Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these strong drivers, the market encounters a major hurdle due to the substantial upfront capital needed for widespread deployment. The high costs associated with replacing legacy systems and installing advanced metering infrastructure can discourage utility providers, particularly in markets that are sensitive to costs. Additionally, the difficulty of ensuring interoperability among diverse systems and mitigating emerging cybersecurity threats presents a significant barrier that could slow down comprehensive market expansion on a global scale.

Market Drivers

Government regulations promoting energy efficiency and the rollout of smart meters act as the primary catalyst for market growth. Legislative bodies around the world are enforcing strict deadlines for the shift from analog to Advanced Metering Infrastructure (AMI) to improve billing precision, lower carbon footprints, and enhance demand-side management. These regulatory frameworks require utilities to replace legacy systems with intelligent, communicating assets that align with national sustainability goals, effectively driving market penetration in both mature and developing economies. For instance, a November 2024 report by the Department for Energy Security and Net Zero titled 'Smart Meter Statistics in Great Britain' indicated that there were 37 million smart and advanced meters active in homes and small businesses, accounting for 65% of all meters in the region.The growth of smart grid infrastructure and modernization projects significantly fuels the demand for precise metering technologies. As utilities integrate decentralized renewable energy sources like wind and solar, they require real-time data to maintain network stability and manage bidirectional power flows. This operational change necessitates the deployment of advanced metering solutions to handle the complexities of a modern, digitized grid. According to the International Energy Agency's 'World Energy Investment 2024' report from June 2024, global spending on electricity grids is expected to reach $400 billion in 2024, largely to support these clean energy transitions. Furthermore, federal initiatives are reinforcing this trend; the U.S. Department of Energy announced in 2024 nearly $2 billion in funding for 38 projects specifically designed to protect the grid and increase capacity.

Market Challenges

The significant upfront capital required for deployment serves as a primary constraint on the Global Power Metering Market. Utility providers face heavy financial obligations when transitioning from legacy analog systems to Advanced Metering Infrastructure (AMI). This expenditure includes not only the procurement of sophisticated hardware but also the substantial costs associated with installation, backend software integration, and the maintenance of communication networks. Consequently, these high initial expenses deter decision-makers, particularly in cost-sensitive regions where budget constraints often take precedence over long-term modernization goals, leading to deferred upgrades and prolonged project timelines.The economic burden is further intensified by the disparity in financing costs across different geographies, which directly hampers the ability of utilities to secure funding. According to the International Energy Agency, in 2024, the cost of capital for grid and clean energy projects in emerging and developing economies was at least twice as high as in advanced economies. This financial discrepancy limits the borrowing capacity of operators in these regions, making capital-intensive metering projects economically unviable. As a result, the market experiences uneven growth, with significant delays in widespread implementation in areas where capital resources are scarce.

Market Trends

The evolution to Advanced Metering Infrastructure (AMI) 2.0 is redefining the market by integrating Artificial Intelligence and Machine Learning directly at the grid edge. Unlike legacy systems focused primarily on billing data, these next-generation platforms leverage edge computing to process real-time waveforms and detect network anomalies instantly. This capability enables utilities to execute predictive maintenance and manage distributed energy resources with high precision, significantly reducing the data load on central servers. Underscoring this technological priority, Itron reported in its '2024 Resourcefulness Insight Report' from October 2024 that 82% of utility executives surveyed are in the process of adopting AI and machine learning tools, primarily to enhance grid safety and operational resilience.Simultaneously, the adoption of Cellular IoT connectivity, including NB-IoT and 5G, is rapidly replacing proprietary radio frequency mesh networks. Utilities are increasingly utilizing public carrier networks to minimize the substantial capital costs and maintenance burdens associated with deploying private communication infrastructure. This strategic shift ensures superior signal penetration for meters located in deep indoor or rural locations and provides the low-latency communication required for modern grid management. Evidencing this trend, Airtel confirmed in a January 2024 press release regarding a strategic partnership with Adani Energy Solutions that it has a mandate to connect over 20 million smart meters using its NB-IoT technology for real-time energy monitoring.

Key Players Profiled in the Power Metering Market

- Eaton Corporation PLC

- Kamstrup A/S

- Siemens AG

- Aclara Technologies LLC

- General Electric Company

- Holley Technology LTD.

- Elster Group GmbH

- Landis+Gyr

- Schneider Electric

- Sensus USA Inc.

Report Scope

In this report, the Global Power Metering Market has been segmented into the following categories:Power Metering Market, by End-User:

- Residential

- Commercial

- Industrial

Power Metering Market, by Type:

- Analog Meters

- Digital Meters

- Smart Meters

Power Metering Market, by Phase:

- Single Phase

- Three Phase

Power Metering Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Power Metering Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Power Metering market report include:- Eaton Corporation PLC

- Kamstrup A/S

- Siemens AG

- Aclara Technologies LLC

- General Electric Company

- Holley Technology LTD

- Elster Group GmbH

- Landis+Gyr

- Schneider Electric

- Sensus USA Inc.

Table Information

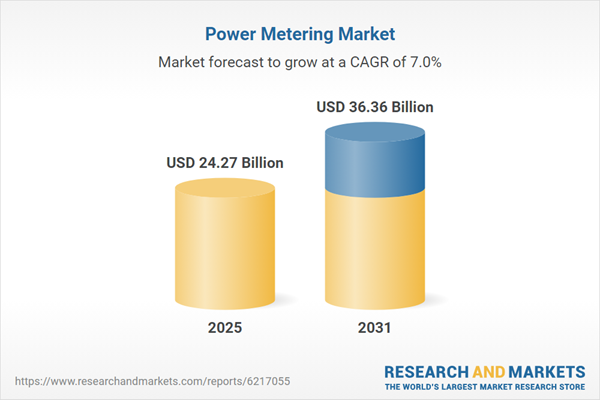

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 24.27 Billion |

| Forecasted Market Value ( USD | $ 36.36 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |