Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is primarily propelled by the global shift toward vehicle electrification and the implementation of strict emission standards, both of which demand efficient thermal management solutions that reduce parasitic energy loss. Consequently, traditional mechanical pumps are being superseded by electrical versions to guarantee precise temperature regulation in hybrid powertrains and battery packs. Highlighting this demand, the European Automobile Manufacturers’ Association (ACEA) reported that electrified vehicles comprised 57.7% of new passenger car registrations in the EU in December 2024, emphasizing the need for compatible electric components.

Nevertheless, the market faces a substantial obstacle in the form of higher manufacturing costs for these units relative to standard mechanical alternatives. This price difference hinders widespread adoption in cost-conscious entry-level segments and emerging markets where affordability is a key determinant. Additionally, the dependence on intricate supply chains for semiconductors and electronic control units subjects manufacturers to logistical risks. These vulnerabilities can interrupt production timelines and limit the industry's capacity to satisfy the escalating volume demands of contemporary automotive assembly.

Market Drivers

The rapid growth of the electric and hybrid vehicle sector acts as the main driver for the broad implementation of automotive electrical pumps. In contrast to internal combustion engines, which typically rely on accessory belt-driven mechanical pumps, electric vehicles necessitate autonomous electrical units to handle the vital thermal needs of power electronics and high-voltage battery packs. This structural change requires energy-efficient electric oil and coolant pumps capable of operating independently of vehicle speed to maintain optimal battery temperatures during heavy discharging and rapid charging cycles. The International Energy Agency’s 'Global EV Outlook 2024', published in April 2024, forecasts that electric car sales will hit roughly 17 million units by the end of the year, indicating strong industrial demand for these specialized thermal management parts to support the expanding electrified fleet.At the same time, strict global regulations regarding fuel economy and emissions are pushing manufacturers to reduce parasitic losses in hybrid and conventional powertrains by switching from mechanical to electrical auxiliaries. While mechanical pumps run continuously alongside the engine, electrical versions operate only on demand, thereby alleviating engine load and boosting overall fuel efficiency to satisfy tightening legal requirements.

For example, the United States Environmental Protection Agency’s 'Final Rule: Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles', released in March 2024, sets a fleet-wide average greenhouse gas emissions target of 85 grams per mile by 2032, a standard that requires the precise energy management offered by electrified ancillaries. Illustrating this procurement trend, Rheinmetall AG announced in 2024 that it received a major order for electric coolant pumps from a premium German automaker worth in the low three-digit million euro range, confirming the commercial magnitude of this technological shift.

Market Challenges

The elevated manufacturing expense of automotive electrical pumps compared to traditional mechanical options constitutes a major hurdle to market growth. These pumps require specialized motors and sophisticated electronic control units, leading to a considerably higher bill of materials that discourages their use in price-sensitive entry-level vehicle categories. In emerging markets where affordability drives purchasing decisions, original equipment manufacturers frequently prioritize cost savings over thermal efficiency, choosing to stick with less expensive mechanical systems. This economic constraint largely limits the electrical pump market to premium vehicle segments, stopping the technology from attaining the mass-market scale needed to achieve volume-based price decreases.Moreover, the aggregated cost of expensive components increases the final price of electrified vehicles, which are the main users of these pumps. When vehicle manufacturers cannot absorb these expenses without sacrificing margins, the resulting higher prices can suppress consumer demand for the vehicles themselves. As noted by the German Association of the Automotive Industry (VDA), new registrations of battery electric vehicles in Germany were projected to fall by 21% to around 551,000 units in 2024. This shrinkage in the primary application sector demonstrates how component-level pricing obstacles directly restrict the broader expansion of the global market.

Market Trends

The shift from brushed to brushless DC (BLDC) motor technology is significantly shaping product development in the market, motivated by requirements for efficiency and durability. Unlike brushed motors that encounter mechanical friction, BLDC versions employ contactless commutation to prevent wear and decrease noise, which is essential for silent electric powertrains. This technology facilitates the creation of compact pumps that offer the exact speed control needed for detailed thermal management. Highlighting this move toward advanced motor-driven solutions, Nidec Corporation reported in January 2025, within its 'Financial Results for Fiscal Third Quarter and Nine Months Ended December 31, 2024', that automotive products comprised 25.5% of its consolidated sales.Concurrently, the move toward 48-volt electrical architectures is becoming a key trend to support high-load applications. This voltage standard enables electrical pumps to deliver the flow rates required for battery cooling while avoiding the heavy cabling and resistive losses associated with 12-volt systems. By transitioning to 48-volt networks, manufacturers can reduce energy waste and improve component packaging. Confirming this architectural evolution, Schaeffler AG stated in its March 2025 press release, 'Schaeffler with stable overall results in transition year 2024', that its E-Mobility division achieved an order intake of 4.7 billion euros in 2024, indicating strong demand for compatible electrified components.

Key Players Profiled in the Automotive Electrical Pump Market

- Johnson Electric Holdings Limited

- Schaeffler Group

- Denso Corporation

- Delphi Automotive PLC

- Robert Bosch GmbH

Report Scope

In this report, the Global Automotive Electrical Pump Market has been segmented into the following categories:Automotive Electrical Pump Market, by Type:

- Fuel Pump

- Steering Pump

- Water Pump

- Vacuum Pump

- Others

Automotive Electrical Pump Market, by Vehicle Type:

- Passenger Car

- LCV

- M&HCV

Automotive Electrical Pump Market, by Demand Category:

- OEM vs Replacement

Automotive Electrical Pump Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Electrical Pump Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Electrical Pump market report include:- Johnson Electric Holdings Limited

- Schaeffler Group

- Denso Corporation

- Delphi Automotive PLC

- Robert Bosch GmbH

Table Information

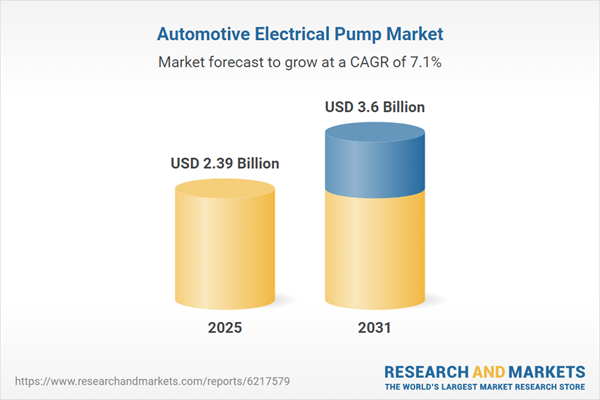

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.39 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |