Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, market growth is significantly hindered by an increasingly strict regulatory climate established by governments worldwide to reduce smoking rates. Legislators are progressively enacting restrictive policies, including high excise taxes and rigorous plain packaging mandates, which directly diminish affordability and limit brand distinction. These intense regulatory actions, paired with extensive public health initiatives, establish a constrained business environment that actively restricts volume expansion for producers.

Market Drivers

The transition towards premiumization and value-added products serves as a vital strategy for manufacturers to maintain revenue levels despite falling consumption rates in developed areas. With consumers encountering health anxieties and regulatory constraints, a specific market segment is gravitating towards distinctive, high-quality tobacco options, which permits companies to utilize their brand strength to command higher prices. This approach allows firms to boost unit margins even as overall shipment volumes plateau, thereby protecting financial results from volume declines by selling higher-priced SKUs. For instance, British American Tobacco’s February 2024 'Annual Report and Form 20-F 2023' noted a 6.1% price mix improvement in its combustibles division, demonstrating the significant economic benefit of this strategic shift.Additionally, increasing disposable incomes in emerging economies act as a powerful catalyst for sustained demand, especially in Asia and Africa where economic power is growing in tandem with population numbers. In these regions, a developing middle class is converting occasional users into regular customers, while the spread of organized retail guarantees product access in areas that were once fragmented. This demographic pattern helps offset market saturation in the West, establishing a baseline volume for key industry participants. According to The Economic Times in May 2024, regarding 'ITC Q4 Results Update', ITC Limited recorded a 7% annual revenue increase in its cigarette division due to strong demand in India. This enduring demand supports vast global operations, as evidenced by Philip Morris International reporting a shipment volume of 612.9 billion cigarettes for the previous fiscal year in February 2024.

Market Challenges

A tightening regulatory landscape represents the primary obstacle hindering the expansion of the Global Cigarette Market. Governments across the globe are progressively implementing restrictive actions, such as high excise duties and strict plain packaging requirements, which directly undermine sector profitability. These forceful policies impede market growth by reducing affordability for consumers and eliminating brand differentiation opportunities for manufacturers, essentially commoditizing the product and limiting pricing flexibility. As a result, the legitimate market experiences significant volume reduction as buyers are either priced out or driven towards unregulated, illicit substitutes that fail to produce legal industry revenue.The financial consequences of these prohibitive measures are both empirically proven and severe. Data from the National Association of Tobacco Outlets in 2025 projected that new, rigorous product regulations would result in an annual revenue decline of USD 13.9 billion for tobacco retailers within the United States. This major financial loss highlights the way legislative constraints dismantle the economic infrastructure necessary for continued industry expansion, compelling manufacturers to function within a commercial environment that is steadily contracting.

Market Trends

The rise of super-slim and demi-slim cigarette varieties is swiftly transforming consumer tastes, especially in emerging Asian and Middle Eastern markets where thinner products are linked to modern aesthetics and a milder experience. This innovation in format enables producers to uphold margins by using less tobacco per unit while attracting demographics that value stylish and discreet designs. The market success of this category is clear in the results of major players adapting to this trend; for example, Tobacco Reporter noted in April 2025 ('Esse Cigarettes Power KT&G's Global Push') that Korea Tobacco & Ginseng Corporation saw exports to Gulf Cooperation Council nations hit USD 49 million in the first quarter, an 83.6% annual rise largely fueled by its leading super-slim brand.Concurrently, the sector is prioritizing the adoption of plastic-free and biodegradable materials to comply with international ESG standards and anticipate rigorous single-use plastic laws. Manufacturers are actively shifting from conventional non-recyclable wrappings and cellulose acetate filters to compostable options such as organic fibers and paper to reduce post-consumer waste. This move has become a key indicator of corporate sustainability and is being rolled out extensively across global supply chains. Demonstrating this commitment, Japan Tobacco Inc.'s 'Integrated Report 2025' revealed that the company reached a major milestone in 2024, with 92% of its group-wide packaging materials being recyclable or reusable, highlighting the intensified effort to lower the environmental impact of combustible goods.

Key Players Profiled in the Cigarette Market

- British American Tobacco PLC

- Imperial Brands PLC

- ITC Limited

- Altria Group Inc.

- China National Tobacco Corporation

- Japan Tobacco International SA

- Philip Morris Products SA

- 22nd Century Group

- Korea Tobacco & Ginseng Cooperation

- Eastern Company SAE

Report Scope

In this report, the Global Cigarette Market has been segmented into the following categories:Cigarette Market, by Product Type:

- Light

- Medium

- Others

Cigarette Market, by Sales Channel:

- Tobacco Shops

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Cigarette Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Cigarette Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Cigarette market report include:- British American Tobacco PLC

- Imperial Brands PLC

- ITC Limited

- Altria Group Inc.

- China National Tobacco Corporation

- Japan Tobacco International SA

- Philip Morris Products SA

- 22nd Century Group

- Korea Tobacco & Ginseng Cooperation

- Eastern Company SAE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

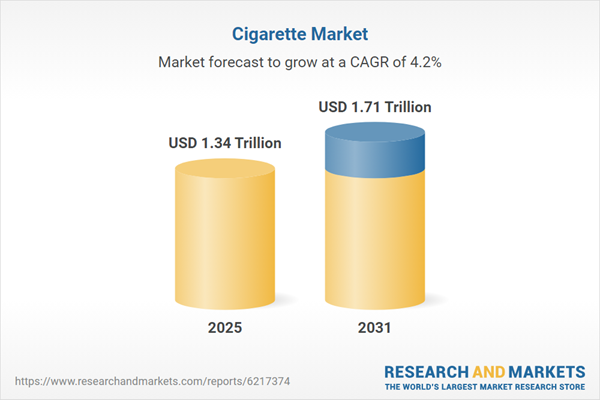

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.34 Trillion |

| Forecasted Market Value ( USD | $ 1.71 Trillion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |