Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry encounters significant obstacles regarding the volatility of raw material prices, specifically for flour and wheat, which generates uncertainty in the supply chain and unpredictable production costs. This instability can hinder steady market growth and complicate the formulation of long-term pricing strategies for manufacturers. To highlight the immense industrial scale supporting these ingredients, the Federation of Bakers reported that the United Kingdom's bakery market volume surpassed 4.5 billion units in 2024, indicating a substantial production foundation for the broader crumb sector.

Market Drivers

The expansion of the processed seafood and meat sectors acts as a primary driver for the bread crumbs market, as these ingredients are essential for establishing the structural integrity and texture of value-added protein products. Manufacturers rely heavily on bread crumbs as coating agents for meat patties, fish fillets, and poultry nuggets to improve visual appeal and moisture retention, a dependency highlighted by the strong consumer demand for convenient protein choices. For example, the American Frozen Food Institute reported in July 2024 that unit sales of frozen processed chicken in the U.S. retail market rose by 9.6% in the first half of the year, while the USDA projected total U.S. red meat and poultry production for 2024 to reach 107.54 billion pounds, ensuring a massive baseline for crumb utilization.Additionally, the rapid growth of foodservice chains and Quick-Service Restaurants (QSR) accelerates market development, as these businesses depend on breaded menu options to deliver standardized, quick-prep meals. Bread crumbs enable operators to maintain consistent flavor and crispiness across high-volume frying processes, which is vital for the performance of chain restaurants. This segment's growth drives higher procurement of industrial-grade crumbs, illustrated by Tyson Foods reporting in August 2024 that sales in its Prepared Foods segment, which includes breaded poultry, reached $2.43 billion for the third fiscal quarter, securing a steady revenue stream for manufacturers serving institutional buyers.

Market Challenges

The volatility of raw material prices, particularly regarding flour and wheat, poses a major barrier to the stability of the global bread crumbs market. Manufacturers encounter considerable challenges in managing production costs when the value of these primary inputs fluctuates without warning. This instability necessitates frequent adjustments to pricing models, complicating relationships with major buyers in the processing and food service industries who rely on consistent cost projections for budgeting. Consequently, the inability to accurately forecast input costs often leads to compressed profit margins and restricts suppliers' capacity to invest in upgrades or expand operations.The direct consequence of this volatility is the disruption of financial forecasting and supply chain continuity. When raw material costs surge, manufacturers are forced to either absorb the difference or pass it downstream, which can negatively affect demand from cost-sensitive quick-service restaurants. Highlighting the severity of these fluctuations, the Food and Agriculture Organization noted that in October 2024, the Cereal Price Index averaged 114.4 points, reflecting persistent instability in global grain markets that directly determines the cost baseline for bread crumb production.

Market Trends

The use of bread crumbs as binding agents in plant-based meat alternatives marks a crucial functional evolution in the market, addressing structural issues found in non-animal protein formulations. Unlike traditional meat, plant-derived bases often lack the natural adhesive qualities needed to hold together during cooking and processing, requiring specialized crumb textures to replicate the cohesion and fibrous bite of muscle tissue. This application has transformed bread crumbs from mere external coatings into vital internal structuring components, supported by the commercial scale of the sector; according to the Good Food Institute's April 2025 report, global retail sales of plant-based meat analogues reached $6.1 billion in 2024, generating a significant revenue stream for crumb manufacturers.Concurrently, the rise of sourdough and ancient grain varieties is reshaping product portfolios as manufacturers premiumize coating systems to satisfy consumer desire for complex, artisanal flavor profiles. This trend elevates the market beyond standard white flour derivatives, positioning crumbs as ingredients that enhance flavor and offer perceived health benefits, such as the improved digestibility linked to fermentation. Food brands are increasingly using sourdough-based crumbs to distinguish high-end prepared meals, effectively separating these products from standard wheat commodity pricing; for instance, Puratos reported in December 2024 that consumer demand for sourdough bakery products rose by 40% in French-speaking regions, indicating a strong appetite for fermented grain derivatives.

Key Players Profiled in the Bread Crumbs Market

- Vigo Importing Co

- General Mills Inc.

- Kikkoman Corporation

- Gonnella Baking Company

- Gillian's Foods

- DeLallo

- 4C Foods

- George DeLallo Company, Inc.

- Edward & Sons Trading Co.

- Aleia's Gluten Free Foods Inc.

Report Scope

In this report, the Global Bread Crumbs Market has been segmented into the following categories:Bread Crumbs Market, by Product:

- Dry Bread Crumbs

- Fresh Bread Crumbs

Bread Crumbs Market, by Seasoning:

- Unflavored

- Italian

- French

- Paprika

- Others

Bread Crumbs Market, by Sales Channel:

- Hypermarkets/Supermarkets

- Departmental Stores

- Online

- Others

Bread Crumbs Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bread Crumbs Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Bread Crumbs market report include:- Vigo Importing Co

- General Mills Inc.

- Kikkoman Corporation

- Gonnella Baking Company

- Gillian's Foods

- DeLallo

- 4C Foods

- George DeLallo Company, Inc.

- Edward & Sons Trading Co.

- Aleia's Gluten Free Foods Inc.

Table Information

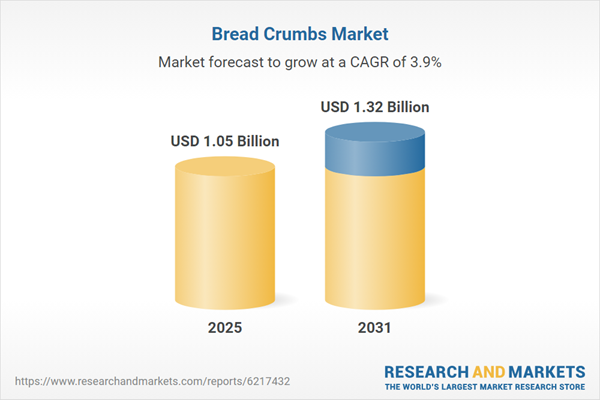

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.05 Billion |

| Forecasted Market Value ( USD | $ 1.32 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |