Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the sector encounters significant hurdles related to the environmental footprint of chemical solvents used during the regeneration process, which invites regulatory scrutiny and demands expensive closed-loop production systems. These complexities can impede rapid capacity growth when compared to synthetic options. According to the Textile Exchange, global viscose fiber production volume reached 6.3 million tonnes in 2023, as reported in 2024. This statistic emphasizes the fiber's significant yet restricted standing within the expansive global fiber marketplace.

Market Drivers

The Global Viscose Staple Fiber market is being fundamentally transformed by the rising demand for biodegradable and eco-friendly textile options, as brands prioritize sustainable sourcing to lower their environmental impact. This movement is hastening the transition from fossil-based synthetics to cellulosic fibers, compelling manufacturers to utilize certified wood pulp and establish transparent supply chains to satisfy rigorous consumer standards. Consequently, incorporating verified sustainable feedstocks has emerged as a crucial competitive advantage for fiber producers seeking contracts with major fashion retailers. According to the 'Materials Market Report 2024' by Textile Exchange in September 2024, manmade cellulosic fibers from certified or controlled forestry sources like FSC and PEFC accounted for an estimated 60% to 65% of the global market share in 2023, highlighting the industry's swift shift toward regulated materials to meet evolving ecological norms.Market growth is further driven by the expansion of the global apparel and fast fashion sectors, which rely on the fiber’s exceptional blending versatility and moisture management traits for high-volume clothing manufacturing. Producers are aggressively boosting output to meet the growing demand for comfortable, breathable fabrics in key emerging markets characterized by rising disposable incomes. According to Grasim Industries' 'Integrated Annual Report 2023-24' released in July 2024, the company achieved its highest-ever viscose staple fiber sales volume of 810 kilotonnes, a 14% year-on-year rise driven by robust domestic consumption. This surge is part of a broader trend where regenerated cellulosics are gaining share against other fiber types; the Textile Exchange reported in 2024 that the total production volume of manmade cellulosic fibers, including viscose, lyocell, and modal, climbed to 7.9 million tonnes in 2023.

Market Challenges

The Global Viscose Staple Fiber market faces a significant obstacle due to the environmental impact of chemical solvents used during the regeneration process. Manufacturers must manage the use of hazardous substances, such as carbon disulfide, within an increasingly strict regulatory environment. Compliance requires the implementation of advanced closed-loop recovery systems to prevent toxic emissions, a necessity that drastically increases both capital investment and operational expenses. These elevated financial hurdles discourage new entrants and severely limit the capacity expansion of existing producers, leading to a struggle to scale production quickly enough to meet growing demand, which ultimately creates supply bottlenecks that favor lower-cost competitors.Such operational constraints put viscose at a marked disadvantage relative to synthetic alternatives, which encounter fewer immediate production obstacles. According to the Textile Exchange in 2024, fossil-based polyester maintained its dominance with a 59% share of the 132 million tonnes of global fiber produced, whereas the market share for man-made cellulosic fibers remained relatively flat. This data underscores how the expensive and complex requirements associated with environmental compliance directly impede the viscose market's potential to secure a larger portion of the expanding global fiber industry.

Market Trends

The integration of Post-Consumer Textile Waste into Fiber Feedstock is gaining momentum as manufacturers actively shift from virgin wood pulp to circular "Next Gen" materials to meet rigorous environmental targets. This trend is driven by the scaling of textile-to-textile recycling technologies capable of dissolving cotton-rich waste into pulp, which decreases the industry's dependence on ancient forests and alleviates landfill accumulation. Leading fiber producers are swiftly commercializing these closed-loop systems, enabling brands to secure recycled-content claims without sacrificing fiber quality or performance. According to the 'Materials Market Report 2025' by Textile Exchange in October 2025, the market share of manmade cellulosic fibers derived from recycled feedstocks rose to 1.1% in 2024, indicating a crucial transition from pilot initiatives to tangible commercial adoption.Concurrently, the proliferation of Biodegradable Non-Woven Hygiene Applications is establishing a strong growth path for the viscose market, fueled by stricter regulations on single-use plastics and evolving consumer tastes. As governments implement bans on synthetic-based wet wipes and sanitary products, manufacturers are increasingly replacing fossil-based fibers with biodegradable viscose to ensure regulatory compliance and eco-friendliness. This structural change is especially apparent in the personal care sector, where the need for dispersible and compostable fibers is redefining production priorities. According to EDANA's 'Statistics Report on Nonwovens Production and Deliveries for 2024' published in April 2025, the hygiene sector continued to be the largest end-use category in Greater Europe, comprising 27% of total nonwoven deliveries, which highlights the vital role hygiene applications play in maintaining industrial fiber demand.

Key Players Profiled in the Viscose Staple Fiber market

- Aditya Birla Chemicals Pvt Limited

- Glanzstoff Group

- Jilin Chemical Fiber Group Co., Ltd.

- Kelheim Fibers GmbH

- Nanjing Chemical Fibre Co. Ltd.

- Xingda Chemical Fibre Co. Ltd.

- Lenzing AG

- Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd.

- Xinjiang Zhongtai Chemical Co. Ltd.

- Sateri Holding Ltd

Report Scope

In this report, the Global Viscose Staple Fiber market has been segmented into the following categories:Viscose Staple Fiber market, by Production Process:

- Rayon Grade Pulp

- Caustic Soda

- Carbon Disulphide

- Sulphuric Acid

Viscose Staple Fiber market, by Application:

- Textiles & Apparels

- Non-Woven and Specialty

- Healthcare

- Automotive

- Others

Viscose Staple Fiber market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Viscose Staple Fiber market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Viscose Staple Fiber market report include:- Aditya Birla Chemicals Pvt Limited

- Glanzstoff Group

- Jilin Chemical Fiber Group Co., Ltd

- Kelheim Fibers GmbH

- Nanjing Chemical Fibre Co. Ltd

- Xingda Chemical Fibre Co. Ltd

- Lenzing AG

- Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd

- Xinjiang Zhongtai Chemical Co. Ltd

- Sateri Holding Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

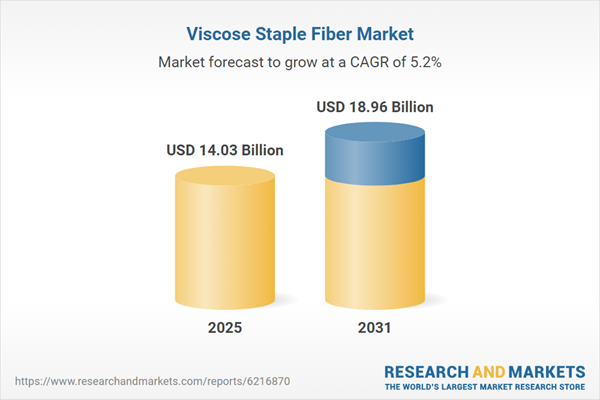

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 14.03 Billion |

| Forecasted Market Value ( USD | $ 18.96 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |