Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to data from the European Automobile Manufacturers’ Association, the average age of cars in the European Union reached 12.3 years in 2024. This statistic underscores the longevity of the vehicle fleet, which serves as a critical catalyst for the refinish sector since older automobiles typically require more frequent maintenance. However, the industry encounters a significant hurdle in the form of stringent environmental regulations limiting volatile organic compounds, which compel manufacturers to invest heavily in compliant technologies.

Market Drivers

The rising incidence of road accidents and collision repairs constitutes the primary source of recurring demand for the global automotive refinish coatings market. As vehicle density increases, the statistical probability of collisions remains significant, necessitating bodywork that requires primers, basecoats, and clearcoats to restore vehicle exteriors. This constant repair volume ensures a steady baseline of consumption for refinish products, regardless of broader economic fluctuations. According to the National Highway Traffic Safety Administration's December 2024 report, 'Early Estimate of Motor Vehicle Traffic Fatalities for the First Nine Months of 2024', an estimated 29,135 people died in traffic crashes, a figure indicative of the substantial frequency of severe collision events that drive throughput in body shops and collision repair centers.Simultaneously, stringent environmental regulations mandating low-VOC coatings are fundamentally reshaping product portfolios and technological investments within the industry. Governments worldwide are enforcing tighter emission standards, compelling a widespread transition from solvent-borne systems to waterborne and high-solid formulations that reduce volatile organic compound emissions.

This regulatory imperative is driving manufacturers to innovate sustainably advantaged solutions that maintain performance while ensuring compliance. According to PPG's 'Sustainability Goals & Progress' update in February 2025, the company reported that 41% of its sales in 2024 were derived from sustainably advantaged products, highlighting the commercial dominance of eco-friendly technologies. Furthermore, the scale of the sector reacting to these drivers is immense; according to Axalta Coating Systems' 'Fourth Quarter and Full Year 2024 Results' from February 2025, the company achieved record full-year net sales of $5.3 billion, reflecting the robust financial activity underpinning the global refinish and mobility coatings landscape.

Market Challenges

The stringent enforcement of environmental regulations limiting volatile organic compounds (VOCs) presents a substantial barrier to the expansion of the automotive refinish coatings market. These regulatory frameworks compel manufacturers to fundamentally restructure their product portfolios, necessitating a costly transition from solvent-borne systems to water-borne or high-solids alternatives. This shift requires significant capital expenditure on research and development as well as compliant manufacturing infrastructure, which directly diverts financial resources that could otherwise be allocated to market expansion or capacity growth. Additionally, the technical complexities associated with applying these compliant coatings can reduce operational throughput in body shops, thereby slowing the consumption rate of refinish materials.The impact of these transformative pressures is evident in global production metrics. According to the China Coatings Industry Association, in 2024, the total output of the coatings industry reached 35.34 million tons, representing a decrease of 1.60% compared to the previous year. This contraction in output from a major manufacturing hub illustrates how the industry’s rigorous focus on environmental compliance and the phasing out of non-compliant formulations are currently constraining production volumes. Consequently, the high costs and operational hurdles associated with meeting these environmental standards act as a direct brake on the market's overall growth trajectory.

Market Trends

The integration of AI-powered digital color matching and retrieval tools is fundamentally reshaping workflow efficiency within the automotive refinish sector. Manufacturers are aggressively deploying cloud-connected spectrophotometers and automated retrieval software that eliminate the subjectivity of manual color chips, allowing technicians to identify complex formulas with precision and reduce material waste. This technological differentiation is directly translating into superior market performance for early adopters. According to PPG's 'First Quarter 2025 Financial Results' released in April 2025, the company's automotive refinish coatings business grew above market rates, a performance attributed to the successful execution of its enterprise growth strategy which centers on the adoption of such digital ecosystem solutions.Simultaneously, the implementation of automated and robotic paint application processes is gaining traction as body shops seek to maximize throughput and profitability. Facilities are increasingly adopting fully automated mixing systems and robotic application arms that ensure consistent dosing, minimize human error, and significantly lower solvent consumption compared to manual methods. This shift toward high-tech, efficiency-driven equipment is improving the financial health of the coating providers supplying these advanced systems. According to Coatings World's report on the 'Axalta Releases First Quarter 2025 Results' in May 2025, the company achieved a record adjusted EBITDA margin of 21.4%, an improvement of 140 basis points, driven by the operational efficiencies and favorable price-mix associated with its premium automated technology offerings.

Key Players Profiled in the Automotive Refinish Coatings market

- Axalta Coatings Systems

- PPG Industries Inc.

- AkzoNobel N.V.

- BASF SE

- Sherwin Williams

- KCC Paints

- Covestro

- Berger Paints

- Kansai Paint

- Nippon Paint

Report Scope

In this report, the Global Automotive Refinish Coatings market has been segmented into the following categories:Automotive Refinish Coatings market, by Resin:

- Epoxy

- Acrylic

- Alkyd & Others

Automotive Refinish Coatings market, by Technology:

- Solvent-borne

- Aqueous

- Powdered & Others

Automotive Refinish Coatings market, by Layers:

- Surfacers

- Sealers

- Activator or Hardener & Others

Automotive Refinish Coatings market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Refinish Coatings market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Refinish Coatings market report include:- Axalta Coatings Systems

- PPG Industries Inc.

- AkzoNobel N.V.

- BASF SE

- Sherwin Williams

- KCC Paints

- Covestro

- Berger Paints

- Kansai Paint

- Nippon Paint

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

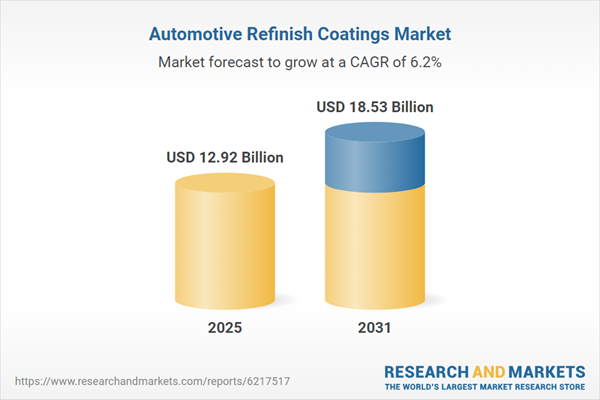

| Estimated Market Value ( USD | $ 12.92 Billion |

| Forecasted Market Value ( USD | $ 18.53 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |