Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, market expansion faces a significant hurdle due to the high capital costs and technical complexities associated with densifying network infrastructure, especially regarding millimeter-wave spectrum deployment. This economic obstacle frequently delays implementation in cost-sensitive areas, creating a bottleneck for the volume growth of components. To illustrate the current scale of adoption, 5G Americas reported that global 5G connections reached roughly 2.6 billion in 2025. Although this figure suggests strong uptake, the uneven distribution of global infrastructure investment continues to constrain the total addressable market for chipset suppliers within developing economies.

Market Drivers

The rapid proliferation of 5G-enabled smartphones and consumer electronics acts as the primary catalyst for volume growth within the chipset sector. As handset manufacturers aggressively update their portfolios to align with fifth-generation standards, there is a corresponding surge in orders for the integrated 5G modems and radio frequency modules required for consumer connectivity.This momentum is further bolstered by continuous reductions in component costs, allowing 5G capabilities to permeate mid-range and budget-tier devices. Highlighting this device-centric expansion, the Global mobile Suppliers Association (GSA) noted in its November 2024 '5G Device Ecosystem' report that the number of announced 5G devices reached 3,142, establishing a massive addressable market for semiconductor vendors. To support this hardware ecosystem, network usage is climbing; Ericsson reported that global 5G subscriptions reached 2.1 billion by the end of the third quarter of 2024, signaling persistent demand for chipset-equipped terminals.

Concurrent with consumer growth, the accelerated deployment of Industry 4.0 and industrial automation is opening a high-value segment for specialized 5G chipsets tailored for ultra-reliable low-latency communications (URLLC). Manufacturing plants and logistics hubs are increasingly adopting private 5G networks to connect sensors, autonomous mobile robots, and legacy machinery, requiring industrial-grade silicon that ensures secure and continuous data flow. Unlike consumer electronics, these applications value edge processing capabilities and stability over raw throughput, driving innovation in specialized system-on-chip architectures. The traction in this enterprise domain is evident; Nokia’s January 2025 financial update revealed the company had secured roughly 850 private wireless network customers globally, reflecting the expanding integration of cellular technology into operational environments and diversifying revenue streams for chipset makers beyond the saturated smartphone market.

Market Challenges

The significant capital expenditure and technical complexity required for network densification severely impede the growth of the Global 5G Chipset Market. Telecommunication operators face immense financial pressure to deploy the dense grid of base stations needed for Standalone architectures and millimeter-wave spectrum. This economic burden compels many service providers, especially in developing regions, to decelerate their infrastructure rollout plans. Consequently, this slowdown limits the physical footprint of 5G networks, directly reducing the volume of infrastructure-grade chipsets required for base stations and indirectly suppressing demand for consumer device chipsets as coverage gaps remain.This bottleneck is further evidenced by the sluggish migration to advanced network standards that necessitate higher-value semiconductor components. The complexity involved in upgrading from Non-Standalone to Standalone architectures creates a tangible gap between market ambition and actual execution. For instance, the Global mobile Suppliers Association (GSA) reported in August 2025 that while 173 operators globally were investing in 5G Standalone networks, only 77 had successfully launched commercial services. This disparity highlights how financial and technical barriers stall deployment, effectively capping the total addressable market for manufacturers producing advanced 5G modems and radio frequency modules.

Market Trends

The integration of On-Device Artificial Intelligence and Neural Processing Units is fundamentally reshaping semiconductor architectures to facilitate generative AI workloads directly at the edge. Chipset manufacturers are moving beyond standard connectivity functions by embedding dedicated neural engines that enable edge devices and smartphones to process large language models locally without relying on the cloud. This architectural evolution significantly increases the silicon value per unit, as original equipment manufacturers seek high-performance logic to differentiate their premium tiers. Highlighting the financial impact of this technical shift, MediaTek’s February 2025 financial update reported that revenue from flagship system-on-chips featuring advanced AI capabilities more than doubled year-over-year to reach $2 billion in 2024.Simultaneously, the adoption of 5G Reduced Capability (RedCap) Standards for IoT is creating a new intermediate market segment between high-performance 5G and low-power wide-area networks. This trend addresses the complexity and cost barriers that previously hindered 5G adoption in surveillance, wearables, and mid-tier industrial sensors by optimizing chipsets for a balance of price and power consumption rather than maximum throughput. By removing unnecessary features found in premium modems, semiconductor vendors can now target a massive volume of cost-sensitive IoT endpoints. Validating this infrastructure commitment, the Global mobile Suppliers Association (GSA) stated in its March 2025 '5G RedCap' report that 26 operators across 18 countries were actively deploying or investing in 5G RedCap technology to support this expanding device ecosystem.

Key Players Profiled in the 5G Chipset Market

- Broadcom Inc.

- Advanced Micro Devices, Inc.

- Analog Devices, Inc.

- NXP Semiconductors N.V.

- Marvell Technology Group

- Qualcomm, Inc.

- Murata Manufacturing Co., Ltd.

- Mediatek Inc.

- Infineon Technologies AG.

- MACOM Technology Solutions Holdings Inc.

- Anokiwave, Inc.

Report Scope

In this report, the Global 5G Chipset Market has been segmented into the following categories:5G Chipset Market, by IC Type:

- ASIC

- RFIC

- Cellular IC

- mm Wave IC

5G Chipset Market, by Operational Frequency:

- Sub 6GHz

- Between 26 & 39 GHz

- Above 39GHz

5G Chipset Market, by Deployment Type:

- Device

- Customer Premises Equipment

- Network Infrastructure Equipment

5G Chipset Market, by Industry Vertical:

- Automotive & Transportation

- Energy & Utilities

- Healthcare

- Consumer Electronics

- Industrial Automation

- Others

5G Chipset Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global 5G Chipset Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this 5G Chipset market report include:- Broadcom Inc.

- Advanced Micro Devices, Inc.

- Analog Devices, Inc.

- NXP Semiconductors N.V.

- Marvell Technology Group

- Qualcomm, Inc.

- Murata Manufacturing Co., Ltd.

- Mediatek Inc.

- Infineon Technologies AG.

- MACOM Technology Solutions Holdings Inc.

- Anokiwave, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

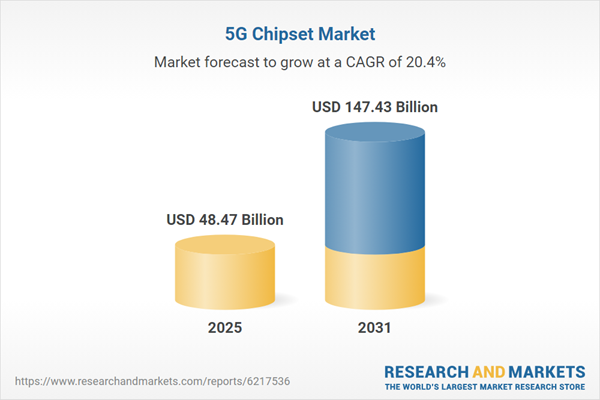

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 48.47 Billion |

| Forecasted Market Value ( USD | $ 147.43 Billion |

| Compound Annual Growth Rate | 20.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |