Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market growth faces potential hurdles due to the enforcement of strict environmental regulations governing noise pollution and vibration levels in residential areas. Data from the Japan Construction Equipment Manufacturers Association indicates that in January 2025, the domestic shipment value of hydraulic breakers and crushers rose by 15.5 percent to 1.9 billion yen. This statistic underscores a complex market environment where industrial demand in major hubs remains strong, even as the equipment sector navigates continuing regulatory challenges.

Market Drivers

A significant catalyst for the Global Rock Breaker Market is the increase in government investment in public works, necessitated by the need to upgrade utility and transportation networks. Nations are actively funding major projects like tunnels, highways, and railway corridors, requiring powerful excavation machinery to break through hard rock geological structures. Such initiatives lead directly to higher procurement rates for hydraulic breakers, as contractors seek equipment capable of high-impact energy for swift site clearance and foundation work. According to the Press Information Bureau's February 2025 summary of the Union Budget 2025-26, the Government of India earmarked a record 11.21 lakh crore rupees for capital expenditure, highlighting a focus on transport infrastructure that demands significant use of heavy demolition attachments.Additionally, the surge in mining and mineral exploration activities acts as a critical driver, fueled by the growing global demand for industrial metals and rare earth elements. As surface deposits become exhausted, operators are excavating deeper and processing harder ores, requiring advanced rock breakers to uphold safety standards and extraction efficiency.

This enables mining firms to fracture oversized boulders and maintain continuous material flow through crushers without relying on explosives. According to Sandvik's interim report for the first quarter of 2025, released in April, organic order intake for its Mining and Rock Solutions division rose by 10 percent, reflecting this enduring demand for excavation technology. Furthermore, Komatsu reported that sales for its Construction, Mining, and Utility Equipment segment hit 3.79 trillion yen in 2025, confirming the substantial capital investment in heavy machinery markets.

Market Challenges

The expansion of the Global Rock Breaker Market is significantly hindered by strict environmental regulations concerning vibration levels and noise pollution. In densely populated urban areas, authorities are increasingly enforcing rigorous decibel limits and restricted operating hours to preserve residential peace. These compliance requirements compel construction companies to curtail the operation time of hydraulic percussion hammers or resort to alternative, lower-impact excavation techniques, thereby diminishing the practical utility of standard rock breaking machinery. As a result, contractors encounter elevated operational costs and risks related to noise mitigation, which suppresses capital expenditure on new heavy-duty attachments.This regulatory pressure is directly linked to periods of market contraction, effectively offsetting broader demand for infrastructure. According to data from the Japan Construction Equipment Manufacturers Association in 2025, domestic shipments of construction equipment fell for the tenth month in a row, declining by 6.1 percent to 70.1 billion yen in May. This persistent downward trend illustrates how the accumulated burden of compliance-driven restrictions impedes the equipment sector's capacity for consistent growth, even while fundamental economic drivers for redevelopment persist.

Market Trends

The Global Rock Breaker Market is being fundamentally transformed by the adoption of remote-controlled and automated operations, especially within hazardous demolition environments and deep-shaft mining. Market participants are increasingly utilizing tele-remote hydraulic breakers that enable operators to break oversized boulders from secure control rooms, thereby eliminating exposure to silica dust and rockfalls. This technological advancement effectively separates operational continuity from on-site personnel constraints, ensuring steady throughput even during blasting intervals or shift changes. According to Epiroc’s interim report for the third quarter of 2025, released in October, organic order intake rose by 7 percent, a growth trend largely driven by the mining sector's heightened demand for equipment with advanced electrification and automation capabilities.Concurrently, the incorporation of IoT-enabled predictive maintenance is becoming a key differentiator for contractors aiming to lower lifecycle costs and maximize asset uptime. By integrating sensors that monitor oil temperature, impact frequency, and hydraulic pressure, modern rock breakers transmit real-time performance metrics to fleet management systems, facilitating preemptive maintenance before major failures occur. This shift toward data-driven support strategies enhances resilience within the equipment sector, establishing a steady revenue stream separate from volatile hardware sales. According to Volvo Construction Equipment's interim report for the third quarter of 2025, published in October, service sales grew by 6 percent, underscoring the industry's increasing dependence on digital aftermarket solutions to sustain fleet efficiency.

Key Players Profiled in the Rock Breaker Market

- Atlas Copco

- Caterpillar Inc.

- Epiroc AB

- Komatsu Ltd.

- Sandvik AB

- Doosan Infracore / Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- JCB

- Furukawa Rock Drill Co., Ltd.

- Montabert

Report Scope

In this report, the Global Rock Breaker Market has been segmented into the following categories:Rock Breaker Market, by Product Type:

- Small

- Medium

- Heavy

Rock Breaker Market, by Application:

- Construction

- Mining

Rock Breaker Market, by Operating Weight:

- Upto 500 Kg

- 501-1200 Kg

- Above 1200 Kg

Rock Breaker Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Rock Breaker Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Rock Breaker market report include:- Atlas Copco

- Caterpillar Inc.

- Epiroc AB

- Komatsu Ltd.

- Sandvik AB

- Doosan Infracore / Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- JCB

- Furukawa Rock Drill Co., Ltd.

- Montabert

Table Information

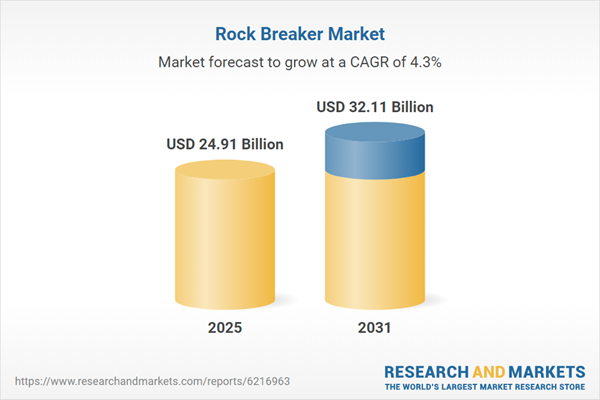

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 24.91 Billion |

| Forecasted Market Value ( USD | $ 32.11 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |