Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces hurdles due to inflationary pressures that influence consumer spending on non-essential items. Price sensitivity presents a challenge to volume growth, as economic volatility may cause shoppers to switch to cheaper still water or tap water alternatives. Data from the International Bottled Water Association indicates that in 2024, imported and domestic sparkling water combined represented approximately 5 percent of the total United States bottled water volume. This figure underscores that, although the segment is gaining ground, it remains a niche category within the broader hydration market compared to still water.

Market Drivers

The primary force transforming the global sparkling water sector is the rapid consumer migration from sugary carbonated soft drinks to healthier alternatives. As public knowledge regarding the dangers of excessive sugar intake - such as diabetes and obesity - grows, individuals are increasingly choosing unsweetened, zero-calorie options that offer the fizz of traditional sodas without the negative metabolic impact. This transition has enabled dedicated sparkling water producers to generate significant recurring revenue by establishing their products as daily wellness essentials rather than occasional indulgences. The magnitude of this health-oriented demand is highlighted by National Beverage Corp., which reported net sales of $1.2 billion for the fiscal year ending April 27, 2024, in its '2024 Annual Report on Form 10-K', confirming the commercial strength of the healthy, flavored sparkling water category.Concurrently, the market is expanding through the rising popularity of functional sparkling waters fortified with vitamins and minerals, moving beyond basic hydration. Consumers are seeking beverages that provide specific benefits like improved energy, focus, or recovery, fueling the growth of options containing caffeine and adaptogens. This trend allows brands to charge premium prices and target new usage occasions, such as pre-workout energy. According to Celsius Holdings' 'Second Quarter 2024 Financial Results' from August 2024, the company saw a 23 percent revenue jump to $402 million, illustrating the swift uptake of functional products. Additionally, strong branding is crucial, as evidenced by Food Dive's March 2024 article 'Liquid Death valued at $1.4B after latest funding round', noting the brand achieved $263 million in 2023 retail sales.

Market Challenges

Inflationary pressures present a significant obstacle to the continued growth of the global sparkling water market. Rising manufacturing and logistical costs force producers to increase retail prices, redefining sparkling water as a discretionary luxury rather than a daily necessity. This economic reality compels budget-conscious consumers to view carbonation as a non-essential attribute, leading them to alter their buying habits. During times of high living costs, price sensitivity prompts individuals to switch from premium effervescent brands to lower-cost still water or municipal tap water, which threatens sales volumes and undermines brand loyalty.The effect of these financial constraints is evident in the slowing growth of market value across the broader industry. When disposable income is limited, the premium price of carbonated water discourages consumer spending. According to the International Bottled Water Association, retail sales growth for the bottled water market slowed to 3.7 percent in 2024, a rate lower than that of the preceding three years. This statistic highlights how ongoing economic volatility and the consequent consumer caution are actively hindering the revenue progress of the hydration sector, including the sparkling water segment.

Market Trends

A major trend influencing the global sparkling water market is the emergence of alcohol-alternative and mocktail-inspired flavors. Driven by the expanding "sober curious" movement, consumers are demanding sophisticated, non-alcoholic drinks that offer the complexity of cocktails without the alcohol. Manufacturers are responding by creating flavor profiles that mimic mixed drinks and using real fruit ingredients to enhance the social drinking experience. The success of these premium, flavor-rich options is clear; as reported by BevNET in January 2025 in the article 'Spindrift Agrees Sale to PE Firm Gryphon Investors', the brand Spindrift recorded over $275 million in dollar sales for the 52 weeks ending December 28, 2024, marking a 22 percent increase in volume.Simultaneously, manufacturing priorities are being reshaped by a shift toward sustainable aluminum and glass packaging solutions. Due to growing criticism of single-use plastics, producers are adopting formats with better recyclability and closed-loop potential to satisfy eco-conscious consumers. Aluminum cans are becoming the preferred choice due to their high recovery value and ability to be recycled indefinitely without degrading, setting them apart from down-cycled plastics. This material efficiency is supported by data from the Can Manufacturers Institute and The Aluminum Association in their December 2024 report 'Aluminum Can Advantage: Sustainability Key Performance Indicators', which notes that the closed-loop circularity rate for aluminum beverage cans hit 96.7 percent, significantly surpassing other packaging materials.

Key Players Profiled in the Sparkling Water Market

- PepsiCo

- Nestle, A.G.

- The Coca-Cola Company.

- CG Roxane, LLC

- Tempo Beverage Ltd.

- Keurig Dr Pepper Inc.

- Dr Pepper/Seven Up, Inc.

- Ferrarelle

- Reignwood Investments UK Ltd.

- Mountain Valley Spring Water

Report Scope

In this report, the Global Sparkling Water Market has been segmented into the following categories:Sparkling Water Market, by Type:

- Flavored

- Unflavored

Sparkling Water Market, by Packaging:

- Bottles

- Cans

- Others

Sparkling Water Market, by Distribution Channel:

- Offline

- Online

Sparkling Water Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Sparkling Water Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Sparkling Water market report include:- PepsiCo

- Nestle, A.G.

- The Coca-Cola Company.

- CG Roxane, LLC

- Tempo Beverage Ltd

- Keurig Dr Pepper Inc.

- Dr Pepper/Seven Up, Inc

- Ferrarelle

- Reignwood Investments UK Ltd

- Mountain Valley Spring Water

Table Information

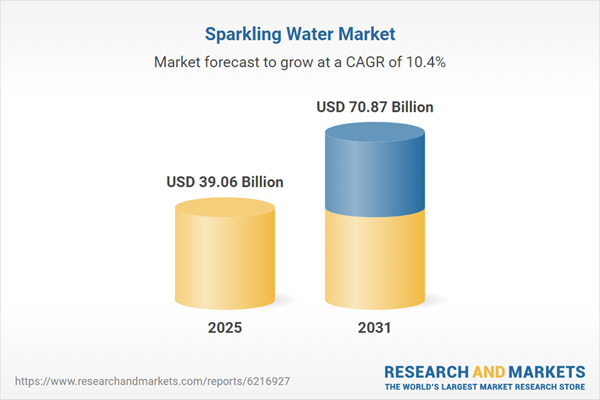

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 39.06 Billion |

| Forecasted Market Value ( USD | $ 70.87 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |