Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this progress, market expansion faces significant obstacles due to cybersecurity risks associated with increased network connectivity. Integrating wireless protocols into critical infrastructure widens the potential attack surface, leading facility managers to worry about operational continuity and data integrity. Consequently, implementing robust encryption and adhering to strict security standards remains a persistent challenge that manufacturers must address to sustain market confidence and guarantee the safety of industrial operations.

Market Drivers

The rapid uptake of Industrial Internet of Things (IIoT) solutions is fundamentally transforming the market by necessitating flexible, data-centric field instruments. As manufacturers shift toward smart factory models, the demand for wireless transmitters has surged, driven by the need to capture process variables from assets that were previously too difficult or expensive to wire.These devices act as the essential sensory layer for digital ecosystems, providing real-time data to analytics platforms to improve operational visibility. According to Rockwell Automation's '10th Annual State of Smart Manufacturing Report' from June 2025, 81% of manufacturers report that internal and external pressures are accelerating digital transformation, with investments prioritizing cloud/SaaS, AI, cybersecurity, and quality management. This trend underscores the critical role of wireless instrumentation in enabling the connectivity required for these advanced digital strategies.

Simultaneously, the integration of high-speed 5G networks is eliminating historical barriers regarding latency and reliability, thereby broadening the use cases for wireless sensing in critical operations. Private 5G networks allow facilities to handle a high density of connected devices with the low latency needed for closed-loop control and safety applications.

Nokia's '2025 Industrial Digitalization Report' from September 2025 reveals that 94% of industrial enterprises have deployed on-premise edge technology alongside private wireless networks, illustrating widespread infrastructure readiness. This strong connectivity foundation supports the adoption of transmitters for predictive maintenance and asset optimization. Furthermore, Ericsson projects that Broadband and Critical IoT connections will reach 2.6 billion by the end of 2025, reflecting the immense scale of the ecosystem supporting these industrial wireless deployments.

Market Challenges

The primary obstacle hindering the growth of the Global Industrial Wireless Transmitter Market is the elevated cybersecurity risk associated with integrating wireless protocols into critical infrastructure. Unlike traditional hardwired loops that provide physical isolation, wireless transmitters broadcast data over radio frequencies that are susceptible to interception or disruption by malicious actors. This vulnerability increases the attack surface, generating concerns about the manipulation of process variables and the potential for induced operational failures. Consequently, risk-averse facility managers often hesitate to replace secure legacy wired systems with wireless alternatives, fearing that the benefits of connectivity do not justify the potential threat to asset integrity.This apprehension is supported by the rising frequency of industrial cyber incidents. In 2024, the Manufacturing Leadership Council reported that 48% of manufacturing executives stated their organizations had experienced at least one cyber attack or data breach in the preceding twelve months. Such statistics reinforce the view that wireless communication channels present unacceptable liabilities within safety-critical environments. As a result, the fear of data compromise directly slows the momentum of wireless adoption, compelling organizations to continue relying on more expensive but perceived-safer cabling infrastructure.

Market Trends

The growth of Low-Power Wide-Area Network (LPWAN) ecosystems is fundamentally altering the market by offering a cost-efficient connectivity tier for geographically scattered assets that do not need high-speed transmission. Unlike cellular solutions that consume significant power, protocols such as LoRaWAN enable the deployment of battery-operated transmitters in remote or hazardous areas, like pipelines and tank farms, where routine maintenance is difficult. This capability permits operators to digitize previously stranded data points without incurring the high infrastructure costs associated with traditional cabling or private cellular networks. According to the LoRa Alliance's '2024 End of Year Report' released in February 2025, the global installed base of LoRaWAN end nodes exceeded 350 million by June 2024, driven by the technology's dominance in massive IoT applications across utility and industrial sectors.Concurrently, the increasing use of Bluetooth Low Energy (BLE) for short-range sensing is transforming how facilities manage dense clusters of instrumentation within factory perimeters. Manufacturers are leveraging BLE to create wireless mesh networks that facilitate non-intrusive monitoring of rotating equipment for predictive maintenance, shifting from manual data collection rounds to continuous automated reporting. This transition is supported by the protocol's low energy consumption and ability to handle high node density, which is essential for granular asset health monitoring. According to the Bluetooth Special Interest Group (SIG) '2025 Bluetooth Market Update' from June 2025, global shipments of Bluetooth Low Energy single-mode devices are projected to grow at a compound annual growth rate of 22 percent over the next five years, reflecting the rapid integration of this technology into industrial sensing architectures.

Key Players Profiled in the Industrial Wireless Transmitter Market

- Honeywell International Inc.

- Schneider Electric SE

- Siemens AG

- General Electric Company

- Emerson Electric Company

- Rohde & Schwarz GmbH & Co KG

- Cannon Water Technology, Inc.

- AMETEK Inc.

- SATEL Oy

- OleumTech Corporation.

Report Scope

In this report, the Global Industrial Wireless Transmitter Market has been segmented into the following categories:Industrial Wireless Transmitter Market, by Type:

- Wireless

- Level Transmitters

- Pressure Transmitters

- Temperature Transmitters

- Flow Transmitters

- Voice Analysis

- Others

Industrial Wireless Transmitter Market, by End User:

- Industrial Automation

- Energy and Power

- Food and Agriculture

- Water

- Wastewater Treatment

- Others

Industrial Wireless Transmitter Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Wireless Transmitter Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Industrial Wireless Transmitter market report include:- Honeywell International Inc

- Schneider Electric SE

- Siemens AG

- General Electric Company

- Emerson Electric Company

- Rohde & Schwarz GmbH & Co KG

- Cannon Water Technology, Inc

- AMETEK Inc

- SATEL Oy

- OleumTech Corporation.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

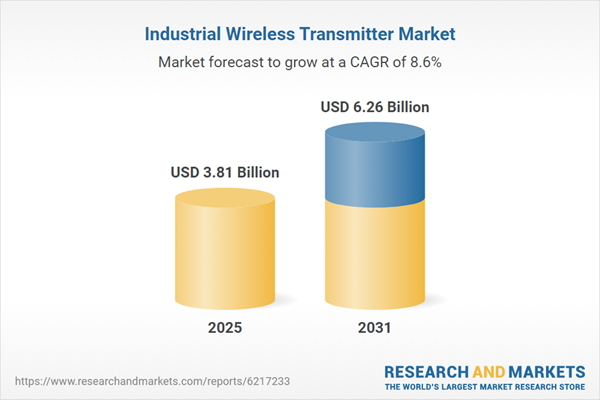

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.81 Billion |

| Forecasted Market Value ( USD | $ 6.26 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |