Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this growth, the market encounters substantial obstacles due to the volatility of raw material prices, which threatens supply chain stability and manufacturing profitability. The magnitude of demand is highlighted by the International Energy Agency, which reported that global battery demand for electric vehicles and storage applications reached nearly 1 terawatt-hour in 2024. This massive volume places intense pressure on component manufacturers to rapidly scale up production while navigating a complex and fluctuating economic environment.

Market Drivers

The surging production of electric and hybrid vehicles serves as the primary engine for the Global Battery Separators Market, creating an urgent need for increased membrane supplies to meet gigawatt-hour demands. As automotive manufacturers ramp up output to achieve electrification goals, the consumption of polyethylene and polypropylene separators for battery packs is escalating. This trend is underscored by data from the China Passenger Car Association, which noted in its 'September National Passenger Car Market Analysis' from October 2024 that retail sales of new energy vehicles hit 1.12 million units in September alone. Furthermore, the China Automotive Battery Innovation Alliance reported that power battery production in the nation reached 101.3 gigawatt-hours in August 2024, highlighting the immense material requirements of the sector.A second major driver is the implementation of strategic government incentives designed to localize battery supply chains and ensure energy independence. Federal authorities are utilizing significant financial tools to subsidize the construction of domestic manufacturing facilities, thereby helping companies manage the high capital costs associated with new production lines. These measures are crucial for meeting regional content mandates and reducing dependence on imports. For example, the U.S. Department of Energy announced in September 2024, under the 'Bipartisan Infrastructure Law Projects Announcement', that it had awarded over $3 billion to 25 projects intended to strengthen domestic production of advanced batteries and materials, securing a resilient industrial foundation for future needs.

Market Challenges

Fluctuating raw material costs pose a major hurdle for the Global Battery Separators Market, undermining supply chain consistency and complicating financial forecasting. Manufacturers rely on stable polymer pricing to preserve margins, yet they must operate within a battery ecosystem defined by unpredictable cost changes. When downstream battery product values oscillate drastically, cell manufacturers pressure component suppliers to reduce costs. This unstable economic climate creates risks for separator producers, who often struggle to balance inventory expenses with the shifting price demands of their clients, potentially delaying necessary capital investments.The severity of this instability is evident in recent market data reported by the International Energy Agency in 2024, which indicated that the average price of battery packs fell by roughly 20% due to sharp corrections in upstream mineral costs. This significant price drop exerts tremendous pressure across the value chain, compelling separator manufacturers to lower their prices to maintain market share, even as their own input costs vary. This financial compression threatens market growth by reducing the profitability needed to fund the advanced manufacturing capacities essential for meeting future demand.

Market Trends

The Global Battery Separators Market is witnessing a decisive transition toward wet-process manufacturing, spurred by the need for higher energy density in electric vehicle batteries. Wet-process membranes provide superior mechanical strength and pore uniformity compared to dry-process options, enabling the use of thinner films that increase active material volume without sacrificing safety. This shift is clearly reflected in production data; according to the Shanghai Metal Market's 'Performance Insights of TOP 10 Lithium Battery Separator Companies in 2024' from May 2025, shipments of wet-process separators in China reached 17.49 billion square meters in 2024, surpassing other methods to dominate the market share.Concurrently, the adoption of ceramic-coated separators is emerging as a vital trend to boost battery safety and thermal stability. To counter thermal runaway risks in high-voltage settings, manufacturers are applying functional ceramic layers to base films, thereby enhancing heat resistance and electrolyte wettability. This value-added process is increasingly necessary to satisfy rigorous automotive safety protocols, fueling growth in the coated segment. As evidence of this trend, Putailai New Energy Technology revealed in its '2024 Annual Report' from April 2025 that its coating processing volume hit 7 billion square meters in 2024, demonstrating the industry's strong reliance on functionalized composite structures for next-generation storage systems.

Key Players Profiled in the Battery Separators Market

- Asahi Kasei Corporation

- Toray Industries Inc.

- SK Innovation Co. Ltd.

- Ube Industries Ltd.

- Sumitomo Chemical Co. Ltd.

- ENTEK International LLC

- Freudenberg Performance Materials

- W-SCOPE Corporation

- Mitsubishi Paper Mills Ltd.

- Celgard LLC

Report Scope

In this report, the Global Battery Separators Market has been segmented into the following categories:Battery Separators Market, by Type:

- Lithium-Ion Battery Separator and Lead-Acid Battery Separator

Battery Separators Market, by Material:

- Polyethylene

- Polypropylene and Others

Battery Separators Market, by End-use Industry:

- Automotive

- Consumer Electronics

- Industrial

- Others

Battery Separators Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Battery Separators Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Battery Separators market report include:- Asahi Kasei Corporation

- Toray Industries Inc.

- SK Innovation Co. Ltd

- Ube Industries Ltd

- Sumitomo Chemical Co. Ltd

- ENTEK International LLC

- Freudenberg Performance Materials

- W-SCOPE Corporation

- Mitsubishi Paper Mills Ltd

- Celgard LLC

Table Information

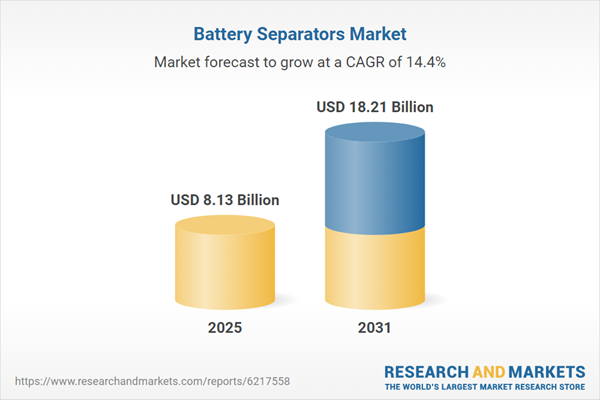

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 8.13 Billion |

| Forecasted Market Value ( USD | $ 18.21 Billion |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |