Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the sector encounters significant obstacles to rapid growth due to the entrenched dominance of lower-cost competing technologies. Data from the China Energy Storage Alliance indicates that in 2024, lithium-ion batteries comprised 96.4% of the cumulative installed new energy storage capacity, emphasizing the formidable competitive barrier flow batteries must surmount to attain widespread commercial scale. This marked disparity in market penetration complicates the ability to secure the investment necessary to optimize supply chains and decrease initial capital expenditures.

Market Drivers

The surging demand for long-duration energy storage (LDES) solutions serves as the primary catalyst for the flow battery sector, stemming from the inability of lithium-ion systems to economically support discharge durations beyond six hours. Flow batteries uniquely decouple power and energy capacity, allowing for cost-effective scaling by simply increasing electrolyte volume, which makes them ideal for stabilizing grids dependent on intermittent renewables. This operational requirement is driving aggressive long-term capacity goals; according to the LDES Council's '2024 Annual Report' from June 2024, the global market requires up to 8 TW of LDES capacity by 2040 to support net-zero power systems, a demand evidenced by Rongke Power's completion of the world's largest 700 MWh vanadium flow battery project in China in December 2024.Simultaneously, government policies and financial incentives are actively lowering the high initial capital expenditure barriers that have historically hindered market adoption. Governments globally are implementing funding mechanisms to de-risk commercialization and expedite the deployment of non-lithium technologies that enhance grid resilience. A key example of this support appeared in September 2024, when the U.S. Department of Energy announced in a press release that it was opening applications for up to $100 million in federal funding to advance pilot-scale demonstrations of long-duration systems. Such financial backing is crucial for optimizing supply chains and bridging the gap between prototype validation and commercial viability, directly improving the competitive standing of flow batteries against incumbent technologies.

Market Challenges

The growth of the global flow battery market is significantly constrained by the established prevalence of lower-cost competing technologies. Project developers and utility operators typically favor storage solutions that offer lower initial capital requirements and proven economies of scale, creating a substantial barrier to entry for flow batteries. This preference for mature technologies deters the investment volume needed to drive manufacturing efficiencies, causing flow battery developers to struggle in achieving the unit cost reductions associated with mass production and leaving the technology at a pricing disadvantage.This competitive imbalance directly retards the pace of infrastructure development and market penetration. The inability to capture a significant share of the market limits the industry's capacity to streamline supply chains, thereby perpetuating the cost gap between flow batteries and their competitors. According to the International Energy Agency, lithium-ion chemistries attracted over 90% of global investment in battery energy storage systems in 2024. This overwhelming concentration of capital in rival technologies reduces the funding available for flow battery deployment, effectively stalling the sector's ability to demonstrate commercial viability at the scale necessary for broader grid integration.

Market Trends

The market is increasingly shifting toward organic and non-vanadium chemistries to mitigate the high costs and supply chain volatility associated with traditional vanadium-based systems. Manufacturers are commercializing iron-flow and organic electrolytes that utilize abundant, non-toxic earth materials, thereby decoupling storage costs from commodity price fluctuations and enabling lower levelized costs of storage. This transition is driving significant capital investment aimed at scaling manufacturing for these alternative chemistries; for instance, ESS Tech, Inc. announced in a June 2024 press release that it secured $50 million from the Export-Import Bank of the United States to triple production capacity for its iron-flow battery systems, validating the commercial readiness of non-vanadium technologies.Concurrently, there is a pronounced expansion into decentralized power and microgrid applications, extending beyond large-scale transmission support to enhance municipal-level energy resilience. This trend is driven by the flow battery's unique ability to provide long-duration discharge for local communities, ensuring operational continuity during grid outages while maximizing the self-consumption of on-site renewable generation. These deployments demonstrate the technology's effectiveness in real-world self-sufficiency scenarios, as seen in December 2024 when Sumitomo Electric Industries, Ltd. successfully installed a 1 MW system with an eight-hour duration in Kashiwazaki, Japan, designed to facilitate the efficient use of locally generated renewable energy.

Key Players Profiled in the Flow Battery Market

- ESS Tech, Inc.

- Invinity Energy Systems

- VRB Energy

- Primus Power

- Dalian Rongke Power

- CellCube Energy Storage Systems

- Lockheed Martin

- Sumitomo Electric Industries

- SCHMID Group

- Infinite Energy Systems

Report Scope

In this report, the Global Flow Battery Market has been segmented into the following categories:Flow Battery Market, by Type:

- Redox Flow Battery

- Hybrid Flow Battery

Flow Battery Market, by Material:

- Vanadium

- Zinc-Bromine

- Others

Flow Battery Market, by Storage:

- Compact

- Large Scale

Flow Battery Market, by Application:

- Utilities

- Commercial & Industrial

- Military

- EV Charging Station

- Others

Flow Battery Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Flow Battery Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Flow Battery market report include:- ESS Tech, Inc.

- Invinity Energy Systems

- VRB Energy

- Primus Power

- Dalian Rongke Power

- CellCube Energy Storage Systems

- Lockheed Martin

- Sumitomo Electric Industries

- SCHMID Group

- Infinite Energy Systems

Table Information

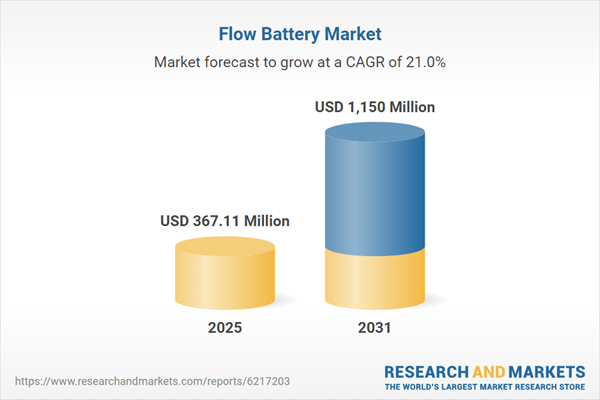

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 367.11 Million |

| Forecasted Market Value ( USD | $ 1150 Million |

| Compound Annual Growth Rate | 21.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |