Growth is supported by rising demand for safe, long-lasting cosmetic formulations and increasing consumer awareness around product hygiene and shelf stability. Cosmetic preservatives are described as essential formulation components that inhibit microbial growth and protect products from contamination during production, storage, and use. Their role is critical in maintaining product integrity, safety, and performance over time. As cosmetic formulations increasingly incorporate water-based systems, the need for effective preservation continues to rise. Regulatory oversight is also shaping market dynamics, as manufacturers must comply with strict safety standards while meeting consumer expectations. Advances in formulation science are supporting the transition toward safer and multifunctional preservation systems. Innovation in packaging and ingredient technology is further enhancing protection against contamination. Together, these factors are reinforcing the importance of preservatives as a core element in modern cosmetic product development.

The parabens segment accounted for USD 365 million in 2025. This category, along with other widely used synthetic preservation systems, continues to be adopted due to reliable antimicrobial performance. At the same time, demand for alternative preservation solutions is increasing as consumers seek gentler and environmentally aligned options. A range of preservation chemistries is being used to meet diverse formulation requirements while ensuring compliance with safety regulations.

The skin care products segment generated USD 545 million in 2025. Growth in this category is being driven by heightened focus on personal wellness, daily care routines, and ongoing product innovation. Rising interest across other personal care categories is also contributing to broader preservative demand.

U.S. Cosmetic Preservatives Market reached USD 418.8 million in 2025. Regional growth is supported by strong consumer spending on beauty products, continued formulation innovation, and rising preference for clean-label and responsibly formulated cosmetics across North America.

Key companies operating in the Cosmetic Preservatives Market include BASF SE, Evonik Industries AG, Clariant International Ltd, Symrise AG, Lanxess Corporation, Ashland, Lonza Group AG, Arkema S.A., Stepan Company, Troy Corporation, Inolex Chemical Company, Galaxy Surfactants Ltd, Sharon Personal Care, Brenntag SE, Naturex (Givaudan), Akema S.r.l, Thor Group (part of Arxada), Kumar Organic Products Ltd, Minasolve, Micro Science Tech, Spec-Chem Industry Inc., Dadia Chemical Industries, Salicylates and Chemicals Pvt Ltd.Companies in the Cosmetic Preservatives Market are strengthening their market positions through innovation, regulatory alignment, and portfolio diversification. Manufacturers are investing in research to develop safer, multifunctional preservation systems that align with clean beauty trends. Expansion of natural and mild preservative solutions is helping brands meet changing consumer preferences. Strategic collaborations with cosmetic formulators are supporting customized solutions and long-term supply agreements.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Cosmetic Preservatives market report include:- Akema S.r.l

- Arkema S.A.

- Ashland Global Holdings Inc

- BASF SE

- Brenntag SE

- Clariant International Ltd

- Dadia Chemical Industries

- Evonik Industries AG

- Galaxy Surfactants Ltd

- Inolex Chemical Company

- Kumar Organic Products Ltd

- Lanxess Corporation

- Lonza Group AG

- Micro Science Tech

- Minasolve

- Naturex (Givaudan)

- Salicylates and Chemicals Pvt Ltd

- Sharon Personal Care

- Spec-Chem Industry Inc.

- Stepan Company

- Symrise AG

- Thor Group (Part of Arxada)

- Troy Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | January 2026 |

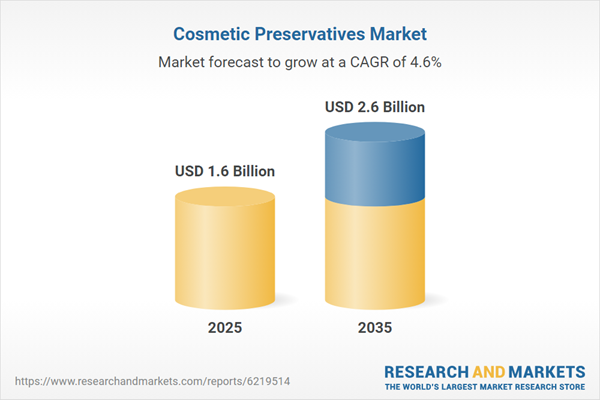

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.6 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |