Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces hurdles due to the significant capital required for installation and the high costs of maintaining complex automated systems. These financial constraints often prevent small and medium-sized enterprises from modernizing their facilities. Highlighting trade dynamics, VDMA reported that in 2024, Italy's meat processing machinery exports rose by 3.8 percent, reaching a record 182 million euros.

Market Drivers

The integration of robotics, AI, and IoT for advanced process automation serves as a primary catalyst for market growth, effectively addressing critical labor shortages and rising operational costs. Meat processors are increasingly deploying automated slaughtering, deboning, and packaging systems to maintain high throughput rates while mitigating the risks associated with manual handling and contamination. This technological shift is essential for manufacturers aiming to reduce long-term expenses and ensure consistent product quality in a labor-constrained environment. Highlighting the scale of this technological adoption, according to Tyson Foods, January 2024, in a press release regarding their new Bowling Green facility, the company invested 355 million USD to integrate advanced robotics and automated technologies specifically for premium bacon production.Simultaneously, the escalating consumer demand for processed and ready-to-eat meat products is compelling manufacturers to expand production capacities and upgrade processing lines. Rapid urbanization and changing lifestyles have intensified the requirement for convenient, protein-rich food options, necessitating versatile equipment capable of handling diverse product formulations and packaging formats.

This surge in consumption directly influences machinery procurement strategies, as companies seek equipment that offers flexibility to meet fluctuating market needs. Substantiating this trend, according to the USDA, April 2024, in the 'Livestock and Poultry: World Markets and Trade' report, global beef production is forecast to reach 59.5 million tons, necessitating sustained equipment utilization. Demonstrating the financial impact of these investments, according to Marel, in 2024, the company reported revenues of 1.72 billion EUR for the full year 2023, reflecting continued spending by processors on modernization projects.

Market Challenges

The substantial capital expenditure required for acquiring and installing modern meat processing machinery constitutes a primary obstacle to market growth. As the industry shifts toward complex automation to ensure hygiene and efficiency, the cost of these advanced systems rises significantly. This financial burden is particularly detrimental to small and medium-sized enterprises, which often lack the liquidity to absorb the high upfront costs associated with automated production lines. Consequently, these smaller entities are frequently forced to delay necessary infrastructure upgrades, directly slowing the adoption rate of new technologies across the broader market.The magnitude of the financial commitment involved in this sector is reflected in recent trade statistics. According to VDMA, in 2023, the global trade in meat processing machinery reached a record value of almost 2.7 billion euros. This figure highlights the premium valuation of current equipment standards. While this indicates a robust market for those who can afford it, the high aggregate value underscores the steep financial threshold that restricts market entry and expansion for budget-constrained operators, thereby limiting the potential volume of machinery sales.

Market Trends

The shift toward energy-efficient and water-recycling processing machinery is reshaping the market as manufacturers seek to decouple production growth from resource consumption. Processors are aggressively upgrading to closed-loop technologies that minimize water usage and recover thermal energy, viewing operational sustainability as a critical lever for reducing long-term utility expenses. This transition establishes eco-performance as a primary procurement criterion alongside throughput, distinguishing modern upgrades from purely capacity-driven investments. Validating this market preference, according to JBT Corporation, July 2024, in the '2023 ESG Report', over 70 percent of the company's product revenue in 2023 was derived from equipment offering specific environmental benefits, demonstrating the substantial demand for resource-saving solutions.The adaptation of processing lines for hybrid and plant-based meat alternatives represents a critical evolution in equipment engineering, driven by the need for production flexibility. Machinery manufacturers are developing versatile platforms capable of handling the unique textures and binding properties of non-meat formulations without requiring separate facilities, allowing processors to diversify portfolios efficiently. This strategic pivot requires significant R&D spending to ensure machinery can switch seamlessly between protein sources. According to Marel, February 2024, in the '2023 Annual Report', the company invested 102.2 million EUR in innovation during 2023 to support product development across segments including plant protein, highlighting the capital commitment to enabling these multi-protein capabilities.

Key Players Profiled in the Meat Processing Equipment Market

- Mepaco

- Minerva Omega Group s.r.l.

- Tomra Systems ASA

- JBT.

- Nemco Food Equipment, LTD.

- RAM Beef Equipment, LLC

- The Middleby Corporation

- Marel

- Equipamientos cArnicos, S.L.

- Bettcher Industries, Inc.

Report Scope

In this report, the Global Meat Processing Equipment Market has been segmented into the following categories:Meat Processing Equipment Market, by Type:

- Cutting Equipment

- Dicing Equipment

- Blending Equipment

- Tenderizing Equipment

- Massaging Equipment

- Smoking Equipment

- Filling Equipment

- Grinding Equipment

- Others

Meat Processing Equipment Market, by Meat Type:

- Processed Beef

- Processed Mutton

- Processed Pork

- Others

Meat Processing Equipment Market, by Product Type:

- Fresh Processed Meat

- Raw Fermented Sausages

- Precooked Meat

- Dried Meat

- Cured Meat

- Others

Meat Processing Equipment Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Meat Processing Equipment Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Meat Processing Equipment market report include:- Mepaco

- Minerva Omega Group s.r.l.

- Tomra Systems ASA

- JBT.

- Nemco Food Equipment, LTD.

- RAM Beef Equipment, LLC

- The Middleby Corporation

- Marel

- Equipamientos cArnicos, S.L.

- Bettcher Industries, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

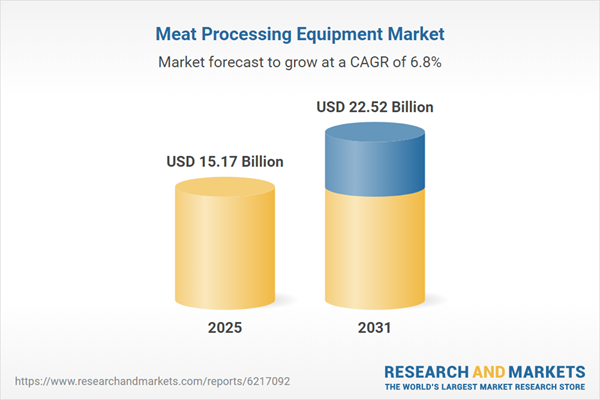

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 15.17 Billion |

| Forecasted Market Value ( USD | $ 22.52 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |