Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion faces a significant obstacle from the rapid spread of digital wallets and mobile payment ecosystems, which threaten to replace physical card usage with virtual alternatives. This trend toward dematerialization risks reducing shipment volumes, especially in technologically advanced regions where smartphone adoption is widespread. Demonstrating the industry's continued magnitude despite these pressures, the Smart Payment Association reported that global shipments of payment cards and modules totaled 2.5 billion units in 2024.

Market Drivers

The accelerated shift toward cashless payment economies serves as the primary engine sustaining high-volume manufacturing of plastic cards. As financial institutions upgrade legacy systems to dual-interface smart cards, there is robust demand for antenna-embedded plastic bodies to ensure redundancy alongside digital wallets, focusing on the issuance of physical tokens capable of near-field communication. To highlight the scale of this structural demand, Visa reported having 4.6 billion payment credentials available at merchant locations globally in 2024. Furthermore, the functional adoption of tap-to-pay technology necessitates these physical upgrades; according to Visa's Fiscal Year 2024 Annual Report released in November 2024, over 80 percent of face-to-face Visa transactions outside the United States were contactless, confirming that physical cards remain the dominant instrument for these high-frequency interactions.Additionally, the proliferation of telecommunications and the demand for Subscriber Identity Modules act as a parallel volume driver, particularly in markets dependent on physical SIMs. Although the sector is investigating embedded technologies, the removable plastic SIM remains the standard for the majority of mobile connections and industrial IoT deployments, ensuring a massive, recurring baseline of manufacturing orders separate from financial sector trends. Illustrating this sustained volume, the Trusted Connectivity Alliance's "eSIM Industry Insights 2024" report from March 2025 noted that the total available market for traditional removable SIM cards remained stable at 3.7 billion units in 2024, indicating that the telecommunications sector remains a pivotal pillar of the global plastic card manufacturing industry.

Market Challenges

The rapid expansion of digital wallets and mobile payment ecosystems poses a fundamental challenge to the Global Plastic Cards Market by decoupling financial transaction growth from the need for physical manufacturing. As consumers increasingly rely on virtual payment credentials stored on smartphones and wearables, the functional necessity of carrying a physical polyvinyl chloride card diminishes significantly. This trend toward dematerialization directly hinders market growth by substituting physical card issuance with software-based tokens, thereby eroding shipment volumes even as payment frequencies increase, a shift that is particularly pronounced in technologically advanced regions where biometric mobile authentication offers a superior user experience.Evidence of this accelerating substitution is evident in key mature markets where digital adoption is fundamentally reshaping consumer behavior. According to UK Finance, 57 percent of adults in the United Kingdom actively utilized mobile wallets for payments in 2024. This substantial adoption rate points to a structural migration away from dependency on physical cards, suggesting that future growth in transaction volumes will increasingly bypass the industrial sector responsible for card manufacturing and personalization.

Market Trends

The integration of recycled and ocean-bound sustainable materials is reshaping the manufacturing supply chain as issuers align physical products with corporate environmental mandates. Financial institutions are aggressively replacing virgin polyvinyl chloride with reclaimed ocean plastics and recycled PVC to reduce Scope 3 emissions and meet consumer expectations, a transition that has evolved from niche pilot programs to a core procurement standard for major payment networks. According to a May 2025 press release from the Smart Payment Association regarding the shipment of 2.5 billion units in 2024, the shipment of sustainable payment cards increased by 28 percent in 2024, now accounting for one-third of all cards shipped globally.Concurrently, the rising demand for premium metal and hybrid composite cards serves as a critical differentiation strategy for issuers targeting affluent market segments. Heavy-weight metal form factors provide a tactile advantage that distinguishes elite offerings from standard plastic products, driving value growth through complex construction techniques. This trend enables manufacturers to offset volume pressures from digital alternatives by capturing higher margins on these specialized physical tokens; evidencing this expansion, CompoSecure reported in its "Fourth Quarter and Full Year 2024 Financial Results" from March 2025 that net sales reached 420.6 million US dollars for the fiscal year 2024, representing an 8 percent increase from the prior year.

Key Players Profiled in the Plastic Cards Market

- Gemalto N.V.

- CPI Card Group Inc.

- Giesecke & Devrient GmbH

- American Banknote Corporation

- IDEMIA France SAS

- Perfect Plastic Printing Corporation

- Goldpac Group Limited

- Inteligensa Group

- Marketing Card Technology, LLC

- TAG Systems SA

Report Scope

In this report, the Global Plastic Cards Market has been segmented into the following categories:Plastic Cards Market, by Type:

- Contact Cards

- Contactless Cards

Plastic Cards Market, by Technology:

- Chip Enabled Cards

- Regular Cards

- Smart Cards

Plastic Cards Market, by Application:

- Payment Cards (Credit Cards, Debit Cards, Charge Cards, Prepaid Cards)

- Government/Health (National Identity Cards, Driving Licenses, Public and Private Health Cards, Others)

- SIM Cards

- Transportation Cards

- Gift Cards

- Access Cards

- Others

Plastic Cards Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Plastic Cards Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Plastic Cards market report include:- Gemalto N.V.

- CPI Card Group Inc.

- Giesecke & Devrient GmbH

- American Banknote Corporation

- IDEMIA France SAS

- Perfect Plastic Printing Corporation

- Goldpac Group Limited

- Inteligensa Group

- Marketing Card Technology, LLC

- TAG Systems SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

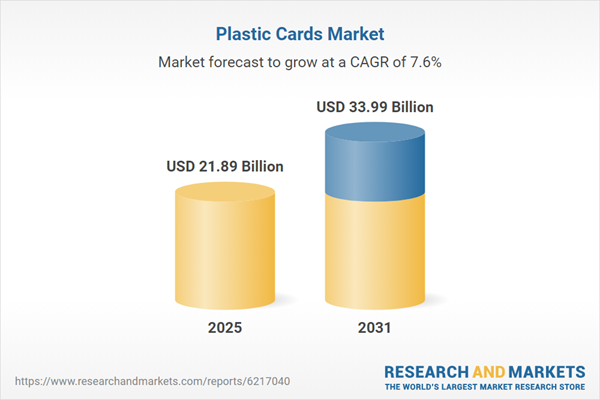

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 21.89 Billion |

| Forecasted Market Value ( USD | $ 33.99 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |