Market growth is fueled by the rapid expansion of global vehicle production, the increasing adoption of electric and hybrid vehicles, and growing consumer demand for enhanced safety, durability, and performance. Manufacturers, OEMs, and aftermarket providers are prioritizing efficient vehicle assembly and lifecycle cost reduction, which has increased the importance of technologically advanced fastener solutions. Innovations in high-strength materials, lightweight components, and smart fastening technologies are reshaping the market, enabling automakers to optimize load-bearing capacity, maintain structural integrity, and monitor assembly stress in real time. The evolution of the market is also supported by digital torque monitoring, predictive maintenance, and AI-driven assembly optimization, all of which contribute to improved vehicle performance, extended component life, and more efficient production processes across passenger, commercial, and electric vehicle segments.

The threaded fasteners accounted for 65% share in 2025 and are expected to grow at a CAGR of 5.9% through 2035. Their dominance is driven by the need for secure, reusable, and high-strength connections across vehicle assemblies. Demand for these fasteners spans passenger vehicles, light and heavy commercial vehicles, and electric vehicles, ensuring safety, precision, and cost-efficient maintenance.

The OEM segment held 71% share in 2025 and is forecasted to grow at a CAGR of 5.2% through 2035. OEMs rely on advanced fastening solutions, including self-locking nuts and EV-optimized systems, to support high production volumes while maintaining structural reliability and assembly efficiency.

China Automotive Fastener Market generated USD 1.46 billion in 2025. Its status as a global automotive manufacturing hub, rapid expansion in electric and hybrid vehicle production, and adoption of advanced fastening technologies contribute to strong market demand. Major automotive clusters across eastern and southern China are increasingly implementing high-performance fasteners, reinforcing the nation’s leadership within the region.

Key players in the Global Automotive Fastener Market include Bossard, Würth, Illinois Tool Works (ITW), ARaymond, Nedschroef, Bulten, Pentair Automotive Fasteners, Stanley Black & Decker, KAMAX, and LISI Automotive. Companies in the Global Automotive Fastener Market are employing multiple strategies to strengthen their position and expand their footprint. They are investing heavily in research and development to create lightweight, corrosion-resistant, and smart fastening solutions. Strategic partnerships with OEMs and aftermarket providers help secure long-term contracts and broaden market access. Firms are also focusing on regional expansion to tap into emerging automotive hubs, particularly in Asia-Pacific. Adoption of digital and AI-based assembly monitoring tools enhances product differentiation.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Automotive Fastener market report include:- ARaymond

- Bossard

- Bulten

- Illinois Tool Works (ITW)

- KAMAX

- LISI Automotive

- Nedschroef

- Pentair Automotive Fasteners

- Stanley Black & Decker

- Würth

- Al Ameen Fasteners

- Anchors Fasteners

- Clavos y Tornillos

- Fastenright

- Gunther Fasteners

- Jorfast

- SAE Fasteners

- Sundaram Fasteners

- Topfast Fasteners

- Yuyama Manufacturing

- EcoFast Automotive

- EVFast Fastening Solutions

- GreenBolt Solutions

- NextGen Fasteners

- Titan Fasteners

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 245 |

| Published | January 2026 |

| Forecast Period | 2025 - 2035 |

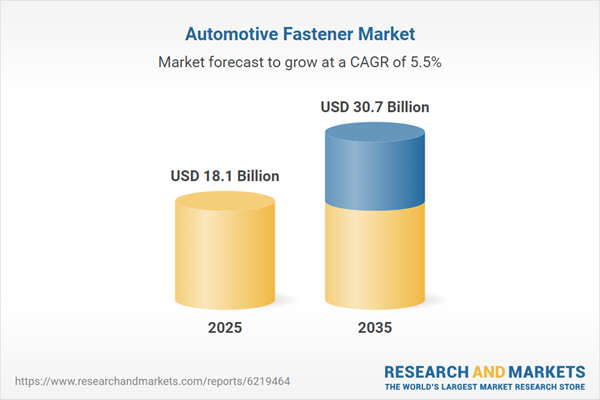

| Estimated Market Value ( USD | $ 18.1 Billion |

| Forecasted Market Value ( USD | $ 30.7 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |