Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is largely driven by the continuous increase in global vehicle manufacturing and the industry's shift toward fuel efficiency, which demands lightweight and low-torque bearing solutions. Additionally, the transition to electric mobility is creating specific requirements for specialized bearings designed to handle higher rotational velocities while minimizing noise. The scale of this demand is highlighted by the China Association of Automobile Manufacturers (CAAM), which reported that domestic passenger car sales in China reached 22.61 million units in 2024, underscoring the massive volume of component needs.

However, the market faces a substantial obstacle in the form of raw material price volatility, specifically regarding the high-grade steel and alloys required for bearing production. When combined with occasional supply chain complications, these fluctuating input costs can severely squeeze manufacturer margins and disrupt delivery schedules. Such instability poses a risk to the sector's consistent expansion, potentially hindering steady market growth in the coming years.

Market Drivers

The ongoing recovery in global automotive manufacturing acts as a primary catalyst for the passenger car bearing sector. As assembly lines accelerate to satisfy consumer demand, the need for essential drivetrain and chassis components rises proportionally. According to a press release by the European Automobile Manufacturers’ Association, the European Union car market grew by 13.9 percent in 2023 compared to the previous year, totaling 10.5 million units. This resurgence in volume necessitates a steady supply of wheel hub units and transmission bearings to support increased output. Illustrating the broader regional contributions to this demand, the Society of Indian Automobile Manufacturers reported that domestic passenger vehicle sales in India reached a record high of 4.22 million units for the fiscal year ending March 31, 2024, highlighting the expanding opportunities for component suppliers in emerging markets.Simultaneously, the rapid integration of electrified powertrains is redefining technical specifications and value opportunities within the bearing market. Electric vehicles introduce distinct operating conditions, including higher rotational speeds and the need for electrical insulation to prevent raceway damage from stray currents. Data from the International Energy Agency’s 'Global EV Outlook 2024' indicates that global electric car sales neared 14 million units in 2023, representing 18 percent of all cars sold. This transition compels manufacturers to innovate beyond standard steel designs, driving the adoption of high-performance ceramic and sensor-integrated bearings that offer reduced friction and enhanced durability. Consequently, the unique engineering needs of battery-electric architectures are establishing a lucrative sub-segment for specialized, high-margin bearing products.

Market Challenges

The volatility of raw material prices, particularly for high-grade steel and specialized alloys, stands as a formidable barrier to the sustained growth of the Global Passenger Car Bearing Market. Bearing manufacturing depends heavily on consistent input costs to maintain competitive pricing structures and secure long-term contracts with automotive OEMs. When the prices of these essential metallurgical inputs fluctuate unpredictably, manufacturers struggle to manage production budgets effectively. This financial instability often forces companies to absorb increased costs, thereby compressing operating margins and limiting the capital available for capacity expansion or delivery optimization, which directly stalls market momentum.This challenging environment regarding raw materials is evident in recent industrial output metrics. According to the World Steel Association, global steel demand was forecast to decline by 0.9 percent to 1.75 billion tonnes in 2024, a contraction driven largely by persistent high manufacturing costs and economic headwinds. This reduction in the consumption of the primary material used in bearing production underscores the severity of the supply-side pressure. As manufacturers grapple with these volatile input conditions, the industry's ability to maintain a steady growth trajectory is significantly compromised.

Market Trends

The transition to lightweight third-generation wheel hub bearing units is emerging as a decisive structural evolution in the sector, particularly as original equipment manufacturers prioritize range extension for battery-electric platforms. Unlike traditional multi-component assemblies, these third-generation units integrate the bearing raceway directly into the hub flange, a design innovation that eliminates redundant parts and significantly lowers unsprung mass. This architectural consolidation enhances vehicle dynamics while directly addressing the stringent efficiency requirements of modern electric drivetrains. Validating the technical impact of this trend, SKF’s 'Year-end Report 2024' from February 2025 noted that the company’s newly commercialized Hub Bearing Unit for electric vehicles achieved a 10 percent weight reduction compared to conventional designs, contributing directly to improved energy efficiency per charge.Concurrently, the shift toward compact and high-power density bearing designs is reshaping product development strategies to accommodate the spatial limitations of electrified axles. As automotive engineers strive to maximize cabin volume and battery capacity within fixed chassis dimensions, bearings are required to support higher loads within significantly smaller operational envelopes. This necessitates the use of ultra-clean steel and optimized internal geometries to maintain durability under intense pressure without increasing component size. This demand for space-efficient, high-performance hardware continues to drive substantial industrial revenue; according to NSK Ltd.’s 'Consolidated Business Results for Fiscal 2024' published in May 2025, the company recorded automotive business sales of 401.67 billion yen, underscoring the sustained reliance of manufacturers on compact bearing portfolios to enable next-generation vehicle architectures.

Key Players Profiled in the Passenger Car Bearing Market

- Federal-Mogul Holdings LLC

- SKF

- NSK Ltd.

- JTEKT Corp.

- Minebea Co. Ltd.

- Nachi Fujikoski

- NTN Corp

- Rheinmetall Automotive

- Schaeffler AG

- SNL Bearings Ltd.

Report Scope

In this report, the Global Passenger Car Bearing Market has been segmented into the following categories:Passenger Car Bearing Market, by Vehicle Type:

- SUV

- Hatchback

- Sedan

- MUV

Passenger Car Bearing Market, by Application Type:

- Engine

- Transmission

- Wheel

- Steering

- Others

Passenger Car Bearing Market, by Bearing Type:

- Ball Roller Plain

Passenger Car Bearing Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Passenger Car Bearing Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Passenger Car Bearing market report include:- Federal-Mogul Holdings LLC

- SKF

- NSK Ltd

- JTEKT Corp.

- Minebea Co. Ltd

- Nachi Fujikoski

- NTN Corp

- Rheinmetall Automotive

- Schaeffler AG

- SNL Bearings Ltd

Table Information

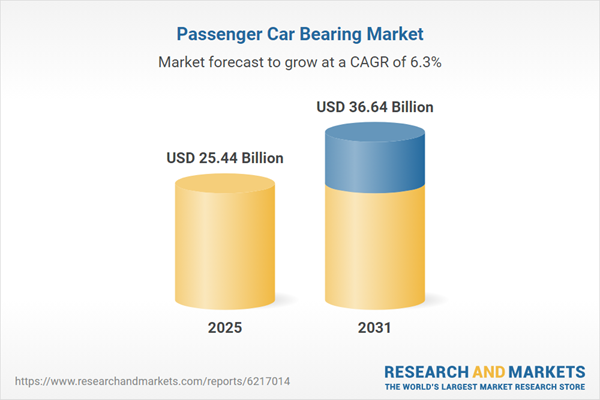

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 25.44 Billion |

| Forecasted Market Value ( USD | $ 36.64 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |