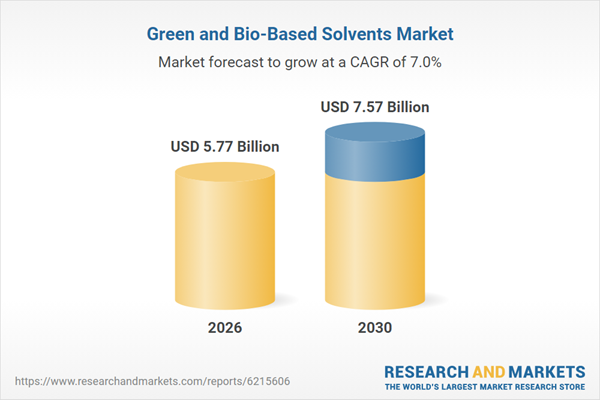

The green and bio-based solvents market size is expected to see strong growth in the next few years. It will grow to $7.57 billion in 2030 at a compound annual growth rate (CAGR) of 7%. The growth in the forecast period can be attributed to carbon footprint reduction targets, expansion of sustainable manufacturing, consumer preference for green products, innovation in bio solvent performance, pharmaceutical sector demand. Major trends in the forecast period include rising replacement of petroleum solvents, growing adoption in industrial cleaning, expansion of bio based paint and coating solutions, increasing regulatory push for low toxicity solvents, higher demand from personal care formulations.

The rising consumer demand for eco-friendly and sustainable products is expected to drive the growth of the green and bio-based solvents market in the coming years. Eco-friendly and sustainable products are goods designed, produced, and used in ways that minimize environmental impact, conserve natural resources, and promote long-term ecological balance. This growing demand is driven by increasing environmental awareness, as consumers recognize the effects of their purchasing choices on the planet and seek products that minimize harm to ecosystems. Green and bio-based solvents support this trend by providing safer, renewable, and environmentally responsible alternatives to traditional petroleum-based solvents, reducing chemical hazards and minimizing ecological impact. For example, in April 2024, Nutraceuticals World, a U.S.-based media company, reported that in 2023, sales of natural and organic products increased by 4.8 percent, reaching $209 billion. Therefore, rising consumer demand for eco-friendly and sustainable products is driving growth in the green and bio-based solvents market.

Leading companies in the green and bio-based solvents market are focusing on developing innovative solutions, such as carbon-neutral solvent portfolios, to meet the increasing demand for sustainable chemical alternatives. A carbon-neutral solvent portfolio includes solvents whose overall carbon emissions are balanced or offset, ensuring that production and use have a net-zero impact on the climate. For instance, in January 2024, Solvay S.A., a France-based chemical company, launched the Augeo carbon-neutral portfolio at the American Cleaning Institute’s 2024 Annual Meeting. The portfolio includes solvents made entirely from renewable feedstocks that are readily biodegradable and formulated with low VOC (LVP VOC) systems. These products support cleaning and fragrance applications by offering strong solubilization power, low odor, slow evaporation, and a certified carbon-neutral lifecycle through high-quality offsets and renewable feedstock sourcing. The portfolio is designed to replace conventional petrochemical cleaning solvents while providing a lower carbon footprint and enhanced sustainability credentials.

In February 2025, ERM International Group Limited, a UK-based company promoting the integration and adoption of green solvents including bio-based and recycled carbon solvents, partnered with Ayming to advance the adoption of green solvents in sustainable pharmaceutical manufacturing. The partnership aims to establish a supply-chain consortium and develop innovative solutions to reduce greenhouse gas emissions and promote eco-friendly practices in pharmaceutical production. Ayming UK Limited is a UK-based professional services company.

Major companies operating in the green and bio-based solvents market are Cargill Incorporated, Archer Daniels Midland Company, BASF SE, LyondellBasell Industries Holdings B.V., Sasol Limited, DowDuPont Inc., Arkema Group, IOI Oleochemical Industries Berhad, Dow Huntsman Corporation, Solvay S.A., Symrise AG, Braskem S.A., Genomatica Inc., Avantium N.V., LanzaTech Inc., Licella Holdings Pty Ltd, Novvi LLC, Vertec Biosolvents Inc., KLK OLEO Sdn Bhd, Zenfold Sustainable Technologies Inc.

North America was the largest region in the green and bio-based Solvents market in 2025. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the green and bio-based solvents market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the green and bio-based solvents market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The green and bio-based solvents market consists of sales of vegetable oil-derived solvents, terpene-based solvents, furanic solvents, organic acid esters, and sugar-derived solvents. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Green and Bio-Based Solvents Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses green and bio-based solvents market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase::

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for green and bio-based solvents? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The green and bio-based solvents market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Report Scope

Markets Covered:

1) By Type: Bio-Alcohols; Bio-Glycols; Bio-Diols; Ethyl Lactate; D-Limonene; Methyl Soyate2) By Application: Paints and Coatings; Industrial and Domestic Cleaning; Printing Inks; Adhesives and Sealants; Pharmaceutical; Cosmetics; Agriculture; Other Applications

3) By End-Use: Automotive; Construction; Packaging; Personal Care; Electronics; Other End-Uses

Subsegments:

1) By Bio-Alcohols: Ethanol; Isopropanol; Butanol; Propanol2) By Bio-Glycols: Ethylene Glycol; Propylene Glycol; Butylene Glycol; Glycerol

3) By Bio-Diols: Ethylene Diol; Propylene Diol; Butylene Diol; Hexylene Diol

4) By Ethyl Lactate: Food Grade; Industrial Grade; Cosmetic Grade

5) By D-Limonene: Orange Peel Extract; Citrus Oil Derived; Technical Grade D-Limonene; Refined D-Limonene

6) By Methyl Soyate: Industrial Grade; Cosmetic Grade; Cleaning Grade

Companies Mentioned: Cargill Incorporated; Archer Daniels Midland Company; BASF SE; LyondellBasell Industries Holdings B.V.; Sasol Limited; DowDuPont Inc.; Arkema Group; IOI Oleochemical Industries Berhad; Dow Huntsman Corporation; Solvay S.a.; Symrise AG; Braskem S.a.; Genomatica Inc.; Avantium N.V.; LanzaTech Inc.; Licella Holdings Pty Ltd; Novvi LLC; Vertec Biosolvents Inc.; KLK OLEO Sdn Bhd; Zenfold Sustainable Technologies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Green and Bio-Based Solvents market report include:- Cargill Incorporated

- Archer Daniels Midland Company

- BASF SE

- LyondellBasell Industries Holdings B.V.

- Sasol Limited

- DowDuPont Inc.

- Arkema Group

- IOI Oleochemical Industries Berhad

- Dow Huntsman Corporation

- Solvay S.A.

- Symrise AG

- Braskem S.A.

- Genomatica Inc.

- Avantium N.V.

- LanzaTech Inc.

- Licella Holdings Pty Ltd

- Novvi LLC

- Vertec Biosolvents Inc.

- KLK OLEO Sdn Bhd

- Zenfold Sustainable Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 5.77 Billion |

| Forecasted Market Value ( USD | $ 7.57 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |