Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

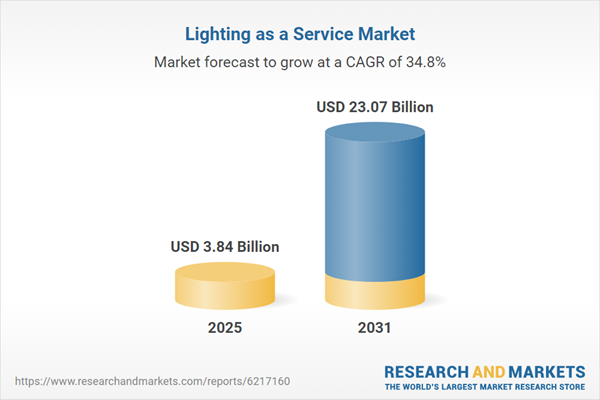

This growth is fundamentally underpinned by the financial transition from capital expenditure to operational expenditure, enabling organizations to modernize infrastructure with energy-efficient LED technology without incurring heavy upfront costs. Furthermore, the pressing need for sustainability in commercial real estate fuels adoption as companies aim to satisfy rigorous regulatory standards and lower utility expenses. As noted by 'LightingEurope' in '2024', lighting represents roughly 20% of the cost-effective electrical energy savings potential in non-residential buildings, emphasizing the significant efficiency gains that drive the shift toward managed lighting solutions.

Despite these potent drivers, a major challenge hindering market growth is the data security risk linked to Internet of Things (IoT) integration. Because LaaS systems rely heavily on connected sensors and cloud-based platforms for real-time monitoring and control, they introduce cybersecurity vulnerabilities into corporate networks. These security implications can cause hesitation among risk-averse enterprises and government bodies, potentially delaying the deployment of smart, connected lighting infrastructures despite their operational advantages.

Market Drivers

The Integration of Internet of Things (IoT) with Connected Lighting Solutions serves as a primary catalyst for the market, converting traditional illumination into intelligent, data-driven networks. This connectivity facilitates real-time monitoring and predictive maintenance, which are the operational foundations of the Lighting as a Service model. By incorporating sensors and control systems, providers can deliver value-added services like occupancy analytics that extend beyond basic light provision. The scale of this deployment is highlighted by Signify’s 'Fourth Quarter and Full-Year Results 2024' from January 2025, which reported that the company's installed base of connected light points grew to 144 million by the end of the year, establishing a strong base for subscription services dependent on continuous connectivity.Concurrently, the Rising Adoption of Energy-Efficient LED Lighting Systems drives momentum by offering operational expenditure reductions that justify long-term service contracts. As organizations face pressure to minimize carbon footprints, the high efficiency of solid-state lighting becomes a financial necessity. According to the New York Power Authority’s November 2024 release regarding 'Energy-Saving LED Streetlights Installation Begins in the City of Amsterdam', smart LED streetlights are 50 to 65 percent more efficient than alternative options. This efficiency gap encourages entities to outsource upgrades to service providers without upfront capital. Public sector support further accelerates this shift; the U.S. Department of Energy awarded $11.5 million in 2024 to install LED lighting in public facilities, reinforcing the trend toward modernized infrastructure.

Market Challenges

The data security risk associated with Internet of Things (IoT) integration is a critical factor impeding the expansion of the Global Lighting as a Service Market. As LaaS models advance from simple LED retrofits to connected systems requiring cloud-based monitoring, they necessitate the continuous collection and transmission of detailed building data. This connectivity broadens the digital attack surface, effectively transforming lighting networks into potential gateways for cybercriminals to infiltrate broader corporate IT infrastructures. Consequently, risk-averse organizations, particularly in sensitive sectors such as finance, healthcare, and government, often consider these vulnerabilities unacceptable, leading to prolonged sales cycles or the rejection of subscription-based lighting models in favor of traditional, offline alternatives.This apprehension regarding digital vulnerability constitutes a quantifiable barrier to the wider deployment of smart infrastructure. In '2024', the 'Association for Smarter Homes & Buildings' noted that '26% of current users identified data privacy and cybersecurity concerns as a significant challenge impeding the adoption of smart building technologies'. This statistic emphasizes the direct correlation between security anxieties and the slowed uptake of connected environments. Since LaaS is intrinsically linked to the smart building ecosystem, this prevailing skepticism regarding data protection limits the market’s addressable customer base and stifles the transition toward fully managed, connected lighting solutions.

Market Trends

The Incorporation of Circular Economy Principles in Service Models is fundamentally reshaping the market's value proposition, moving the focus from linear hardware consumption to comprehensive lifecycle management. In this evolving landscape, Lighting as a Service (LaaS) providers are increasingly utilizing modular, serviceable luminaires that can be repaired, remanufactured, or upgraded, thereby reducing material waste and aligning with the strict sustainability mandates of global enterprises. This strategic shift toward circularity is gaining commercial traction as major players prioritize closed-loop systems to secure long-term contracts; according to Signify, January 2025, in the 'Fourth Quarter and Full-Year Results 2024', the company’s circular revenues comprised 35% of its total sales, surpassing strategic targets and confirming the growing customer demand for sustainable service-based solutions.Simultaneously, the Transition to Cloud-Based and Wireless Control Architectures is acting as the technological backbone for scalable service delivery, allowing providers to avoid the costs and complexity of rigid, hardwired installations. By leveraging wireless connectivity, LaaS vendors can significantly lower the labor associated with retrofitting legacy infrastructure, while cloud integration supports the seamless remote monitoring and usage-based billing essential for subscription models. The magnitude of this industry-wide shift is evident in the revenue streams of leading manufacturers; according to Glamox, May 2025, in the 'Glamox Group Annual Report 2024', 42% of the company's total turnover came from connected lighting solutions, highlighting the critical role of connectivity in modernizing the built environment for managed services.

Key Players Profiled in the Lighting as a Service Market

- Signify Holding

- Koninklijke Philips N.V.

- General Electric Company

- Eaton Corporation PLC

- Zumtobel Group AG

- Cree Inc.

- Acuity Brands, Inc.

- Lutron Electronics Co., Inc.

- Future Energy Solutions, LLC

- SIB Lighting

Report Scope

In this report, the Global Lighting as a Service Market has been segmented into the following categories:Lighting as a Service Market, by Application:

- Residential

- Office

- Shops

- Hospitality

- Industrial

- Architectural Lighting and Others

Lighting as a Service Market, by Installation:

- Indoor and Outdoor

Lighting as a Service Market, by Component:

- Luminaries & Control Equipment

- Software & Communication Systems and Maintenance Services

Lighting as a Service Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Lighting as a Service Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Lighting as a Service market report include:- Signify Holding

- Koninklijke Philips N.V.

- General Electric Company

- Eaton Corporation PLC

- Zumtobel Group AG

- Cree Inc.

- Acuity Brands, Inc.

- Lutron Electronics Co., Inc.

- Future Energy Solutions, LLC

- SIB Lighting

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.84 Billion |

| Forecasted Market Value ( USD | $ 23.07 Billion |

| Compound Annual Growth Rate | 34.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |