Non-alcoholic beer, including alcohol-free (0% ABV), non-alcoholic (0.5% ABV), and low-alcohol (0.5% to 2.5% ABV) varieties, has become a notable segment in the global beverage industry. These beverages cater to health-conscious consumers, designated drivers, and those seeking the authentic taste of beer without alcohol’s effects. The market spans multiple beer styles, from lagers and IPAs to wheat beers, stouts, and specialty brews, delivering genuine flavor experiences with minimal or no alcohol. Growth is driven by increasing health awareness, changing lifestyle preferences, and consumer interest in premium, innovative brewing options. Advancements in brewing technology, including vacuum distillation, reverse osmosis, and arrested fermentation, allow producers to improve taste and aroma, enhancing acceptance and reducing historical skepticism around non-alcoholic beers.

The Non-alcoholic (0.5% ABV) segment held a 60% share in 2025 and is expected to grow at a CAGR of 7.6% through 2035. This segment balances authentic beer flavor with minimal alcohol, aligning with legal non-alcoholic standards while delivering a drinking experience closest to traditional beer. Established brewing techniques preserve flavor complexity, mouthfeel, and aroma better than fully alcohol-free alternatives.

The non-alcoholic lager segment accounted for a 54.5% share in 2025 and is forecast to grow at a CAGR of 7.6% through 2035. Its global appeal, clean taste, mild bitterness, and smooth finish make it a preferred choice for new and existing consumers in the non-alcoholic category.

U.S. Non-Alcoholic Beer Market was valued at USD 6.4 billion in 2025. The country leads North America’s market due to strong health and wellness awareness, the mainstream adoption of the sober-curious movement, and a vibrant craft brewing culture that embraces innovation. Millennials and Gen Z consumers’ emphasis on mindful drinking, premium craft product adoption, and marketing that positions non-alcoholic beer as a lifestyle choice drives sustained demand.

Major players in the Global Non-Alcoholic Beer Market include Athletic Brewing Company, Heineken N.V., Anheuser-Busch InBev, Carlsberg Group, Molson Coors, Clausthaler/Radeberger Group, BrewDog, Partake Brewing, Bravus Brewing Company, Nirvana Brewery, Big Drop Brewing Co., Erdinger Alkoholfrei, WellBeing Brewing, Grüvi, Surreal Brewing Company, Hairless Dog Brewing, Mikkeller, Infinite Session, and Rightside Brewing. Companies in the Non-Alcoholic Beer Market strengthen their position through strategies such as investing in advanced brewing technologies to enhance taste, aroma, and mouthfeel. They expand product portfolios across multiple ABV categories and beer styles to attract diverse consumer segments. Geographic expansion into emerging markets and urban centers helps tap growing health-conscious populations. Marketing campaigns focus on lifestyle branding, emphasizing wellness, mindful drinking, and premium craft experiences. Partnerships with distributors, retailers, and e-commerce platforms ensure wider availability, while collaborations with influencers and event sponsorships increase brand visibility.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Non-Alcoholic Beer market report include:- Athletic Brewing Company

- Heineken N.V.

- Anheuser-Busch InBev

- Carlsberg Group

- Molson Coors

- Clausthaler / Radeberger Group

- BrewDog

- Partake Brewing

- Bravus Brewing Company

- Nirvana Brewery

- Big Drop Brewing Co.

- Erdinger Alkoholfrei

- WellBeing Brewing

- Grüvi

- Surreal Brewing Company

- Hairless Dog Brewing

- Mikkeller

- Infinite Session

- Rightside Brewing

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | December 2025 |

| Forecast Period | 2025 - 2035 |

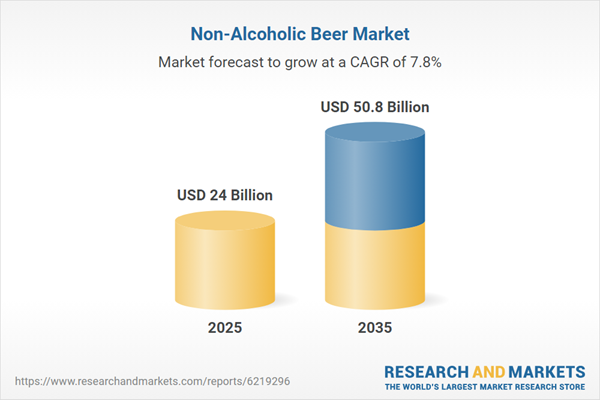

| Estimated Market Value ( USD | $ 24 Billion |

| Forecasted Market Value ( USD | $ 50.8 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |