Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A major obstacle hindering wider market reach is the higher initial cost of materials and fabrication for high-performance composites compared to traditional bronze or steel alternatives. Despite this economic barrier, the industrial infrastructure supporting these components remains strong and continues to scale. Data from the China Bearing Industry Association indicates that the bearing industry generated a record revenue of 231.5 billion yuan in 2024, highlighting the vast scale of the manufacturing sector that is increasingly incorporating these advanced tribological solutions.

Market Drivers

The expansion of renewable energy infrastructure, specifically wind power, serves as a primary catalyst for the adoption of composite bearings. These components are vital for wind turbine yaw and pitch systems, where low maintenance and high load capacity are essential. Unlike metal options, fiber-reinforced polymer bearings eliminate the need for complex lubrication systems, a significant advantage for offshore installations where maintenance logistics are difficult and expensive. This growth necessitates durable materials capable of withstanding wear and corrosion, aligning well with modern composite properties. According to the Global Wind Energy Council's 'Global Wind Report 2024' from April 2024, the global wind industry installed a record 117 GW of new capacity in 2023, directly increasing the requirement for specialized tribological components to support this energy transition.Simultaneously, the rapid shift toward electric vehicle manufacturing is driving the integration of lightweight materials to extend battery range and minimize noise, vibration, and harshness. Composite bearings are replacing heavier metallic versions in steering systems, hinges, and suspension units, offering weight savings while maintaining structural integrity.

This transition is supported by high production volumes in the electric mobility sector, ensuring a steady demand for non-metallic bushings. The International Energy Agency's 'Global EV Outlook 2024' from April 2024 notes that electric car sales reached nearly 14 million in 2023, representing a significant volume of units requiring advanced engineered components. This demand is further validated by financial performance; for instance, RBC Bearings Incorporated reported net sales of $1.56 billion for the fiscal year in 2024, reflecting sustained industrial appetite for highly engineered bearing products across transportation and industrial sectors.

Market Challenges

The significant disparity in initial expenditure between fiber-reinforced polymers and traditional metallic counterparts acts as a persistent restraint on market penetration. Developing high-performance composite bearings involves complex fabrication processes and specialized resin matrices, which inherently drive up the unit price compared to mass-produced steel or bronze alternatives. This price gap is particularly problematic for manufacturers with tight profit margins or those managing legacy equipment where low-cost replacement parts are prioritized over long-term performance gains. Consequently, procurement departments often hesitate to authorize the higher upfront capital required for these advanced components, delaying widespread integration.This economic sensitivity is significantly exacerbated by broader industrial contractions that force companies to retrench rather than invest in premium technologies. According to the German Mechanical Engineering Industry Association (VDMA), production in the mechanical engineering sector declined by 7.5% in 2024 compared to the previous year due to global demand fluctuations. Such a contraction in the wider manufacturing base compels equipment builders to prioritize immediate cost-savings, thereby reinforcing the preference for cheaper, conventional bearing solutions and slowing the transition to composite alternatives in cost-critical applications.

Market Trends

The development of eco-friendly and bio-based composites is rapidly emerging as a critical trend, driven by stringent environmental regulations and a corporate shift toward carbon-neutral manufacturing. This evolution involves replacing traditional petrochemical resins with renewable matrices derived from plant fibers and vegetable oils, effectively lowering the carbon footprint of production without sacrificing the tribological performance required for heavy-duty applications. This material transition is particularly vital for sectors like marine and food processing, where regulatory compliance regarding toxicity and end-of-life disposal is intensifying. According to European Bioplastics, in the 'Bioplastics Market Development Update 2024' from December 2024, global bioplastics production capacity is projected to increase to approximately 5.73 million tonnes by 2029, ensuring a scalable and robust supply chain to support the widespread fabrication of these sustainable bearing solutions.Simultaneously, the integration of IoT and smart sensor technology is transforming composite bearings from passive mechanical components into intelligent diagnostic tools. By embedding miniaturized wireless sensors directly into the bearing structure, operators can monitor real-time performance metrics such as temperature, vibration, and rotational speed to detect anomalies before catastrophic failure occurs. This capability enables a shift from reactive repairs to predictive maintenance strategies, which is essential for maximizing uptime in remote or hazardous industrial environments. According to SKF's 'Annual Report 2024' published in March 2025, the company invested SEK 3.33 billion in research and development, directing a substantial portion of these funds toward smart bearing technologies and condition monitoring systems to drive growth in high-performance markets.

Key Players Profiled in the Composite Bearings Market

- Trelleborg Group

- Polygon Company

- Saint-Gobain S.A.

- Schaeffler Group

- Hycomp LLC

- Tiodize Co. Inc.

- Spaulding Composites Inc.

- Tiodize Co. Inc.

- Rexnord Corporation

- RBC Bearings Incorporated

Report Scope

In this report, the Global Composite Bearings Market has been segmented into the following categories:Composite Bearings Market, by Product Type:

- fibre Matrix

- Metal Matrix

Composite Bearings Market, by Application:

- Construction & Mining

- Automotive

- Agriculture

- Marine

- Aerospace

- Others

Composite Bearings Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Composite Bearings Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Composite Bearings market report include:- Trelleborg Group

- Polygon Company

- Saint-Gobain S.A.

- Schaeffler Group

- Hycomp LLC

- Tiodize Co. Inc.

- Spaulding Composites Inc.

- Tiodize Co. Inc.

- Rexnord Corporation

- RBC Bearings Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

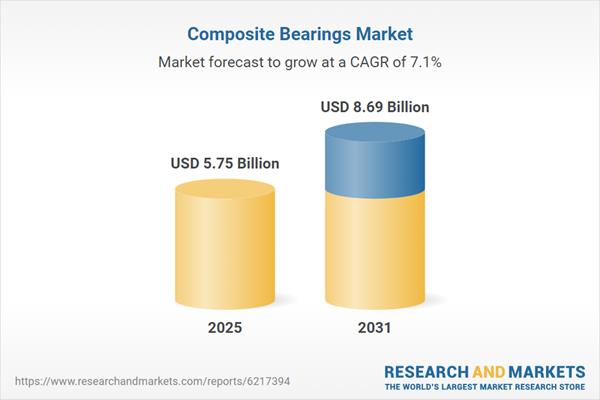

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.75 Billion |

| Forecasted Market Value ( USD | $ 8.69 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |