Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the sector faces a significant challenge regarding the high capital expenditure required to scale fermentation infrastructure and the difficulty of navigating fragmented global regulatory frameworks for novel ingredients. These hurdles can extend development timelines and impede the commercial viability of emerging technologies such as precision fermentation. Despite these operational barriers, the investment landscape is broadening; according to the Good Food Institute, the number of unique investors actively funding the fermentation sector increased by 22% in 2023.

Market Drivers

The surge in consumer demand for probiotics and digestive health solutions is fundamentally reshaping the fermented ingredients market, elevating these components from simple preservatives to essential functional agents. This shift is driven by a deepening consumer understanding of the microbiome's role in systemic wellness, leading to the integration of fermented solutions into complex medical and dietary regimens. Highlighting this trend, a June 2025 consumer perception study by Kerry Group found that 69% of participants attributed their continued use of GLP-1 medications to the digestive health benefits provided by concurrent probiotic supplementation, indicating that fermented ingredients are becoming critical adjuncts to modern pharmaceutical therapies and expanding their commercial application beyond traditional food products.Simultaneously, the rapid expansion of precision fermentation for alternative proteins is catalyzing significant industrial investment despite high entry barriers. This technology enables the production of bio-identical proteins without animal agriculture, effectively addressing sustainability mandates while necessitating substantial infrastructure development. The sector continues to attract robust capital inflows to support this scaling process; according to the Good Food Institute's 'State of the Industry Report: Fermentation' from May 2025, the sector demonstrated financial resilience by raising $651 million in total private funding throughout 2024. To convert this capital into operational capacity, companies are aggressively funding physical infrastructure, as evidenced by Liberation Labs securing $50.5 million in convertible note funding in January 2025 to finalize its commercial-scale biomanufacturing facility in Indiana.

Market Challenges

The Global Fermented Ingredients Market is critically impeded by the high capital expenditure required to establish and scale fermentation infrastructure. Unlike sectors with low physical asset requirements, fermentation necessitates massive upfront investment in bioreactors, downstream processing equipment, and specialized facilities before meaningful revenue can be generated. This financial barrier prevents many companies from transitioning from pilot scale to commercial production, creating a bottleneck where innovative technologies fail to reach the market due to a lack of manufacturing capacity, consequently keeping the supply of novel ingredients constrained and unit costs artificially high compared to conventional commodities.This infrastructure bottleneck is exacerbated by a tightening investment climate that restricts the flow of capital needed for such asset-heavy projects. Without sufficient funding, companies cannot construct the large-scale facilities necessary to achieve price parity with animal-based or synthetic alternatives. According to the Good Food Institute, the fermentation sector attracted $651 million in total funding in 2024, a figure that highlights a constrained environment relative to the substantial resources required for global infrastructure build-out. This shortfall directly slows the pace at which new capacity can be brought online and stalls the broader commercialization of fermentation-derived ingredients.

Market Trends

The integration of bio-fermented ingredients in "nutri-cosmetics" and skincare is fundamentally altering the personal care sector by replacing chemically synthesized actives with sustainable, high-efficacy bio-equivalents. Manufacturers are increasingly utilizing precision fermentation to engineer specific molecules, such as low-molecular-weight hyaluronic acid, which offer superior skin penetration while drastically lowering resource consumption. This convergence of biotechnology and beauty creates a scalable pathway to meet "clean label" demands without compromising performance or depleting natural resources; according to a January 2024 corporate press release from Givaudan Active Beauty, its precision-fermented ingredient PrimalHyal 50 Life achieved a 91% reduction in environmental impact compared to conventional production methods.Simultaneously, the market is witnessing a decisive shift from live probiotic strains to stable postbiotic ingredient formulations, overcoming the logistical limitations of cold-chain distribution. Unlike probiotics, which require viability preservation, postbiotics consist of inanimate microorganisms and bioactive metabolites that remain effective under high-heat processing and extended storage conditions, enabling their incorporation into diverse shelf-stable applications like baked goods and beverages. This transition allows brands to functionalize mainstream food products with microbiome benefits previously restricted to chilled dairy. According to an ADM consumer perception study from October 2024, 89% of participants in the United States expressed openness to trying products containing postbiotics based on their perceived health benefits, validating the commercial potential of this functional evolution.

Key Players Profiled in the Fermented Ingredients Market

- DuPont de Nemours, Inc.

- Kerry Group PLC

- Cargill, Incorporated

- BASF SE

- Chr. Hansen Holding A/S

- Ajinomoto Co., Inc.

- Lonza Group Ltd.

- Lallemand Inc.

- Evonik Industries AG

- Lesaffre

Report Scope

In this report, the Global Fermented Ingredients Market has been segmented into the following categories:Fermented Ingredients Market, by Type:

- Amino Acids

- Organic Acids

- Industrial Enzymes and Others

Fermented Ingredients Market, by Form:

- Dry and Liquid

Fermented Ingredients Market, by Process:

- Batch Fermentation

- Continuous Fermentation

- Aerobic Fermentation and Anaerobic Fermentation

Fermented Ingredients Market, by Application:

- Food & Beverages

- Feed

- Pharmaceuticals and Others

Fermented Ingredients Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fermented Ingredients Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Fermented Ingredients market report include:- DuPont de Nemours, Inc.

- Kerry Group PLC

- Cargill, Incorporated

- BASF SE

- Chr. Hansen Holding A/S

- Ajinomoto Co., Inc.

- Lonza Group Ltd.

- Lallemand Inc.

- Evonik Industries AG

- Lesaffre

Table Information

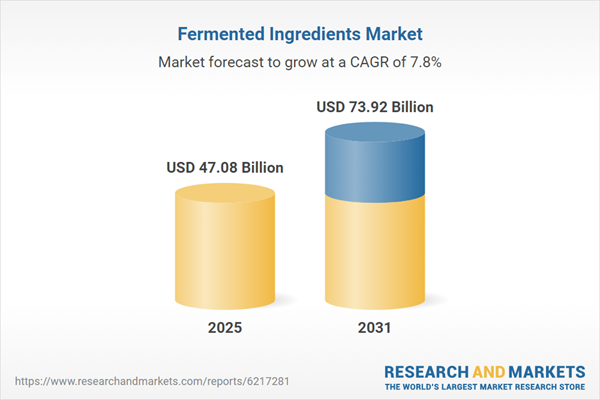

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 47.08 Billion |

| Forecasted Market Value ( USD | $ 73.92 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |