Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to data from 5G Americas, global 5G connections exceeded two billion in 2024, a milestone that underscores the immense scale of physical infrastructure and cabling components needed to support such rapid adoption. However, the market faces a significant obstacle in the form of volatile raw material prices, particularly for copper and high-performance dielectrics. This financial unpredictability leads to pricing instability for manufacturers and complicates the establishment of long-term supply agreements, potentially delaying vital capital expenditures in regions sensitive to price fluctuations.

Market Drivers

The aggressive rollout of 5G networks and telecommunications infrastructure acts as a primary driver for the Global RF Cable Assemblies & Jumpers Market. As network operators increase coverage density using small cells and massive MIMO antennas, the need for high-performance, low-loss interconnects becomes crucial for maintaining signal integrity across higher frequency bands. These specialized assemblies are vital for connecting baseband units to remote radio heads, ensuring reliable transmission within increasingly crowded spectral environments. The massive data throughput required by modern mobile networks highlights the necessity for robust physical layer infrastructure to support capacity growth. According to the Ericsson Mobility Report from November 2024, 5G networks are expected to handle 80% of global mobile data traffic by 2030, a trend that demands continuous upgrades to the cabling components underpinning these communication grids.Simultaneously, rising investment in aerospace and defense communication systems is significantly boosting market demand. Modern military operations depend heavily on sophisticated Command, Control, Communications, Computers, and Intelligence (C4ISR) platforms, which require ruggedized RF assemblies capable of withstanding extreme conditions while delivering precise signal transmission for radar, navigation, and electronic warfare. Governments are prioritizing the modernization of these electronic backbones to ensure tactical superiority, directly driving the procurement of advanced interconnects. In March 2024, the U.S. Department of Defense requested $21.1 billion for C4I systems in its Fiscal Year 2025 budget, reflecting a major commitment to upgrading connectivity assets. Additionally, IPC reported in January 2024 that global electronics manufacturers anticipated revenue growth of 9.5% for the year, signaling a positive outlook for the component supply chain driven by these critical sectors.

Market Challenges

The main impediment to the expansion of the Global RF Cable Assemblies & Jumpers Market is the persistent volatility of raw material prices, particularly regarding copper and high-performance dielectrics. This fluctuation creates a financially precarious environment for manufacturers who depend heavily on these commodities for the production of coaxial cables and connectors. When input costs swing unpredictably, producers struggle to maintain stable pricing, often forcing them to pass increased costs on to customers or absorb losses that erode profit margins. Consequently, this instability complicates the negotiation of long-term supply agreements, making it difficult for network operators to commit to the large-scale purchasing necessary for 5G and industrial IoT deployments.This uncertainty significantly disrupts supply chain planning and delays critical infrastructure investments. The International Wrought Copper Council reported in October 2024 that global copper mine output was forecast to increase by only 1.6% for the year due to various supply disruptions. Such restricted production growth in the face of rising demand exacerbates the pricing instability that hampers the steady capital expenditures required for market growth, particularly in price-sensitive regions.

Market Trends

The miniaturization of RF interconnects for compact electronics is significantly reshaping the component landscape, driven by the relentless demand for denser internal architectures in mobile devices and wearables. Manufacturers are focusing on the development of ultra-small, low-profile connectors that conserve printed circuit board space while preserving signal integrity in increasingly crowded, space-constrained environments.This strategic shift toward high-density packaging is evident in the financial results of major industry players. Amphenol Corporation reported in its 'Fourth Quarter 2024 Results' press release in January 2025 that the company achieved a 30% increase in sales compared to the prior year, a performance attributed in part to robust organic growth within the mobile devices market. This surge highlights the critical need for miniaturized cabling solutions to support the next generation of portable electronic hardware.

At the same time, the market is undergoing a decisive transition toward millimeter-wave frequency cable assemblies, necessitated by the deployment of 5G Advanced and early 6G infrastructure operating in bands above 24 GHz. These high-frequency applications require specialized interconnects engineered with advanced dielectrics to minimize insertion loss and ensure phase stability, particularly in dense urban deployments where signal propagation is difficult. The acceleration of this technology is most pronounced in regions that are aggressively upgrading their wireless grids. In its 'Annual Report 2024' released in March 2025, Huber+Suhner reported that net sales in the Asia-Pacific region increased by 26.0%, a growth trajectory driven by the strong uptake of communication connectivity solutions. This substantial regional expansion indicates a growing reliance on high-performance RF assemblies capable of sustaining the rigorous demands of millimeter-wave transmission.

Key Players Profiled in the RF Cable Assemblies & Jumpers Market

- TE Connectivity Ltd.

- Radiall GmbH

- Aptiv PLC

- Rosenberg GmbH

- W. L. Gore & Associates

- Lighthorse Technologies Inc.

- Molex LLC

- Amphenol RF

- Pasternack Enterprises Inc.

- Samtec Inc.

Report Scope

In this report, the Global RF Cable Assemblies & Jumpers Market has been segmented into the following categories:RF Cable Assemblies & Jumpers Market, by Cable Type:

- Connector

- Plug

- Switch

- Other

RF Cable Assemblies & Jumpers Market, by End User:

- IT & Telecommunication

- Defense

- Automobile

- Healthcare

- Commercial

- Others

RF Cable Assemblies & Jumpers Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global RF Cable Assemblies & Jumpers Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this RF Cable Assemblies & Jumpers market report include:- TE Connectivity Ltd.

- Radiall GmbH

- Aptiv PLC

- Rosenberg GmbH

- W. L. Gore & Associates

- Lighthorse Technologies Inc.

- Molex LLC

- Amphenol RF

- Pasternack Enterprises Inc.

- Samtec Inc.

Table Information

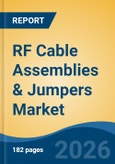

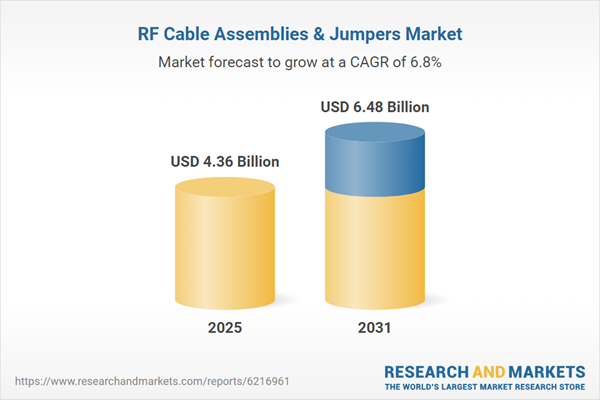

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.36 Billion |

| Forecasted Market Value ( USD | $ 6.48 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |