in clinical trials due to tariff-related shortages of specialized reagents. In response, the industry is expanding API production in India and Europe, increasing inventory stockpiles, and pushing for trade exemptions for essential medicines.

The biopharmaceutical excipients market research report is one of a series of new reports that provides biopharmaceutical excipients market statistics, including the biopharmaceutical excipients industry global market size, regional shares, competitors with the biopharmaceutical excipients market share, detailed biopharmaceutical excipients market segments, market trends, and opportunities, and any further data you may need to thrive in the biopharmaceutical excipients industry. This biopharmaceutical excipients market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Biopharmaceutical excipients are inactive components combined with active pharmaceutical ingredients to support the development, stability, and delivery of biologic drugs. They improve the effectiveness, safety, and shelf-life of biopharmaceutical products without providing any therapeutic action themselves. These excipients consist of various substances such as sugars, polymers, and proteins that assist in drug formulation and administration.

The key product types of biopharmaceutical excipients include binders, coatings, diluents, disintegrants, lubricants and glidants, polyols, preservatives, solubilizers and surfactants or emulsifiers, and suspending and viscosity agents. Binders are materials added to powders or granules in pharmaceutical, food, or material formulations to keep ingredients together, ensuring cohesion and structural integrity in the final product. The different types of biologics include antibodies, vaccines, cell therapies, and others. Their multiple functionalities consist of fillers and diluents, binders, suspending and viscosity agents, flavoring agents and sweeteners, coating agents, colorants, disintegrants, lubricants and glidants, and preservatives. The various applications include injectable formulations, oral formulations, topical formulations, transdermal formulations, and cell and gene therapies, and they are used by several end users such as biopharmaceutical and pharmaceutical companies, contract manufacturers, and research institutes.

The biopharmaceutical excipients market consists of sales of growth media, buffer solutions, stabilizers, cryoprotectants, preservatives, surfactants, salts, amino acids, sugars. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Biopharmaceutical Excipients Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biopharmaceutical excipients market which is experiencing strong growth. the report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biopharmaceutical excipients? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The biopharmaceutical excipients market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Product Types: Binders; Coatings; Diluents; Disintegrants; Lubricants and Glidants; Polyols; Preservatives; Solubilizers and Surfactants or Emulsifiers; Suspending and Viscosity Agents2) By Type of Biologics: Antibodies; Vaccines; Cell Therapies; Other Biologics

3) By Functionality: Fillers and Diluents; Binders; Suspending and Viscosity Agents; Flavouring Agents and Sweeteners; Coating Agents; Colourants; Disintegrants; Lubricants and Glidants; Preservatives

4) By Application: Injectable Formulations; Oral Formulations; Topical Formulations; Transdermal Formulations; Cell and Gene Therapy

5) By End Users: Biopharmaceutical Companies and Pharmaceutical Companies; Contract Manufacturers; Research Institutes

Subsegments:

1) By Binders: Starch Binders; Cellulose Binders; Synthetic Binders; Natural Polymer Binders2) By Coatings: Film Coatings; Sugar Coatings; Enteric Coatings; Polymer Coatings

3) By Diluents: Lactose; Microcrystalline Cellulose; Starch; Mannitol

4) By Disintegrants: Crosslinked Cellulose; Starch Derivatives; Crospovidone; Sodium Starch Glycolate

5) By Lubricants and Glidants: Magnesium Stearate; Stearic Acid; Talc; Silicon Dioxide

6) By Polyols: Sorbitol; Mannitol; Glycerol; Xylitol

7) By Preservatives: Parabens; Benzoates; Sorbates; Phenols

8) By Solubilizers and Surfactants or Emulsifiers: Polysorbates; Polyethylene Glycol; Lecithin; Sodium Lauryl Sulfate

9) By Suspending and Viscosity Agents: Cellulose Derivatives; Xanthan Gum; Guar Gum; Carbomers

Companies Mentioned: the Archer-Daniels-Midland Company; BASF SE; the Dow Chemical Company; Mitsubishi Chemical Group Corporation; Novo Nordisk A/S; Associated British Foods plc; Merck KGaA; Asahi Kasei Corporation; Evonik Industries AG; Kerry Group plc; Wacker Chemie AG; Clariant AG; Shin-Etsu Chemical Co. Ltd.; Roquette Frères; IMCD Group N.V.; Croda International Plc; Ashland Global Holdings Inc.; NOF Corporation; Colorcon Limited; J. Rettenmaier & Söhne GmbH + Co. KG; Spectrum Chemical Manufacturing Corporation; BioSpectra Inc.; Sigachi Industries Limited; DFE Pharma; FUJIFILM Toyama Chemical Co. Ltd; Kirsch Pharma GmbH; Meggle Group GmbH; InVitria Inc.; BOC Sciences Inc.

Companies Mentioned

The companies profiled in this Biopharmaceutical Excipients market report include:- The Archer-Daniels-Midland Company

- BASF SE

- The Dow Chemical Company

- Mitsubishi Chemical Group Corporation

- Novo Nordisk A/S

- Associated British Foods plc

- Merck KGaA

- Asahi Kasei Corporation

- Evonik Industries AG

- Kerry Group plc

- Wacker Chemie AG

- Clariant AG

- Shin-Etsu Chemical Co. Ltd.

- Roquette Frères

- IMCD Group N.V.

- Croda International Plc

- Ashland Global Holdings Inc.

- NOF Corporation

- Colorcon Limited

- J. Rettenmaier & Söhne GmbH + Co. KG

- Spectrum Chemical Manufacturing Corporation

- BioSpectra Inc.

- Sigachi Industries Limited

- DFE Pharma

- FUJIFILM Toyama Chemical Co. Ltd

- Kirsch Pharma GmbH

- Meggle Group GmbH

- InVitria Inc.

- BOC Sciences Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | December 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.27 Billion |

| Forecasted Market Value ( USD | $ 4.63 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |