Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry encounters significant hurdles due to fluctuating raw material costs, especially for key ingredients like sugar and cocoa, which can drastically affect production margins and final retail prices. Despite these economic stressors, the market maintains strong financial health. According to the National Confectioners Association, confectionery sales exceeded $54 billion in 2024. This figure highlights the sector's lasting resilience and the substantial volume of consumption that continues despite ongoing supply chain difficulties.

Market Drivers

Seasonal and gifting-focused consumption acts as a crucial driver for volume growth, with major holidays creating concentrated revenue spikes that underpin annual results. Manufacturers and retailers increasingly depend on these occasions to launch limited-edition products, utilizing the cultural acceptance of indulgence during festivals to mitigate price sensitivity. The importance of this calendar-driven demand is clearly demonstrated in recent spending data. According to the National Retail Federation’s 'Halloween Spending 2025' forecast from October 2025, consumers were expected to spend $3.9 billion on candy alone, emphasizing the massive financial impact of a single seasonal event and validating the strategy of extending holiday sales periods.Additionally, continuous product innovation regarding formats, textures, and flavors serves as a secondary engine for market progress, fueling value growth even within established markets. Companies are heavily investing in research and development to address changing consumer tastes by introducing premium variants and novel combinations. This dedication to diversification is evident in the financial strategies of leading firms.

According to the Ferrero Group's 'Consolidated Financial Statements for the 2023/2024 Financial Year' released in February 2025, the company raised its total capital investment by 18% to bolster product development and manufacturing. Such investment is essential for long-term growth; indeed, the National Confectioners Association’s '2025 State of Treating' report from March 2025 predicts U.S. confectionery sales will surpass $70 billion by 2029.

Market Challenges

The instability of raw material costs, specifically for critical inputs like sugar and cocoa, poses a significant threat to the financial stability and growth of the Global Candy Market. Unpredictable fluctuations in input prices place immediate strain on operating margins, compelling manufacturers to either absorb these costs or transfer them to retailers and consumers. This economic pressure often results in increased retail prices, which can reduce consumer purchase volumes and hinder market penetration, particularly in price-sensitive areas. Consequently, businesses may be forced to curtail marketing or innovation budgets to maintain profitability, thereby slowing potential growth strategies.The severity of these supply-side pressures is highlighted by recent industrial data indicating acute shortages. According to the International Cocoa Organization, the global cocoa market experienced a massive supply deficit of roughly 478,000 tonnes in 2024, leading to a stocks-to-grindings ratio of 27.0%, the lowest recorded in nearly fifty years. Such a substantial deficit directly increases procurement costs, creating a difficult environment where confectionery producers worldwide struggle to maintain affordable pricing structures.

Market Trends

The shift toward 'Better-For-You' (BFY) reformulations marks a structural change in the industry, driven by consumers wishing to indulge without abandoning their health objectives. Manufacturers are actively reworking core product lines to lower sugar levels and include natural sweeteners such as monk fruit or stevia, effectively blurring the boundaries between functional nutrition and traditional confectionery. This trend is vital for retaining health-conscious consumers who might otherwise leave the category. Consumer perception is evolving alongside this segment; according to the National Confectioners Association's '2025 State of Treating' report from March 2025, 62% of consumers now acknowledge the existence of better-for-you options, indicating a maturing market where clean-label and low-sugar attributes are becoming established differentiators.Concurrently, the industry is prioritizing the integration of upcycled ingredients and sustainable packaging to satisfy strict regulatory standards and mitigate environmental impact. Companies are moving past vague commitments to implement circular economy principles, focusing on the reduction of virgin plastic and ensuring materials are ready for recovery. This operational evolution is essential for complying with global packaging mandates and maintaining brand equity among eco-conscious consumers. Major corporations are reporting measurable progress in this area. According to Mondelēz International’s '2024 Snacking Made Right Report' from April 2025, approximately 96% of the company’s packaging is now designed to be recyclable, demonstrating a sector-wide dedication to modernizing logistics and minimizing waste footprints.

Key Players Profiled in the Candy Market

- Mars Inc.

- Mondelez International Inc.

- Nestle S.A.

- Ferrero SpA

- The Hershey Company

- Perfetti Van Melle Holding B.V.

- Wrigley Company

- Haribo GmBh & Co. KG

- Lindt & SprUngli AG

- Meiji Group

Report Scope

In this report, the Global Candy Market has been segmented into the following categories:Candy Market, by Type:

- Sugar Candy

- Chocolate Candy & Gum Candy

Candy Market, by Distribution Channels:

- Convenience Stores

- Traditional Grocery Stores

- Supermarkets/Hypermarkets

- Online Sales Channel

- Departmental Store

Candy Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Candy Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Candy market report include:- Mars Inc.

- Mondelez International Inc.

- Nestle S.A.

- Ferrero SpA

- The Hershey Company

- Perfetti Van Melle Holding B.V.

- Wrigley Company

- Haribo GmBh & Co. KG

- Lindt & SprUngli AG

- Meiji Group

Table Information

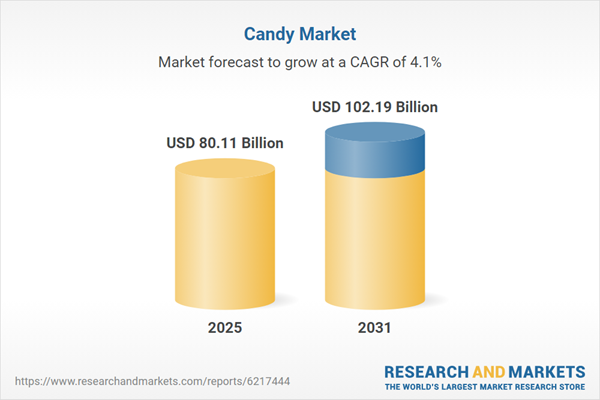

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 80.11 Billion |

| Forecasted Market Value ( USD | $ 102.19 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |