Growth is supported by rising global wealth levels and increasing disposable incomes, which are enabling more consumers to access premium automotive offerings. Demand is also fueled by the growing population of ultra-high-net-worth individuals and evolving consumer expectations around comfort, performance, and brand exclusivity. Luxury vehicles are increasingly positioned as lifestyle assets that combine advanced technology, superior craftsmanship, and personalization. Automakers are expanding manufacturing capabilities across multiple regions to improve market access and reduce cost barriers, which further strengthens sales potential. Electrification strategies are also reshaping the competitive landscape, as luxury brands accelerate the development of premium electric models to align with sustainability goals while preserving performance standards. Early adoption of advanced powertrains and digital features continues to attract affluent buyers seeking innovation alongside status. As global mobility preferences evolve, luxury car manufacturers remain well-positioned to capture long-term demand through diversified product portfolios and enhanced ownership experiences.

The luxury SUVs and crossovers segment accounted for 50.1% share in 2025. This segment leads the market as buyers increasingly favor vehicles that combine upscale interiors with versatility, elevated seating positions, and strong visual presence. Spacious cabin layouts and adaptable storage configurations further enhance appeal among affluent consumers.

The internal combustion engine vehicles segment held 71.4% share in 2025 and is forecast to reach USD 750.8 billion by 2035. Despite the shift toward electrification, many luxury buyers continue to prioritize driving dynamics, acoustic performance, and mechanical refinement traditionally associated with ICE platforms. Extensive customization options linked to these powertrains also support sustained demand.

United States Luxury Car Market reached USD 162.3 billion in 2025. The country remains the largest global market due to strong purchasing power, high brand awareness, and sustained interest in premium mobility. Changing ownership models and demand for enhanced customer experiences continue to create expansion opportunities.

Key companies operating in the Global Luxury Car Market include Mercedes-Benz, BMW, Volkswagen, Toyota Motor (Lexus), General Motors, Ferrari, Tata Motors, Volvo, Aston Martin, and McLaren. Companies in the Global Luxury Car Market strengthen their market position through continuous innovation and strategic expansion. Manufacturers invest heavily in advanced powertrain technologies, digital connectivity, and autonomous features to enhance vehicle differentiation. Expanding electric and hybrid portfolios allows brands to address sustainability expectations without compromising performance. Strategic localization of production facilities improves cost efficiency and market responsiveness. Personalized design options and exclusive ownership programs help deepen customer loyalty. Strong branding, immersive retail experiences, and premium after-sales services further elevate value perception.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Luxury Car market report include:- BMW

- Volkswagen

- Mercedes-Benz

- Toyota Motor (Lexus)

- General Motors

- Tata Motors

- Ferrari

- Volvo

- Aston Martin

- Ford Motor

- Tesla

- Stellantis

- Pagani Automobili

- Koenigsegg Automotive

- Hyundai Motor

- McLaren Automotive

- Geely

- FAW

- BYD Auto

- SAIC Motor

- VinFast

- Lucid

- Rivian Automotive

- Xpeng Motors

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | January 2026 |

| Forecast Period | 2025 - 2035 |

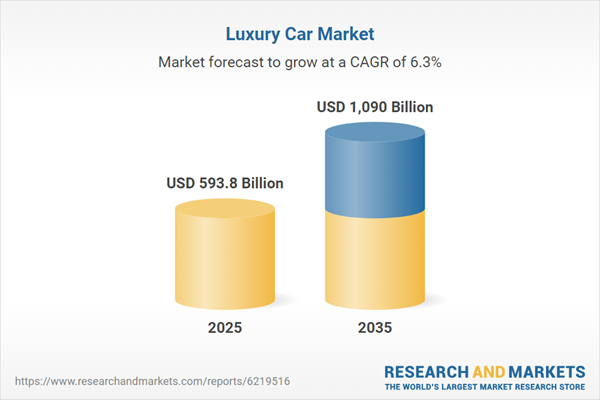

| Estimated Market Value ( USD | $ 593.8 Billion |

| Forecasted Market Value ( USD | $ 1090 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |