Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to data from the Cloud Native Computing Foundation, 60% of organizations employed continuous integration and continuous delivery platforms to build and deploy applications in 2024, marking a 31% increase from the previous year. This rise highlights a strong reliance on automated workflows to achieve high-velocity development. However, the market faces a significant obstacle regarding security vulnerabilities. The prioritization of speed can result in inadequate testing or the accumulation of technical debt, potentially exposing sensitive data to cyber threats if rigorous governance measures are not implemented alongside these rapid processes.

Market Drivers

The widespread adoption of low-code and no-code development platforms is a primary factor advancing the Global Rapid Application Development Market, as it democratizes software creation and lessens the reliance on specialized coding skills. These platforms empower cross-functional teams to collaborate more effectively, enabling business users to participate directly in the development process and relieving the workload on IT departments. By converting complex coding requirements into intuitive visual interfaces, organizations can fast-track their digital transformation initiatives and meet the growing demand for custom software without incurring proportional technical debt. As noted in the '2025 State of Application Development' report by OutSystems in December 2024, 74% of respondents indicated their organizations intend to build 10 or more applications in the coming year, a volume that necessitates the efficiency and scalability offered by rapid development environments.Concurrently, the integration of Artificial Intelligence and Machine Learning is serving as a force multiplier for rapid application development. AI-driven coding assistants, automated code generation, and intelligent testing tools are optimizing workflows, reducing manual errors, and significantly shortening release cycles. This technological convergence ensures that high velocity does not come at the expense of quality, as intelligent systems assist in maintaining robust security and governance standards during rapid iterations. According to the '2024 Developer Survey' by Stack Overflow in May 2024, 76% of developers reported using or planning to use AI tools, signaling a major shift toward AI-enhanced workflows. This strategic adoption is producing tangible results; GitLab reported in 2024 that 69% of CxOs are shipping software at least twice as fast as the previous year, validating the impact of these advanced methodologies on market velocity.

Market Challenges

The principal challenge obstructing the Global Rapid Application Development Market is the risk of security vulnerabilities resulting from the methodology's focus on speed and iterative delivery. Although the use of prebuilt modules and automated workflows accelerates deployment, it often circumvents deep security assessments, creating a governance gap. This prioritization of speed over stability frequently leads to the accumulation of technical debt, where undetected flaws in third-party components or hastily written code are released into production. As organizations scale these applications, the cost and complexity of fixing these ingrained defects rise significantly, causing enterprises to hesitate in applying rapid frameworks to mission-critical or data-sensitive operations.Highlighting this issue, the Cloud Security Alliance reported in 2024 that over 50% of the vulnerabilities addressed by organizations recurred within a month of remediation. This high recurrence rate underscores the difficulty of maintaining application integrity within high-velocity development environments. When businesses cannot guarantee that rapid iterations are secure, they are forced to restrict the use of these tools to low-risk internal functions. This lack of trust effectively places a ceiling on market expansion, as large-scale enterprises avoid integrating rapid application development strategies into their core, revenue-generating digital infrastructure.

Market Trends

The Shift Toward Composable and API-First Architectures is fundamentally reshaping the market as organizations move away from monolithic structures in favor of flexible, modular ecosystems. This strategy allows developers to assemble applications using Packaged Business Capabilities connected via APIs, which significantly reduces development time while enhancing scalability. Instead of building complex back-end services from scratch, teams are increasingly prioritizing API design to facilitate seamless integration between disparate systems and third-party services, thereby accelerating the composability of digital solutions. According to the '2025 State of the API Report' by Postman in October 2025, 82% of organizations have adopted some level of an API-first approach, with 25% operating as fully API-first organizations, indicating a structural transition where APIs serve as the primary building blocks for rapid digital delivery.Simultaneously, the Expansion of Low-Code Platforms into Mission-Critical Application Development is validating the reliability and maturity of rapid application frameworks for core enterprise functions. Enterprises are no longer limiting rapid development tools to peripheral or departmental tasks; they are leveraging them to construct high-stakes systems that drive revenue and operational resilience. This migration is driven by the enhanced security, compliance, and architectural robustness now embedded within modern platforms, which alleviates concerns regarding governance and technical debt. In its 'Fourth Quarter and Full-Year 2024 Financial Results' released in January 2025, ServiceNow reported having 2,109 customers with more than $1 million in annual contract value, representing a 12% year-over-year growth, demonstrating the increasing reliance of large-scale enterprises on these platforms for their most vital digital operations.

Key Players Profiled in the Rapid Application Development Market

- Microsoft Corporation

- Salesforce, Inc.

- IBM Corporation

- Oracle Corporation

- Amazon Web Services, Inc.

- Appian Corporation

- OutSystems

- Pegasystems, Inc.

- Zoho Corporation

- Mendix Technology B.V.

Report Scope

In this report, the Global Rapid Application Development Market has been segmented into the following categories:Rapid Application Development Market, by Type:

- Low-code Development Platform

- No-code Development Platform

Rapid Application Development Market, by Component:

- Tools

- Services

Rapid Application Development Market, by Business Function:

- Sales & Marketing

- HR & Operations

- Finance

- IT

Rapid Application Development Market, by Deployment:

- Cloud

- On-premise

Rapid Application Development Market, by Organization Size:

- SMEs

- Large Enterprises

Rapid Application Development Market, by Vertical:

- BFSI

- Automotive

- Retail

- IT & Telecom

- Government

- Healthcare

- Others

Rapid Application Development Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Rapid Application Development Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Rapid Application Development market report include:- Microsoft Corporation

- Salesforce, Inc.

- IBM Corporation

- Oracle Corporation

- Amazon Web Services, Inc.

- Appian Corporation

- OutSystems

- Pegasystems, Inc.

- Zoho Corporation

- Mendix Technology B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

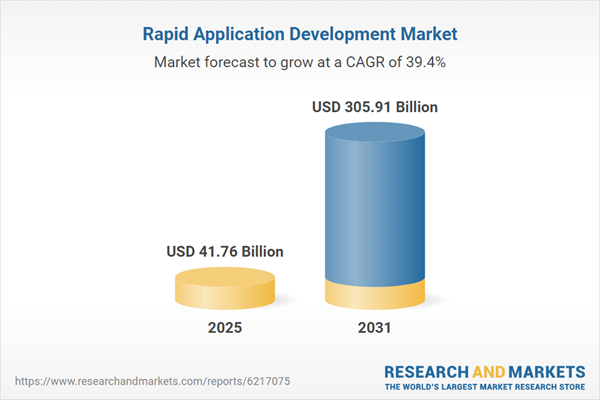

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 41.76 Billion |

| Forecasted Market Value ( USD | $ 305.91 Billion |

| Compound Annual Growth Rate | 39.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |