Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One significant obstacle impeding market progress is the apprehension surrounding data security and the protection of intellectual property. Manufacturers frequently hesitate to grant service providers remote access to essential operational data because of the potential risks associated with cyber threats or the leakage of competitive information. This lack of trust acts as a barrier to the adoption of fully connected, digital service solutions and delays the implementation of predictive maintenance strategies, which depend heavily on deep system integration.

Market Drivers

The swift adoption of Industry 4.0 and IIoT technologies serves as a major engine for growth in the specialized industrial services sector. As manufacturers digitize their operations, they increasingly turn to external experts to design, deploy, and oversee complex, interconnected systems that internal teams often lack the proficiency to manage. This wave of digital transformation fuels the demand for service contracts covering system integration, data analytics, and cybersecurity as facilities upgrade legacy infrastructure to maintain competitiveness. The magnitude of this shift is highlighted by Rockwell Automation's '2024 State of Smart Manufacturing Report' from April 2024, which indicates that 95% of manufacturers are currently utilizing or evaluating smart manufacturing technologies, underscoring the pervasive need for professional technical support to navigate smart factory complexities.Concurrently, the accelerating shift from reactive repairs to predictive maintenance strategies is transforming service delivery models and stimulating market expansion. Industrial operators are moving away from run-to-failure methods, favoring data-driven approaches that predict equipment issues before they cause failures, thereby protecting vital assets. The financial motivation for this transition is significant; according to Siemens in 2024, the estimated annual cost of unplanned downtime for an average large plant has escalated to $253 million. In response, service providers are implementing advanced monitoring solutions to minimize these financial risks. This strategic change is proving effective, as evidenced by MaintainX's '2024 State of Industrial Maintenance Report' from August 2024, where 65% of professionals surveyed identified the move toward proactive maintenance as the most successful strategy for curtailing unplanned downtime incidents.

Market Challenges

Concerns regarding data security and the safeguarding of intellectual property represent a significant hurdle to the growth of the Global Industrial Services Market. As service providers increasingly move toward digitally integrated offerings - such as predictive maintenance and remote monitoring - they require persistent access to a manufacturer’s sensitive operational networks. However, manufacturers are often unwilling to permit this external connectivity, fearing that third-party access points could become vulnerabilities for cyberattacks or unauthorized data theft. This protective stance inhibits the uptake of advanced service agreements, compelling facilities to depend on less efficient, reactive maintenance approaches instead of embracing integrated digital partnerships.This hesitation is justified by the intensifying threat landscape within the sector, validating the cautious stance of facility owners. Data from the Mechanical Engineering Industry Association (VDMA) in 2024 reveals that roughly 25% of surveyed member companies had experienced a serious cybersecurity incident in the previous two years. The high frequency of such security breaches strengthens the reluctance to share proprietary data with external vendors, which directly retards the market’s progress toward establishing interconnected service ecosystems.

Market Trends

The rise of industrial energy efficiency and decarbonization services is actively transforming the market as manufacturers increasingly delegate sustainability initiatives to meet rigorous net-zero goals. Service providers are currently offering specialized optimization and retrofit programs designed to lower energy intensity and carbon footprints throughout asset lifecycles, evolving from simple regulatory compliance to strategic resource management. This trend is propelled by the necessity to operationalize complex environmental targets, with major industry participants proving the effectiveness of these external collaborations. For instance, in its 'Annual Reporting Suite 2024' released in February 2025, ABB reported helping customers prevent 66 megatons of greenhouse gas emissions via the lifecycle of products sold in 2024, underscoring the significant influence of third-party involvement in industrial sustainability.At the same time, the sector is experiencing a fundamental transition toward servitization and outcome-based business models, where revenue is derived from guaranteed uptime rather than the sale of discrete parts. This shift redefines the traditional client-vendor dynamic, as service providers accept the risk associated with asset performance by charging for quantifiable results - such as production output or machine availability - instead of billable hours. This evolution allows industrial firms to correlate service expenditures directly with productivity improvements while motivating providers to ensure maximum equipment reliability. According to the 'State of Service 2025: Manufacturing Transformation Report' by IFS in October 2025, 39% of manufacturing leaders surveyed now identify servitization as a core component of their long-term growth strategy, affirming the move toward value-oriented service partnerships.

Key Players Profiled in the Industrial Services Market

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Jacobs Solutions Inc.

- AECOM Technology Corporation

- Fluor Corporation

Report Scope

In this report, the Global Industrial Services Market has been segmented into the following categories:Industrial Services Market, by Type:

- Engineering & Consulting

- Operational Improvement & Maintenance and Installation & Commissioning

Industrial Services Market, by Application:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Valves & Actuators

- Electric Motors & Drives

- Manufacturing Execution System (MES) and Others

Industrial Services Market, by Industry:

- Chemicals

- Aerospace & Défense

- Automotive

- Pharmaceuticals

- Metals & Mining and Others

Industrial Services Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Services Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Industrial Services market report include:- Siemens AG

- General Electric Company

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Jacobs Solutions Inc.

- AECOM Technology Corporation

- Fluor Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

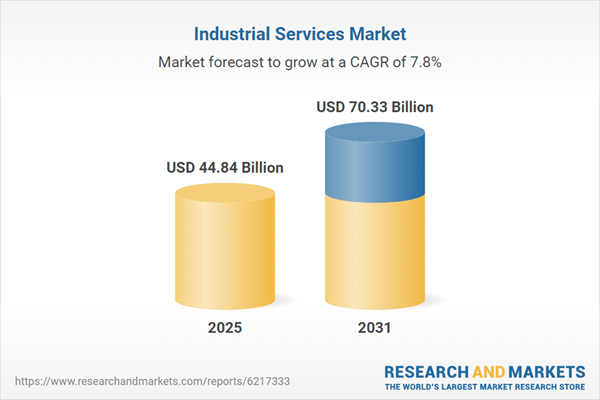

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 44.84 Billion |

| Forecasted Market Value ( USD | $ 70.33 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |