Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry faces significant hurdles related to the cybersecurity risks associated with connected mobility. As digitization in vehicles advances, criminals are leveraging software vulnerabilities through techniques like relay attacks, thereby reducing the efficacy of conventional electronic defenses. The ongoing requirement for sophisticated, high-security updates increases manufacturing costs, which presents a barrier to integrating these systems into price-sensitive, entry-level vehicle categories.

Market Drivers

Rigorous government security mandates function as a major propellant for the market, with regulators stepping in to mitigate the economic fallout of organized vehicle theft. Authorities are establishing strict compliance standards and dedicating substantial resources to dismantling international theft rings, thereby forcing manufacturers to adopt robust security architectures. This regulatory push is underscored by significant public funding aimed at tightening supply chain security; for instance, Public Safety Canada's October 2025 update to the 'National Action Plan on Combatting Auto Theft' confirmed a $28 million investment to bolster border services' ability to intercept stolen automobiles at shipping ports.Simultaneously, the incorporation of artificial intelligence and biometric technologies addresses the rising complexity of modern criminal tactics. With standard mechanical locks becoming less effective, the industry is shifting toward digital countermeasures designed to combat high-tech threats like signal jamming and relay attacks, which exploit keyless entry systems. The urgency of this shift is highlighted by Tracker Network (UK), which noted in its February 2025 analysis that 97% of the vehicles it recovered the prior year were taken using keyless compromise methods. Despite these advancements, the sheer volume of theft creates sustained demand, as evidenced by the National Insurance Crime Bureau's March 2025 report stating that 850,708 vehicles were stolen across the United States in 2024.

Market Challenges

The central obstacle impeding the market is the widespread prevalence of cybersecurity flaws within the infrastructure of connected mobility. As vehicle operation becomes increasingly dependent on digital interfaces, cars are becoming more vulnerable to non-invasive theft techniques, such as signal jamming and relay attacks. These software vulnerabilities enable perpetrators to circumvent standard electronic security measures without using physical force, diminishing trust in traditional protections and compelling manufacturers to maintain a costly and continuous cycle of defensive software updates.This requirement for perpetual technological reinforcement drastically increases research and development expenses, which in turn raises the production cost per unit. The financial burden of addressing these vulnerabilities makes it difficult to equip budget-friendly, entry-level vehicles with sufficient security features. As reported by the Association of British Insurers in 2025, motor insurance payouts hit a record £11.7 billion for the previous year, a figure driven partly by soaring theft claim costs and complex repairs; these high liability and implementation costs restrict the broader inclusion of advanced anti-theft systems in mass-market vehicles, thereby constraining total market growth.

Market Trends

The rise of Automotive Cybersecurity for Software-Defined Vehicles marks a pivotal change in how manufacturers defend connected fleets against large-scale digital risks. In contrast to physical theft, contemporary attacks target the centralized data frameworks of Software-Defined Vehicles (SDVs), spurring the industry-wide implementation of cloud-based defenses and Vehicle Security Operation Centers (vSOCs). This shift is necessary due to the increasing scale of remote breaches capable of disabling large numbers of vehicles simultaneously; according to the '2025 Global Automotive Cybersecurity Report' by Upstream Security in February 2025, massive-scale cyber incidents affecting thousands to millions of units more than tripled to constitute 19% of all recorded automotive attacks in 2024, driving the move toward fleet-wide, AI-driven security.Concurrently, the expansion of IoT-Enabled Real-Time Remote Monitoring is shifting the industry focus from passive prevention to active, data-driven recovery. This trend relies on advanced telematics units that maintain cellular connectivity with command centers, enabling precise tracking of stolen assets even when they are concealed in shipping containers or enclosed buildings. By utilizing detailed data streams, these systems allow for swift law enforcement response, reducing losses for fleet operators and insurers more effectively than standalone alarms. Highlighting the success of this approach, Ituran Location and Control reported in an October 2025 press release that its IoT-based recovery network successfully retrieved approximately $300 million in stolen asset value during 2024.

Key Players Profiled in the Vehicle Anti-Theft System Market

- Continental AG

- Robert Bosch GmbH

- DENSO Corporation

- Lear Corporation

- Mitsubishi Electric Corporation

- Valeo SA

- ZF Friedrichshafen AG

- Tokai Rika Co., Ltd.

- VOXX International Corporation

- U-Shin Ltd.

Report Scope

In this report, the Global Vehicle Anti-Theft System Market has been segmented into the following categories:Vehicle Anti-Theft System Market, by Vehicle Type:

- Passenger Cars

- Commercial Vehicle and OTR

Vehicle Anti-Theft System Market, by Product:

- Alarm

- Passive Keyless Entry

- Immobilizer

- Steering Lock

- Biometric Capture Device and Central Locking System

Vehicle Anti-Theft System Market, by Technology:

- Face Detection System

- Real-Time Location System

- Positioning System

- Remote Frequency Identification Device

- Automotive Biometric Technology and Others

Vehicle Anti-Theft System Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Vehicle Anti-Theft System Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Vehicle Anti-Theft System market report include:- Continental AG

- Robert Bosch GmbH

- DENSO Corporation

- Lear Corporation

- Mitsubishi Electric Corporation

- Valeo SA

- ZF Friedrichshafen AG

- Tokai Rika Co., Ltd.

- VOXX International Corporation

- U-Shin Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

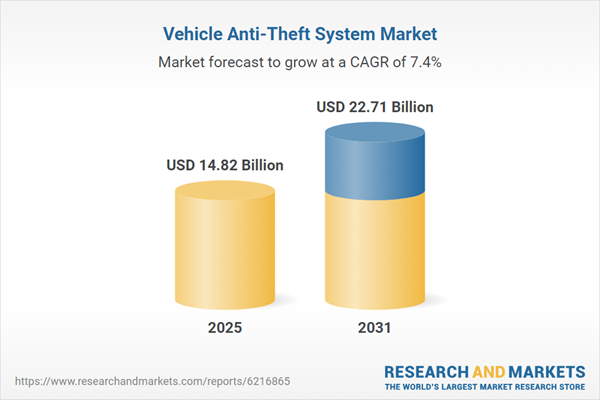

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 14.82 Billion |

| Forecasted Market Value ( USD | $ 22.71 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |