Market growth is driven by tightening global climate regulations, rising corporate net-zero commitments, and increasing adoption of market-based mechanisms to reduce greenhouse gas emissions. Carbon credits have emerged as a critical financial instrument enabling governments and corporations to offset emissions while supporting climate mitigation projects such as renewable energy, reforestation, and methane capture. The growing integration of carbon markets into national climate policies and emissions trading systems is enhancing market transparency and liquidity. Additionally, increasing pressure from investors and consumers for environmental accountability is compelling organizations to actively participate in carbon credit trading as part of long-term sustainability strategies.

Based on type, the compliance carbon credits segment held 98% share in 2025, owing to mandatory emission reduction frameworks under regulated emissions trading schemes. Compliance markets are primarily driven by strict regulatory mandates imposed on power generation, manufacturing, and heavy industrial sectors to limit carbon emissions. These credits provide regulated entities with flexibility to meet emission targets while maintaining operational continuity. The segment benefits from standardized verification mechanisms, government oversight, and predictable demand, making compliance carbon credits a cornerstone of global decarbonization efforts.

The renewable energy segment held 26.9% share in 2025, driven by large-scale investments in wind, solar, hydro, and bioenergy projects aimed at reducing dependence on fossil fuels. Renewable energy projects generate carbon credits by displacing carbon-intensive power generation, making them highly attractive for both compliance and voluntary markets. Utilities, independent power producers, and project developers increasingly monetize these credits to improve project viability and secure additional revenue streams. The segment benefits from strong policy support, long-term power purchase agreements, and growing corporate demand for clean energy-backed offsets.

Europe Carbon Credit Market will grow at a CAGR of 15.9% through 2026-2035, supported by the well-established EU Emissions Trading System (EU ETS). The region benefits from stringent climate regulations, advanced monitoring frameworks, and strong political commitment toward carbon neutrality. European industries actively participate in carbon trading to comply with emission caps while optimizing operational costs. The expansion of cross-border trading mechanisms and integration of additional sectors into the EU ETS continue to strengthen Europe’s leadership in the global carbon credit ecosystem.

Key players operating in the Global Carbon Credit Market include Verra, Gold Standard Foundation, Climate Impact X, South Pole, Carbon Trust, EcoAct, Shell plc, BP plc, TotalEnergies, and ENGIE, among others. These companies focus on project development, credit certification, digital trading platforms, and corporate decarbonization advisory services to expand their market footprint. Companies in the Carbon Credit Market are strengthening their market position through strategic investments in high-integrity carbon projects, digital trading platforms, and verification technologies. Leading players focus on expanding renewable energy, forestry, and nature-based projects to ensure long-term credit availability and quality. Partnerships with governments, corporates, and financial institutions help scale trading volumes and improve market transparency. Firms are also leveraging blockchain and AI-driven monitoring tools to enhance traceability, prevent double-counting, and build buyer confidence.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Carbon Credit market report include:- 3Degrees

- Allcot

- Atmosfair

- Carbon Clear

- Carbon Collective Company

- Carbon Credit Capital

- Carbonmark

- Carbonplace

- Climate Impact Partners

- Climeco

- EcoAct

- Ecosecurities

- Green Mountain Energy

- Shell

- South Pole

- Sterling Planet

- Terrapass

- The Carbon Trust

- Verra

- WGL Holdings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 151 |

| Published | January 2026 |

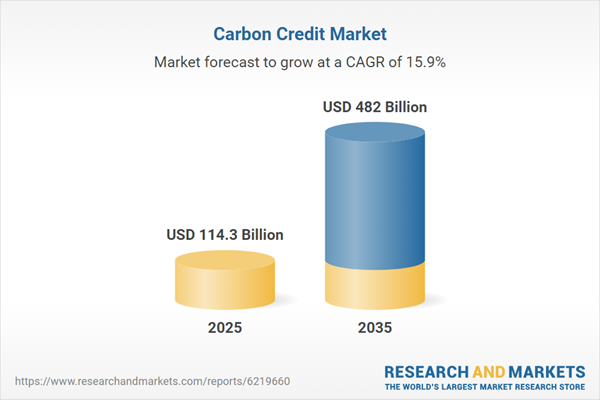

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 114.3 Billion |

| Forecasted Market Value ( USD | $ 482 Billion |

| Compound Annual Growth Rate | 15.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |