Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a substantial hurdle due to the escalating threat of cybersecurity breaches and data privacy vulnerabilities. As vehicles increasingly become connected and software-defined, manufacturers encounter significant challenges in protecting proprietary data and critical control systems from malicious attacks. These security concerns often result in extended development cycles and elevated compliance costs that burden profitability. Consequently, the difficulty of securing complex digital ecosystems against intrusion acts as a significant restraint on the seamless expansion of the automotive software industry.

Market Drivers

The transition toward Software-Defined Vehicle (SDV) architectures is reshaping the market by separating hardware from software, which facilitates continuous feature delivery and enhanced personalization. This structural shift allows original equipment manufacturers to move beyond traditional one-time sales, generating recurring revenue streams through over-the-air updates and subscription services that establish a lifecycle relationship with the consumer. Major technology suppliers are securing substantial long-term commitments as automakers upgrade their electronic infrastructure; for instance, Qualcomm announced during the 'Snapdragon Summit 2024' in October 2024 that it had established an automotive design-win pipeline of approximately $45 billion, emphasizing the scale of this architectural transformation.Concurrently, the growing adoption of Advanced Driver Assistance Systems (ADAS) acts as a primary catalyst, driving the need for robust, safety-certified software platforms to handle complex sensor fusion and decision-making. As regulatory bodies enforce higher safety standards and consumer demand for L2+ capabilities rises, the reliance on specialized operating systems that ensure functional safety is deepening. This trend is evident in BlackBerry Limited's April 2024 report, which noted a QNX royalty backlog increase to approximately $815 million, fueled largely by safety-critical ADAS wins. To support these sophisticated requirements, high-performance processing is essential, as reflected by NVIDIA's second-quarter 2024 automotive revenue hitting $346 million due to surging demand for AI-driven computing.

Market Challenges

The intensifying threat of cybersecurity breaches and data privacy vulnerabilities presents a severe obstacle to the growth of the Global Automotive Software Market. As the industry pivots toward software-defined vehicles, the incorporation of open-source platforms and third-party applications broadens the digital attack surface, leaving proprietary technology and driver data exposed to potential exploitation. This insecurity impedes market progress by forcing manufacturers to reallocate significant capital from feature innovation to defensive compliance measures and crisis management. As a result, vehicle release schedules are often delayed because engineers must perform extended, rigorous testing to satisfy stringent safety standards before mass production, thereby slowing the commercial rollout of next-generation fleets.The gravity of this operational strain is underscored by the evolving nature of these vulnerabilities. According to the Automotive Information Sharing and Analysis Center (Auto-ISAC), remote cyberattacks constituted approximately 92% of all reported incidents in 2024, highlighting the critical fragility of connected ecosystems. This prevalence of remote interference compels original equipment manufacturers to implement expensive, continuous monitoring protocols. These necessary yet costly defensive strategies erode profit margins and increase the unit cost of vehicle software, ultimately restraining the broader market adoption of advanced digital architectures.

Market Trends

The adoption of Cloud-Native Workflows for Automotive Software Development is fundamentally changing engineering methodologies by shifting validation processes from physical test benches to virtualized cloud environments. This "shift-left" testing approach allows software to be verified earlier in the lifecycle, significantly reducing hardware dependencies and accelerating the time-to-market for complex architectures. The efficiency gains are substantial; according to a January 2025 press release by Valeo regarding its collaboration with AWS, the deployment of virtualized hardware labs has reduced the development cycle of Electronic Control Unit (ECU) software by up to 40%, enabling OEMs to maintain the continuous delivery pipelines necessary for modern fleets.Simultaneously, the integration of Generative AI for Advanced In-Cabin Personalization is transforming vehicle interiors into context-aware digital assistants capable of natural dialogue and proactive support. Unlike traditional command-based systems, these large language model (LLM) interfaces analyze driver behavior and preferences to tailor infotainment, navigation, and comfort settings in real-time, thereby deepening the user-brand relationship. The scale of this integration is rapidly expanding as suppliers leverage massive installed bases; for example, Cerence Inc. announced in January 2025 that its AI-powered technology is now embedded in more than 500 million cars globally, providing an extensive foundation for the widespread rollout of these next-generation generative experiences.

Key Players Profiled in the Automotive Software Market

- Cox Automotive

- Microsoft Corporation

- SAP SE

- CDK Global

- Robert Bosch GmbH

- Continental AG

- NXP Semiconductors N.V.

- NVIDIA Corporation

- BlackBerry Limited

- Aptiv PLC

Report Scope

In this report, the Global Automotive Software Market has been segmented into the following categories:Automotive Software Market, by Vehicle Type:

- Passenger Car

- Light Commercial Vehicle

- Medium

- Heavy Commercial Vehicle

Automotive Software Market, by Application:

- ADAS & Safety

- Connected Services

- Autonomous Driving

- HMI

- V2X

- Infotainment

- Electric Vehicle Charging Management

- Electric Vehicle Battery Management

- V2G

Automotive Software Market, by Software Layer:

- Operating System

- Middleware

- Application Software

Automotive Software Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Software Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Software market report include:- Cox Automotive

- Microsoft Corporation

- SAP SE

- CDK Global

- Robert Bosch GmbH

- Continental AG

- NXP Semiconductors N.V.

- NVIDIA Corporation

- BlackBerry Limited

- Aptiv PLC

Table Information

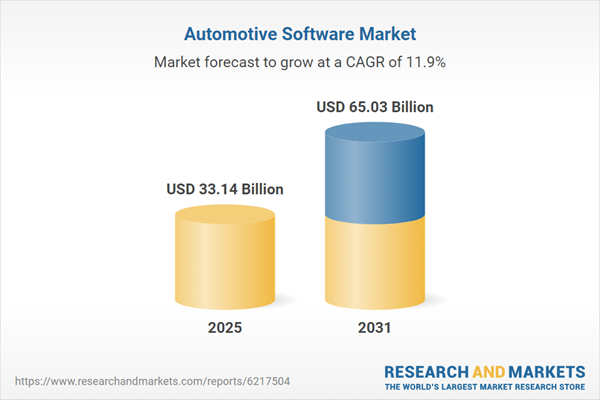

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 33.14 Billion |

| Forecasted Market Value ( USD | $ 65.03 Billion |

| Compound Annual Growth Rate | 11.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |