Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive indicators, the market faces significant hurdles related to workforce availability and retention. The shortage of skilled personnel capable of managing complex cleaning systems, coupled with escalating wage expenses, limits the ability of service providers to satisfy increasing client demands. This labor gap constrains operational scalability and places considerable financial strain on industry players, which could potentially hinder broader market progression.

Market Drivers

Rigid regulatory standards regarding industrial hygiene and safety oblige manufacturers to implement strict sanitation procedures to lower hazardous risks within production settings. Adhering to agency mandates requires the use of specialized industrial cleaning agents and automated equipment to efficiently handle toxic residues. These regulations serve as a crucial enforcement tool, compelling companies to prioritize facility upkeep to escape punitive actions and operational halts. The financial liabilities linked to non-compliance prompt substantial spending on professional cleaning services and safety gear. As noted by the U.S. Department of Labor in January 2024, the 'Federal Civil Penalties Inflation Adjustment Act Annual Adjustments for 2024' raised the maximum fine for willful or repeated workplace safety infractions to $161,323 per violation, establishing a robust financial motivation for maintaining compliant hygiene levels.The expansion of global automotive and manufacturing production directly drives a heightened need for heavy-duty cleaning solutions to handle assembly line waste and equipment maintenance. As industrial output grows, facilities encounter increased accumulations of lubricants, metal shavings, and chemical byproducts that must be cleared to guarantee product quality and machine durability.

This rise in production volume necessitates significant investment in cleaning machinery to sustain uninterrupted operations. According to the European Automobile Manufacturers’ Association's March 2024 'World Motor Vehicle Production' report, global vehicle manufacturing rose by 10.3 percent to 93.5 million units in 2023, requiring intensified maintenance efforts. Mirroring this industrial demand, Alfred Kärcher SE & Co. KG reported in 2024 a record turnover of 3.294 billion euros for the prior fiscal year, largely fueled by sales to professional customers.

Market Challenges

The shortage of skilled workers and high rates of workforce turnover currently pose a significant obstacle to the Global Industrial Cleaning Market's expansion. Because industrial cleaning involves managing hazardous substances and operating heavy equipment, the necessary training requirements considerably limit the pool of eligible applicants. This shortfall constrains the operational capabilities of service providers, often forcing them to refuse new contracts or postpone essential maintenance timelines. Consequently, the inability to expand the workforce to match rising client needs directly hampers broader market growth and restricts potential revenue generation.Additionally, the financial strain caused by increasing wages and ongoing recruitment expenditures establishes a volatile commercial environment. Service providers are frequently required to redirect funds away from innovation and equipment modernization to support retention initiatives, thereby stalling improvements in efficiency. This pattern is supported by recent industry statistics; according to the Building Service Contractors Association International, in 2025, 40 percent of surveyed contractors anticipated that recruitment difficulties would escalate in the coming year. This continuing instability in the workforce not only restricts operational scalability but also jeopardizes the reliability of critical industrial maintenance services.

Market Trends

The rapid adoption of autonomous industrial cleaning robots is fundamentally transforming operational processes by facilitating continuous, high-precision sanitation without the need for direct human involvement. This technology permits facilities to uphold consistent hygiene levels during non-operational hours, effectively separating cleaning schedules from shift rotations and minimizing the need for manual supervision of repetitive chores. Modern navigation systems now enable these machines to function safely within dynamic settings, guaranteeing thorough coverage across complex logistics and manufacturing sites. As reported by the International Federation of Robotics in October 2024, within the 'World Robotics 2024 Service Robots' publication, sales of professional cleaning robots increased by 4 percent to roughly 12,000 units in 2023, illustrating the steady incorporation of automated tools into professional maintenance plans.Concurrently, the market is undergoing a clear shift toward bio-based and enzymatic cleaning solutions, propelled by corporate sustainability requirements and the necessity to lower the environmental impact of industrial maintenance. Manufacturers are increasingly substituting petroleum-based solvents with renewable components derived from agricultural byproducts and plant extracts, which provide similar effectiveness while reducing toxicity and water contamination risks. This transition is further quickened by voluntary industry commitments to ensure responsible chemical ingredient supply chains. According to the American Cleaning Institute's October 2024 '2024 Sustainability Report', 60 percent of member firms have pledged to source RSPO-certified sustainable palm oil, highlighting the sector's strategic move toward environmentally sound raw materials for cleaning products.

Key Players Profiled in the Industrial Cleaning Market

- Evonik Industries AG

- BASF SE

- Pilot Chemical Corp.

- Novozymes

- Solvay

- The DOW Chemical Company

- Stepan Company

- Clariant

- Spartan Chemical Company Inc.

- Ecolab

Report Scope

In this report, the Global Industrial Cleaning Market has been segmented into the following categories:Industrial Cleaning Market, by Ingredient Type:

- Chelating Agents

- Solubilizers/Hydrotropes

- Others

Industrial Cleaning Market, by Application:

- Healthcare

- Food Processing

- Others

Industrial Cleaning Market, by Product Type:

- Metal Cleaners

- Disinfectants

- Dishwashing

- Others

Industrial Cleaning Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Cleaning Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Industrial Cleaning market report include:- Evonik Industries AG

- BASF SE

- Pilot Chemical Corp.

- Novozymes

- Solvay

- The DOW Chemical Company

- Stepan Company

- Clariant

- Spartan Chemical Company Inc.

- Ecolab

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

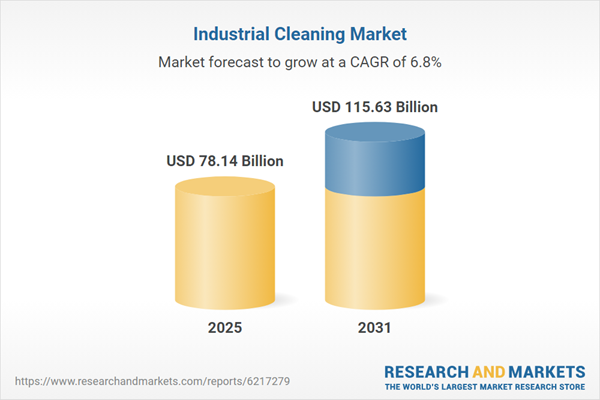

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 78.14 Billion |

| Forecasted Market Value ( USD | $ 115.63 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |