Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these drivers, the sector encounters a significant challenge regarding the massive upfront capital investment and prolonged construction timelines necessary for developing these large infrastructure projects. These financial and procedural hurdles can cause funding gaps and delay project implementation, thereby impeding rapid market growth. According to the International Hydropower Association, global pumped storage hydropower capacity increased by 8.4 gigawatts in 2024, reaching a total installed capacity of 189 gigawatts.

Market Drivers

The exponential growth of variable renewable energy integration acts as the primary catalyst for the Global Pumped Hydro Storage Market. As nations rapidly scale up solar and wind generation, the inherent intermittency of these sources creates critical imbalances between supply and demand that threaten grid stability. Pumped hydro storage serves as a vital buffer, absorbing excess renewable output during periods of low demand and releasing it during peak consumption, effectively functioning as a giant rechargeable battery for national grids. This capability is essential for maintaining frequency control and preventing blackouts in high-penetration renewable scenarios. The urgency of this requirement is highlighted by recent projections; according to the International Energy Agency's 'Renewables 2025' report from October 2025, annual pumped storage capacity additions are forecasted to double to nearly 16.5 GW by 2030 to accommodate surging levels of variable green energy.Supportive government frameworks and aggressive decarbonization targets further accelerate market expansion by de-risking the substantial capital requirements of these infrastructure projects. Governments worldwide are implementing long-term policy mechanisms, such as capacity payments and streamlined permitting processes, to ensure sufficient energy storage supports their net-zero commitments.

China, leading this policy-driven charge, has established rigorous mandates to bolster its energy security. According to the International Hydropower Association's '2025 World Hydropower Outlook' from June 2025, China is on track to exceed its national targets, with installed pumped storage capacity potentially reaching 130 GW by 2030. This policy momentum is reflected globally, as developers rush to secure sites to meet future storage needs. According to the International Hydropower Association, in 2025, the total global development pipeline for pumped storage hydropower projects has swelled to approximately 600 GW, signaling robust long-term growth.

Market Challenges

The substantial upfront capital investment and extended construction timelines required for pumped hydro storage projects act as a formidable barrier to market expansion. These facilities necessitate massive civil engineering works, including the construction of large reservoirs, dams, and complex underground tunneling, which drive initial costs into the billions of dollars. The magnitude of such infrastructure inevitably leads to lengthy development periods, often spanning a decade or more from planning to commissioning. This prolonged duration introduces significant financial uncertainty, as investors face delayed returns and risks associated with potential cost overruns or regulatory shifts, effectively deterring private capital and stalling project financial closure.Consequently, a major disparity exists between the capacity under planning and the projects that successfully reach the construction phase, creating a bottleneck in market growth. The financial risks associated with these long lead times prevent many technically viable sites from progressing to execution. According to the International Hydropower Association, in 2025, the global development pipeline for pumped storage hydropower comprised around 600 gigawatts of capacity. This extensive backlog highlights how financial and procedural hurdles severely restrict the conversion of planned facilities into operational assets, thereby impeding the sector's ability to scale rapidly.

Market Trends

Repurposing abandoned mine sites for brownfield development is gaining traction as a strategic trend to address land scarcity and reduce construction timelines. This approach utilizes disused open-pit mines or underground shafts as pre-existing reservoirs, significantly lowering the capital expenditure required for massive excavation works and minimizing the environmental impact compared to greenfield projects. Developers are increasingly capitalizing on these sites to leverage established grid connections and road infrastructure while providing economic revitalization to former mining regions. Highlighting this shift, according to Water Power & Dam Construction, December 2024, in the 'Reviving disused mines' report, the Kidston Pumped Storage Hydro Project in Australia is advancing with a capacity of 250 MW, transforming retired gold mining pits into a functional energy storage asset.Simultaneously, the integration of floating solar photovoltaics on reservoirs is emerging as a key strategy to hybridize assets and enhance operational efficiency. By deploying solar panels directly on water surfaces, operators can generate supplementary renewable electricity while reducing reservoir evaporation, a critical advantage for maintaining water levels in arid regions. This configuration optimizes existing transmission infrastructure and improves solar panel performance through the cooling effect of the water, creating a synergistic energy system. Evidence of this growing adoption is clear; according to Rinnovabili, June 2025, in the '2025 World Hydropower Outlook', Brazil commenced the construction of the country's largest floating solar plant with a capacity of 54 MW at the Lajeado hydro reservoir, showcasing the scalability of this hybrid solution.

Key Players Profiled in the Pumped Hydro Storage Market

- Electricite de France SA

- Iberdrola SA

- EON SE

- General Electric Company

- Voith GmbH & Co. KGaA

- Mitsubishi Heavy Industries Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Andritz Hydro GmbH

- Alstom SA

- Duke Energy Corporation

Report Scope

In this report, the Global Pumped Hydro Storage Market has been segmented into the following categories:Pumped Hydro Storage Market, by System:

- Open-Loop

- Closed-Loop

Pumped Hydro Storage Market, by Application:

- Natural Reservoirs

- Man-Made Reservoirs

Pumped Hydro Storage Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Pumped Hydro Storage Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Pumped Hydro Storage market report include:- Electricite de France SA

- Iberdrola SA

- EON SE

- General Electric Company

- Voith GmbH & Co. KGaA

- Mitsubishi Heavy Industries Ltd

- Toshiba Energy Systems & Solutions Corporation

- Andritz Hydro GmbH

- Alstom SA

- Duke Energy Corporation

Table Information

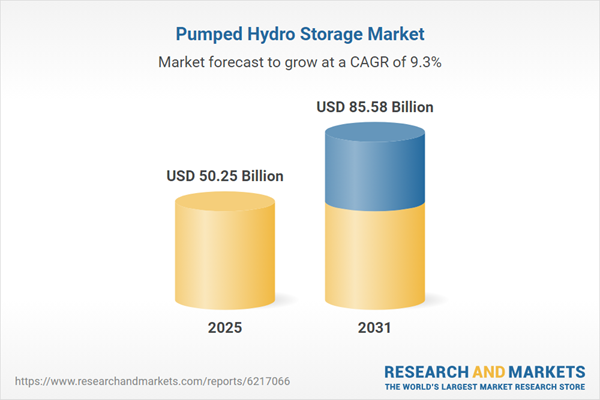

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 50.25 Billion |

| Forecasted Market Value ( USD | $ 85.58 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |