Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive growth trends, the market encounters a major obstacle concerning the danger of hitting existing underground utilities during drilling activities. Accidental damage to buried infrastructure results in safety risks and expensive delays, frequently leading to strict regulatory supervision that hinders project schedules. Consequently, the elevated technical sophistication needed to maneuver through crowded subterranean environments persists as a significant barrier to broader market development.

Market Drivers

The proliferation of 5G and fiber-to-the-home telecommunications networks acts as a primary driver for the horizontal directional drilling sector. As the need for high-speed connectivity grows, providers are densifying networks by installing extensive backhaul and last-mile fiber optic cables in dense urban environments where open trenching is not feasible. This necessitates the use of trenchless techniques to navigate crowded underground corridors while minimizing interference with traffic and existing hardscapes. According to the 'Ericsson Mobility Report' from June 2024, 5G mobile subscriptions are anticipated to surpass 5.6 billion by the end of 2029, indicating a continued demand for the physical underground infrastructure required to support this vast digital growth.Simultaneously, the increase in renewable energy grid connectivity and underground cabling profoundly impacts the market's direction. Utility companies are increasingly transitioning overhead power lines underground to bolster grid resilience against wildfires and severe weather, a strategy that depends heavily on directional drilling to traverse complex terrains without causing environmental harm. According to PG&E Corporation's '2023 Annual Report to Shareholders' from February 2024, the utility successfully undergrounded 364 miles of distribution lines in 2023 as part of its wildfire mitigation efforts. This move toward hardened infrastructure is backed by wider investment patterns; the International Energy Agency noted in 2024 that global investment in electricity grids is expected to hit USD 400 billion, highlighting the significant capital driving utility-focused drilling operations.

Market Challenges

A critical barrier hindering the expansion of the Global Horizontal Directional Drilling Market is the substantial risk of hitting existing underground utilities during operations. As urbanization accelerates, subsurface environments become increasingly crowded with intricate networks of cables and pipes, making navigation hazardous. Accidental strikes create severe safety risks for the public and workers, while also causing immediate project suspensions, reputational damage to contractors, and significant financial liabilities for repairs. Such occurrences undermine the perceived efficiency of trenchless technology, ultimately eroding client trust and diminishing project profitability.These operational hazards directly lead to strict regulatory obstacles and higher insurance premiums, which challenge the financial feasibility of HDD projects. The continuing frequency of these incidents underscores the scale of this operational challenge. According to the Common Ground Alliance, there were 196,977 unique reported damages to underground infrastructure in the United States and Canada in 2024. This high volume of utility strikes forces regulatory authorities to implement rigorous oversight and permitting processes, which inevitably extends project timelines and raises operational costs, thereby slowing the overall growth momentum of the market.

Market Trends

The automation of drill rod handling and exchange processes is developing as a pivotal trend to improve operational efficiency and alleviate workforce shortages within the market. Manufacturers are increasingly adopting mechanized systems that autonomously control the loading and unloading of drill rods, which reduces physical stress on operators and lowers the likelihood of jobsite injuries. This technological advancement meets the industry's demand for consistent performance and faster cycle times, especially in complicated urban projects where manual handling frequently causes delays. According to a November 2024 press release titled 'Vermeer Unveils The D24 Horizontal Directional Drill' by Vermeer Corporation, the newly launched Automated Rod Exchange (ARE) system enables operators to execute the full rod changeout sequence with a single button press, effectively removing up to 19 manual steps previously needed for the process.Concurrently, the use of HDD applications for offshore wind farm cabling is redefining the market's path as the global energy transition gains speed. This trend centers on utilizing directional drilling for shore landing operations, where export cables from offshore turbines must traverse sensitive coastal areas without disturbing shallow water ecosystems or beaches. As nations aggressively expand their renewable energy capacities, the need for trenchless solutions to install these high-voltage transmission cables has increased. According to the 'Global Offshore Wind Report 2024' released by the Global Wind Energy Council in June 2024, the global offshore wind sector successfully installed 10.8 GW of new capacity in 2023, generating a sustained demand for specialized HDD rigs equipped to execute long-distance bore paths for coastal grid interconnections.

Key Players Profiled in the Horizontal Directional Drilling Market

- Baker Hughes

- Halliburton Co.

- Nabors Industries Ltd.

- Schlumberger Ltd.

- Scientific Drilling International Inc.

- Weatherford International PLC

- American Augers, Inc.

- Barbco, Inc.

- Creighton Rock Drill Ltd.

- Direct Horizontal Drilling, Inc.

Report Scope

In this report, the Global Horizontal Directional Drilling Market has been segmented into the following categories:Horizontal Directional Drilling Market, by Machine:

- Conventional

- Rotary Steerable System

Horizontal Directional Drilling Market, by Type:

- Small

- Medium

- Large

Horizontal Directional Drilling Market, by Application:

- Oil and Gas

- Telecommunication

- Drain Pipe

- Electric Transmission

- Others

Horizontal Directional Drilling Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Horizontal Directional Drilling Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Horizontal Directional Drilling market report include:- Baker Hughes

- Halliburton Co.

- Nabors Industries Ltd.

- Schlumberger Ltd.

- Scientific Drilling International Inc.

- Weatherford International PLC

- American Augers, Inc.

- Barbco, Inc.

- Creighton Rock Drill Ltd.

- Direct Horizontal Drilling, Inc.

Table Information

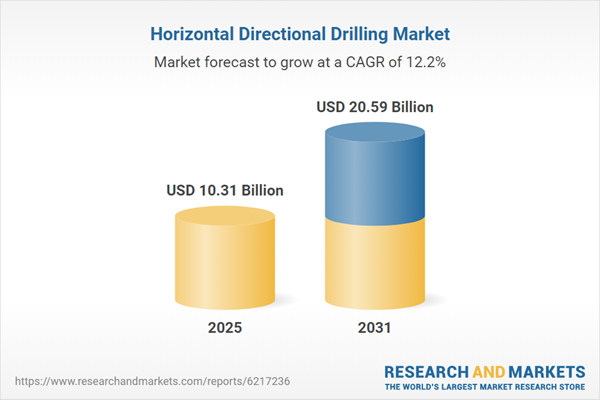

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 10.31 Billion |

| Forecasted Market Value ( USD | $ 20.59 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |