Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry faces a major hurdle regarding the substantial capital expenditure required for sophisticated testing instrumentation. The high cost of acquiring complex measurement tools restricts market entry for smaller entities and limits the scalability of operations for existing firms. This financial strain can prevent service providers from upgrading facilities quickly enough to match technological speeds, potentially delaying the commercialization of new wireless solutions and slowing overall market growth.

Market Drivers

The rapid deployment of 5G and 6G network infrastructures serves as a primary catalyst for the wireless testing market. As operators transition to standalone 5G and explore sub-terahertz frequencies, the demand for high-frequency testing equipment increases. This expansion requires rigorous validation of base stations and massive MIMO systems to maintain signal integrity. According to the 'Ericsson Mobility Report' from June 2024, global 5G subscriptions increased by 160 million in the first quarter of 2024 to reach 1.7 billion. This widespread adoption compels manufacturers to scale protocols to handle heavier user loads, thereby sustaining the demand for testing solutions.The exponential growth of the Internet of Things ecosystem further fuels this momentum by diversifying the range of devices requiring certification. IoT devices operate across various protocols that demand specialized testing for energy efficiency and interoperability. Manufacturers must validate connectivity stability for critical applications in automation and healthcare to ensure reliable performance. The GSMA's 'The Mobile Economy 2024' report from February 2024 notes that cellular IoT connections reached 3.5 billion at the end of 2023, reflecting the volume of endpoints needing verification. To support these networks, infrastructure spending remains high; CTIA reported in 2024 that the United States wireless industry invested $30 billion into network development during the previous year.

Market Challenges

The Global Wireless Testing Market encounters a significant barrier due to the high capital expenditure required for advanced testing instrumentation. The cost of acquiring and maintaining complex measurement tools creates a difficult entry point for smaller entities and limits the operational scalability of existing firms. This financial burden restricts the ability of service providers to upgrade their facilities at a pace that matches the rapid evolution of wireless technologies. Consequently, the high cost of ownership for validation systems reduces the number of capable testing labs, potentially creating bottlenecks in the certification process for new devices.The intensity of these financial requirements is reflected in the massive investment figures seen across the wider wireless infrastructure sector. According to CTIA, in 2024, the U.S. wireless industry reported a capital investment of $30 billion during the preceding year. This magnitude of spending highlights the expensive nature of deploying and validating network technology, which directly strains the budgets allocated for testing equipment. When companies cannot sustain these high investment levels, the commercialization of new wireless solutions is delayed, hampering the overall expansion of the market.

Market Trends

The integration of AI and Machine Learning in Test Automation is revolutionizing how service providers handle the increasing complexity of wireless networks. As 5G systems introduce dynamic spectrum sharing and massive MIMO configurations, traditional manual testing methods are becoming insufficient. Operators are deploying AI-driven algorithms to automatically generate test cases, predict network failures, and optimize resource allocation, thereby significantly reducing the time-to-market for new services. This shift toward intelligent automation allows for continuous testing pipelines that adapt in real-time to network changes; according to Nvidia's 'State of AI in Telecommunications' report from February 2025, 49 percent of telecom respondents reported actively using AI in their operations, indicating a widespread transition toward automated and intelligent network management workflows that necessitate advanced testing protocols.Simultaneously, the market is experiencing a decisive focus on 5G Standalone (SA) and Network Slicing Validation. Moving beyond initial Non-Standalone deployments, the industry is prioritizing the certification of cloud-native 5G cores which support critical features like ultra-low latency and service isolation. This transition requires rigorous testing solutions capable of verifying end-to-end network slicing performance to ensure that specific quality of service guarantees are met for industrial and enterprise applications. The scale of this architectural shift is substantial, creating a surge in demand for specialized validation equipment; according to the Global mobile Suppliers Association's 'Global 5G Investment and Deployment Trends 2025-2026' report from December 2025, 181 operators in 73 countries are investing in public 5G standalone networks, underscoring the massive global requirement for infrastructure compliance and performance testing.

Key Players Profiled in the Wireless Testing Market

- SGS Group

- Anritsu Corporation

- Bureau Veritas

- DEKRA SE

- Rohde & Schwarz GmbH & Co.

- Anritsu Corporation

- Electro Magnetic Test, Inc.

Report Scope

In this report, the Global Wireless Testing Market has been segmented into the following categories:Wireless Testing Market, by Offerings:

- Equipment

- Services

Wireless Testing Market, by Technology:

- Bluetooth

- Wi-Fi

- 4G/LTE

- 5G

Wireless Testing Market, by Application:

- Consumer Electronics

- Automotive

- IT

- Telecommunication

Wireless Testing Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wireless Testing Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Wireless Testing market report include:- SGS Group

- Anritsu Corporation

- Bureau Veritas

- DEKRA SE

- Rohde & Schwarz GmbH & Co.

- Anritsu Corporation

- Electro Magnetic Test, Inc.

Table Information

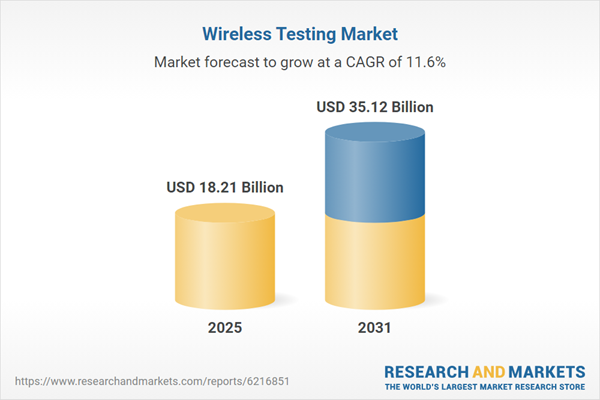

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 18.21 Billion |

| Forecasted Market Value ( USD | $ 35.12 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |