Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry faces significant obstacles due to strict environmental regulations and the accelerating shift toward low-carbon energy sources. Regulatory authorities are increasingly imposing rigorous standards on emissions and flaring during testing operations, which raises compliance costs and adds logistical complexity for service providers. This regulatory pressure forces companies to invest substantially in greener technologies, potentially compressing profit margins and hindering the rapid expansion of traditional testing projects, particularly in jurisdictions with high environmental sensitivity.

Market Drivers

The increase in deepwater and ultra-deepwater projects serves as a pivotal driver for the industry, creating a demand for advanced solutions to handle complex reservoir conditions. As operators venture into deeper frontiers, the need for precise data regarding fluid properties, pressure, and temperature becomes crucial for ensuring safety and assessing commercial viability. This trend is defined by high-value investments in offshore jurisdictions that require thorough appraisal before full-scale production begins. For example, TotalEnergies announced in October 2024 that it had sanctioned the GranMorgu deepwater project in Suriname with an estimated total investment of USD 10.5 billion, demonstrating how capital-intensive offshore developments directly increase reliance on high-specification testing services to mitigate risks and optimize performance.Furthermore, rising capital expenditure in upstream exploration and production activities propels market growth by increasing the volume of assets that require evaluation. Service providers benefit from the financial commitment of major energy corporations to sustain output levels and replace reserves, ensuring a continuous pipeline of drilling and completion operations. Highlighting this trend, Saudi Aramco reported in November 2024 that its capital expenditures for the third quarter reached USD 13.2 billion, reflecting a strategic emphasis on enhancing upstream capacity. This capital flow ensures that essential appraisal phases remain funded despite fluctuating commodity prices, while the physical scale of activity - evidenced by Baker Hughes reporting an average international rig count of 947 in September 2024 - supports the persistent demand for testing services across various regions.

Market Challenges

The Global Well Testing Services Market is hindered by stringent environmental regulations and the rapid transition toward low-carbon energy sources. As regulatory bodies enforce strict standards regarding emissions and flaring, service providers are forced to absorb increased compliance costs and manage complex logistical challenges. Although traditional well testing methods often release greenhouse gases, evolving mandates now require companies to invest significantly in advanced abatement technologies. This necessary shift in capital allocation compresses profit margins and restricts the resources available for expanding traditional service offerings, particularly in jurisdictions with aggressive decarbonization goals.This tightening regulatory landscape creates a difficult environment for rapid market expansion, as operators encounter delays in securing permits for appraisal activities. The extent of this compliance pressure is illustrated by recent industry metrics; according to the American Petroleum Institute, the number of references to its technical standards in global laws and regulations reached 1,395 in 2025, representing a 20% increase compared to the previous assessment. This rise in regulatory incorporation underscores the growing operational constraints placed on service providers, directly impeding their ability to execute testing projects efficiently and restricting overall market growth.

Market Trends

The Integration of Real-Time Data Acquisition and IoT-Enabled Monitoring is fundamentally transforming the sector by enabling immediate decision-making capabilities that were previously unattainable with batched data processing. Operators are increasingly prioritizing digital solutions that update reservoir models instantaneously during operations, allowing for dynamic adjustments to well placement and testing parameters. This shift toward live data integration diminishes geological uncertainty and improves the precision of asset evaluation, moving the market away from static reporting. For instance, Halliburton announced in May 2024 that Wintershall Dea utilized its Unified Ensemble Modeling solution to integrate static and dynamic data in real-time, enabling the operator to continuously update earth models and risk assessments while drilling.Simultaneously, the Adoption of Zero-Flaring and Green Well Testing Solutions is gaining traction as service providers deploy advanced hardware to eliminate surface emissions and reduce operational footprints. This trend involves replacing traditional combustion-based testing methods with closed-loop systems that capture and process hydrocarbons directly, thereby aligning technical operations with strictly defined corporate sustainability mandates. This technological evolution significantly mitigates environmental impact while maintaining data quality, effectively phasing out conventional burner booms in sensitive regions. According to SLB, in July 2024, the company introduced the Ora intelligent wireline formation testing platform, which allows operators to evaluate zonal deliverability with zero flaring, successfully reducing carbon emissions by up to 96% compared to conventional drillstem testing methods.

Key Players Profiled in the Well Testing Services Market

- Akamai Technologies, Inc.

- Cloudflare, Inc.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Fastly, Inc.

- Gcore

- KeyCDN LLC

- CDN77

- Limelight Networks, Inc.

- ChinaCache International Holdings Ltd.

Report Scope

In this report, the Global Well Testing Services Market has been segmented into the following categories:Well Testing Services Market, by Services:

- Downhole Testing

- Surface Testing

- Reservoir Sampling

- Real Time Testing

- Hydraulic Fracturing Method Testing

Well Testing Services Market, by Well type:

- Horizontal Wells

- Vertical Wells

Well Testing Services Market, by Stage:

- Exploration

- Appraisal

- Development Production

Well Testing Services Market, by Application:

- Onshore

- Offshore

Well Testing Services Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Well Testing Services Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Well Testing Services market report include:- Akamai Technologies, Inc.

- Cloudflare, Inc.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Fastly, Inc.

- Gcore

- KeyCDN LLC

- CDN77

- Limelight Networks, Inc.

- ChinaCache International Holdings Ltd.

Table Information

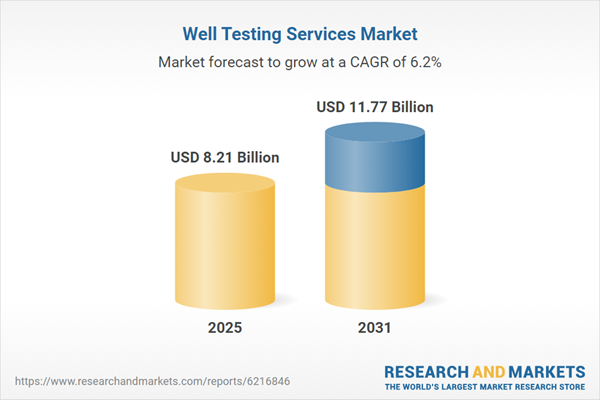

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 8.21 Billion |

| Forecasted Market Value ( USD | $ 11.77 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |