Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, the market encounters significant hurdles arising from strict environmental rules concerning volatile organic compound emissions and the ecological footprint of conventional propellants. Such regulatory demands compel manufacturers to undertake expensive reformulations and supply chain modifications. The industrial magnitude of this sector is evident in data from the European Aerosol Federation, which reported that aerosol production among member nations hit 3.46 billion units for the 2024 year, with the cosmetics and household sectors accounting for two-thirds of this volume.

Market Drivers

The increasing incidence of Healthcare-Associated Infections (HAIs) acts as a major engine for market expansion, pushing medical institutions to implement strict decontamination measures that depend heavily on aerosolized disinfectants. These pressurized products are vital for sanitizing inaccessible areas and lowering microbial counts in busy settings, especially considering the growing danger of antimicrobial resistance. The global burden of resistant pathogens highlights the urgency of this driver, necessitating regular sanitation to prevent cross-contamination. As per the World Health Organization's 'Global report on infection prevention and control 2024' from November 2024, approximately 136 million antibiotic-resistant healthcare-associated infections occur annually worldwide, underscoring the reliance on sophisticated disinfection methods to protect patients and limit transmission.Concurrently, the growing preference for ready-to-use and convenient sanitization options is fueling adoption in commercial and residential areas. Facility managers and consumers alike favor application ease and speed, choosing aerosol formats that provide uniform coverage without requiring mixing or complicated equipment. This trend toward accessible hygiene solutions has strengthened revenues for leading producers, confirming the format's lasting appeal. For example, Reckitt's 'Half Year Results 2024 & Strategy Update' in July 2024 noted that its Hygiene unit achieved 4.5% like-for-like net revenue growth, indicating continued success for its disinfectant brands. Highlighting the sector's size, The Clorox Company reported that its Health and Wellness segment, containing its disinfecting line, produced $2.5 billion in net sales in 2024.

Market Challenges

The expansion of the Global Aerosol Disinfectants Market is directly impeded by the enforcement of rigorous environmental standards regarding volatile organic compound emissions and the ecological effects of standard propellants. Producers are forced to shift from proven, high-performance propellants to environmentally friendly substitutes, a transition that requires costly and extensive product reformulation. These regulatory mandates obligate companies to allocate significant funds to research and compliance testing to guarantee that new mixtures preserve antimicrobial effectiveness without breaching emission limits. Consequently, these elevated operational expenses frequently lead to reduced profit margins or increased product costs, which restricts investment in growth and slows adoption in price-sensitive areas.Additionally, the necessity to restructure supply chains to handle compliant materials imposes major logistical challenges on mass-production centers. The magnitude of the industry dealing with these compliance obstacles is vast, complicating agility. Illustrating this industrial scale, the British Aerosol Manufacturers' Association noted in 2025 that the UK aerosol filling sector experienced production growth of almost 2% for the year 2024. Managing such substantial production volumes while maneuvering through complex regulatory environments creates operational instability, serving as a continuous constraint on the sector's overall progress.

Market Trends

The incorporation of Post-Consumer Recycled (PCR) Aluminum is swiftly transforming the market as manufacturers emphasize circular economy concepts to lower their environmental impact. Distinct from regulatory pressures centered on propellant emissions, this trend targets the physical packaging lifecycle by substituting virgin materials with high-quality recycled aluminum, substantially reducing production energy requirements. This active transition toward sustainable packaging is achieving industrial significance; according to Trivium Packaging's '2024 Sustainability Report' released in April 2025, 47% of the firm's total revenue stemmed from eco-designed goods, underscoring the commercial feasibility and rising use of these circular packaging options in the aerosol industry.At the same time, the rise of Multi-Surface and Hybrid Disinfectants is gathering momentum, fueled by the need for flexible formulations capable of treating various substrates, such as air, soft fabrics, and hard non-porous surfaces, in one go. This development advances beyond basic pathogen elimination to provide dual benefits like cleaning and odor removal, enabling users to combine several hygiene chores. The strong market demand for these all-in-one household products is reflected in production figures; AEROBAL reported in February 2025 that global shipments of aluminum aerosol cans for the household sector saw a significant increase of 22.7% in 2024, markedly outstripping other categories and confirming the move toward these multifunctional types.

Key Players Profiled in the Aerosol Disinfectants Market

- Procter and Gamble Company

- Unilever PLC

- The 3M Company

- Reckitt Benckiser Group PLC

- ITC Limited

- The Clorox Company

- Dabur Ltd.

- Diversey Holdings Ltd.

- Clean Control Corporation

- Zep Inc.

Report Scope

In this report, the Global Aerosol Disinfectants Market has been segmented into the following categories:Aerosol Disinfectants Market, by Type:

- Plain

- Scented

Aerosol Disinfectants Market, by End User:

- Household

- Commercial

Aerosol Disinfectants Market, by Distribution Channel:

- Hypermarkets/Supermarkets

- Pharmacy/Drug Stores

- Departmental Stores

- Online

- Others

Aerosol Disinfectants Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aerosol Disinfectants Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Aerosol Disinfectants market report include:- Procter and Gamble Company

- Unilever PLC

- The 3M Company

- Reckitt Benckiser Group PLC

- ITC Limited

- The Clorox Company

- Dabur Ltd.

- Diversey Holdings Ltd.

- Clean Control Corporation

- Zep Inc.

Table Information

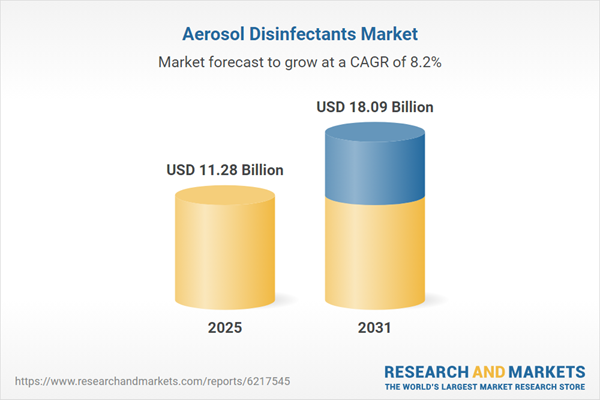

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 11.28 Billion |

| Forecasted Market Value ( USD | $ 18.09 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |