Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, a major obstacle hindering broader market expansion is the global shortage of skilled talent necessary to manage diverse and evolving IT architectures. The growing disparity between the demand for specialized maintenance and the availability of qualified professionals can result in service delivery delays and heightened operational risks. Despite these workforce constraints, the sector retains a massive economic presence. According to NASSCOM, technology industry revenue was estimated to reach 254 billion dollars in 2024. This figure highlights the substantial scale of the services market even as providers struggle with the challenges of recruiting and retaining adequate technical expertise.

Market Drivers

Accelerated Digital Transformation and IT Modernization Initiatives are fundamentally reshaping the sector as enterprises embed advanced technologies into their core operations. Organizations are increasingly depending on external providers to manage the complexities of adopting generative AI and upgrading legacy infrastructure, tasks that require specialized skill sets often unavailable internally.This pressure to modernize is highlighted by the rapid prioritization of intelligence technologies; according to Rackspace Technology’s '2024 IT Outlook Report' from January 2024, 65% of global IT professionals identified pervasive artificial intelligence as the technology expected to have the most significant positive impact on their organization in the coming year. Consequently, service providers have become essential partners in executing these critical digital pivots while ensuring system stability.

The strategic imperative to reduce operational costs and total cost of ownership further solidifies reliance on managed services. As cloud environments expand, the financial burden of managing disparate systems has increased, prompting leaders to outsource maintenance to optimize spending and enhance efficiency. This focus on fiscal discipline is currently outpacing other corporate goals. According to Flexera’s '2024 State of the Cloud Report' from March 2024, 59% of organizations prioritized cost optimization over sustainability initiatives, emphasizing the urgent focus on budget efficiency. This drive supports high workload mobility, with Nutanix reporting in 2024 that 95% of organizations moved applications between environments over the past year, underscoring the dynamic nature of modern application management.

Market Challenges

The global shortage of skilled talent acts as a formidable barrier directly impeding the growth of the Global Application Management Services Market. As enterprise IT environments become increasingly intricate by integrating legacy systems with modern hybrid cloud architectures, the demand for highly specialized technical expertise has surged. Although AMS providers rely heavily on human capital to deliver maintenance and modernization services, the scarcity of qualified professionals capable of navigating these complex ecosystems creates severe operational bottlenecks. This lack of available expertise restricts the ability of service providers to scale their operations efficiently or onboard new clients at the desired pace, effectively placing a hard limit on potential market expansion.This workforce imbalance results in tangible operational risks and inflated service costs. When demand exceeds the supply of capable engineers, providers face higher wage bills and longer recruitment cycles, which erode profit margins and delay service delivery. According to ISC2, in 2024, the global workforce gap for skilled cybersecurity professionals reached approximately 4.8 million. Since security is a foundational element of application management, this specific shortfall significantly hampers the ability of providers to guarantee secure, consistent support, thereby limiting the overall capacity of the market to grow in response to rising demand.

Market Trends

The accelerated adoption of AIOps and intelligent automation is fundamentally redefining the operational baseline of the Global Application Management Services Market. As enterprise IT ecosystems fracture into increasingly complex multi-cloud environments, traditional manual oversight is proving insufficient to maintain system reliability. Service providers are consequently integrating Artificial Intelligence for IT Operations (AIOps) to enable predictive maintenance, automated root cause analysis, and self-healing capabilities that preemptively resolve incidents before they impact end-users. This shift is driven by the necessity to handle the exponential volume of telemetry data generated by modern stacks, moving the industry away from reactive support models. According to Dynatrace’s '2024 State of Observability' report from March 2024, 72% of organizations have adopted AIOps specifically to reduce the complexity of managing their multi-cloud environments.Concurrently, the shift toward cloud-native and microservices architectures is forcing AMS providers to re-engineer their service delivery frameworks. The monolithic application structures of the past are being rapidly dismantled in favor of distributed, containerized systems orchestrated by Kubernetes, which offer greater agility but demand significantly higher technical proficiency to manage. This transition requires support teams to possess deep expertise in container orchestration and immutable infrastructure, moving beyond simple server maintenance to managing dynamic, ephemeral workloads. The scale of this architectural transformation is evident; according to the Cloud Native Computing Foundation’s (CNCF) 'Annual Survey 2023' published in April 2024, 66% of cloud consumers were using Kubernetes in production, underscoring the urgent market requirement for managed services capable of navigating these sophisticated landscapes.

Key Players Profiled in the Application Management Services Market

- Wipro Limited

- Tech Mahindra Limited

- Atos SE

- Capgemini SE

- DXC Technology Company

- Cognizant Technology Solutions Corporation

- International Business Machines Corporation

- HCL Technologies Limited

- Fujitsu Limited

- Accenture PLC

Report Scope

In this report, the Global Application Management Services Market has been segmented into the following categories:Application Management Services Market, by Services:

- Vertical Portfolio Assessment

- Vertical Security

- Vertical Modernization

- Vertical Managed Services and Others

Application Management Services Market, by Organization Size:

- Small and Medium-Sized Enterprises and Large Enterprises

Application Management Services Market, by Vertical:

- Banking

- Financial Services

- and Insurance

- Healthcare and Life Sciences

- Government

- Energy and Utilities

- Telecom and IT and Others

Application Management Services Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Application Management Services Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Application Management Services market report include:- Wipro Limited

- Tech Mahindra Limited

- Atos SE

- Capgemini SE

- DXC Technology Company

- Cognizant Technology Solutions Corporation

- International Business Machines Corporation

- HCL Technologies Limited

- Fujitsu Limited

- Accenture PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

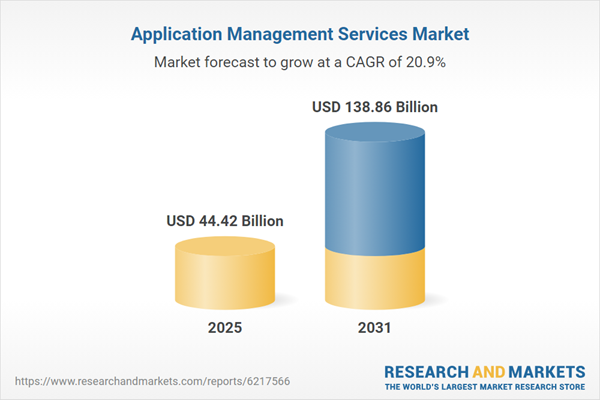

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 44.42 Billion |

| Forecasted Market Value ( USD | $ 138.86 Billion |

| Compound Annual Growth Rate | 20.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |