Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Data indicates a rapid acceleration of this category within the wider beverage industry. According to the Adult Non-Alcoholic Beverage Association, sales of non-alcoholic spirits in off-premise channels surged by 86% year-over-year for the period ending December 2024. Despite this strong commercial growth, the sector encounters a major obstacle in attaining sensory equivalence with full-strength spirits. The technical challenge of mimicking the viscosity and thermal mouthfeel provided by ethanol remains a significant barrier, potentially hindering widespread adoption among consumers who expect the specific texture of traditional alcoholic drinks.

Market Drivers

Consumption habits among Gen Z and Millennials are fundamentally transforming the Global Non-Alcoholic Spirits Market. These younger demographics are prioritizing mental clarity and physical wellness, driving the rapid growth of the sober-curious movement. Unlike previous generations, these consumers actively demand sophisticated, alcohol-free options that support their moderation goals while ensuring social inclusion. This shift represents a structural lifestyle change rather than a fleeting trend, compelling brands to innovate with complex flavors and functional ingredients. According to a January 2025 report by Beverage Industry, over 65% of Gen Z consumers intend to reduce their alcohol intake in 2025, a statistic that is heavily influencing product development toward premium, health-focused offerings.The expansion of retail availability and integration into on-trade menus are equally vital for market growth. Leading retailers and hospitality venues are validating the category by allocating premium shelf space and creating exclusive non-alcoholic cocktail lists, effectively normalizing abstinence in social environments. This improved accessibility transforms alcohol-free options from niche items into standard staples alongside traditional spirits, directly meeting the demand for inclusivity. As noted by the Adult Non-Alcoholic Beverage Association in February 2025, 42% of on-premise consumers expressed a likelihood of participating in Dry January 2025, highlighting the need for diverse hospitality options. This strategy is delivering commercial success; Ocado Retail reported in January 2025 that sales of non-alcoholic spirits rose by 13% year-on-year, proving the effectiveness of increased availability.

Market Challenges

A primary obstacle to the sustained growth of the global non-alcoholic spirits market is the technical complexity of reproducing the viscosity and thermal mouthfeel associated with ethanol. Ethanol provides a specific weight and warming sensation that establishes the expected texture of traditional spirits. When this structural element is absent, the beverage often fails to provide the sensory depth consumers anticipate from a premium product. As a result, this deficiency fosters a perception of lower value, as the liquid appears thinner and less substantial than alcoholic equivalents, which deters repeat purchases among those looking for a genuine liquor alternative.The lack of sensory parity poses a significant risk to customer retention, which is essential for market maturity. According to the Adult Non-Alcoholic Beverage Association, the percentage of drinkers in the United States consuming non-alcoholic products increased to 13% in 2024. Although this rise indicates successful consumer acquisition, the inability to replicate mouthfeel restricts the industry's capacity to convert these initial trials into enduring habits. Without the tactile satisfaction provided by ethanol, the category faces the threat of high consumer churn, potentially stalling the transition from growing curiosity to stable market volume.

Market Trends

The rise of Ready-to-Drink (RTD) cocktail formats is significantly transforming consumption occasions by eliminating the complexities of mixology. While the market's initial growth was driven by full-sized bottles for home use, the current momentum favors convenient, pre-mixed options that offer the same portability as traditional canned drinks. This shift in format is essential for normalizing alcohol-free choices at casual social events, such as festivals or picnics, where mixing ingredients is inconvenient. According to Ocado Retail in January 2025, sales of no- and low-alcohol ready-to-drink cocktails rose by 31% compared to the same month the previous year. This increase highlights a consumer preference for professionally balanced, consistent beverages that offer immediate gratification without requiring extra garnishes or mixers.Simultaneously, the emergence of non-alcoholic agave and tequila alternatives marks a sophisticated evolution in flavor preferences, moving past the early dominance of botanical gin substitutes. Innovation within this segment targets the replication of specific peppery, earthy, and vegetal notes found in agave, catering to the demand for functional palomas and margaritas central to modern cocktail culture. This diversification is crucial for retaining consumers who may experience palate fatigue from standard herbal profiles and desire the distinct "bite" of agave spirits. As reported by The Spirits Business in August 2025, regarding Waitrose sales data, purchases of non-alcoholic tequila substitutes increased by 69% year-on-year. This sharp rise suggests that shoppers are actively expanding their collections to include complex, region-specific alternatives that enable a broader range of cocktail applications.

Key Players Profiled in the Non-Alcoholic Spirits Market

- Diageo PLC

- Celtic Soul Drinks Limited

- Spiritless LLC

- Drink Monday Inc.

- Fluere Drinks B.V

- ArKay Beverages Ltd.

- Ritual Beverage Company

- Lyre's Spirit Co

- Three Spirit Drinks Ltd.

- Berkshire Labels Ltd.

Report Scope

In this report, the Global Non-Alcoholic Spirits Market has been segmented into the following categories:Non-Alcoholic Spirits Market, by Product Type:

- Whisky

- Vodka

- Rum

- Gin

- Others

Non-Alcoholic Spirits Market, by Sales Channel:

- Offline

- Online

Non-Alcoholic Spirits Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Non-Alcoholic Spirits Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Non-Alcoholic Spirits market report include:- Diageo PLC

- Celtic Soul Drinks Limited

- Spiritless LLC

- Drink Monday Inc.

- Fluere Drinks B.V

- ArKay Beverages Ltd.

- Ritual Beverage Company

- Lyre's Spirit Co

- Three Spirit Drinks Ltd

- Berkshire Labels Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

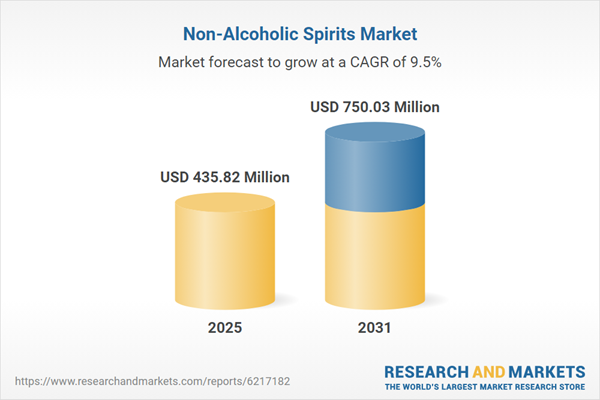

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 435.82 Million |

| Forecasted Market Value ( USD | $ 750.03 Million |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |