Speak directly to the analyst to clarify any post sales queries you may have.

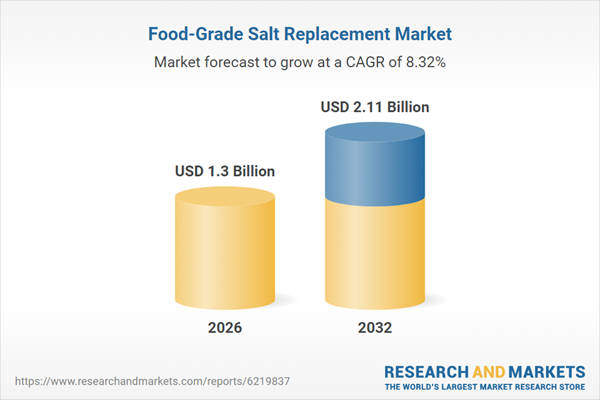

The Food-Grade Salt Replacement Market grew from USD 1.20 billion in 2025 to USD 1.30 billion in 2026. It is expected to continue growing at a CAGR of 8.32%, reaching USD 2.11 billion by 2032.

Food-grade salt replacement is moving from niche reformulation to strategic taste architecture as health policy and clean labels converge

Food-grade salt replacement is no longer a niche ingredient conversation confined to specialty “low sodium” SKUs. It has become a core capability for mainstream brands and foodservice operators that are being asked to deliver familiar taste while responding to public-health pressure to reduce sodium and to consumer expectations for simpler labels. The practical reality is that sodium chloride does far more than provide saltiness: it stabilizes microbial safety, shapes texture, influences fermentation kinetics, and modulates aroma release. As a result, replacing it is an engineering problem as much as a nutrition initiative.

At the same time, the demand signal is persistent. In the United States, average sodium intake remains well above recommended limits, and a large share of dietary sodium comes from commercially processed, packaged, and prepared foods rather than discretionary use at the table. (fda.gov) This creates sustained incentives for manufacturers to reformulate everyday categories without sacrificing consumer liking.

Against this backdrop, salt replacement is best understood as a portfolio of solutions that can be combined: mineral salts that partially substitute sodium chloride, flavor enhancers that amplify savory perception so less salt is required, and natural alternatives that support clean-label positioning. The winners are aligning ingredient selection with product matrix, processing conditions, and labeling strategy-then validating performance with sensory science and shelf-life data, not assumptions.

From sodium reduction to multisensory design: technology, regulation, and consumer trust are reshaping the salt-replacement playbook

The landscape is shifting from “salt out” thinking toward “salt function rebuilt” programs. The most advanced reformulators now start by mapping the roles of sodium chloride in a specific product-water activity control, protein extraction, dough rheology, emulsification, and flavor release-then choose a blend of substitutes and process changes to rebuild those functions. This is why salt replacement is increasingly sold as an application solution supported by pilot trials, rather than as a commodity ingredient.

Regulatory momentum is also changing the center of gravity. FDA’s voluntary sodium reduction targets have moved beyond a one-time publication into an iterative program, with a Phase II draft update issued in August 2024 that is intended to replace the 2021 guidance once finalized. (fda.gov) In parallel, FDA has pursued rulemaking intended to permit “safe and suitable” salt substitutes in standardized foods where standards of identity historically constrained reformulation flexibility. (fda.gov) Together, these actions increase the likelihood that more categories can be reformulated without forcing brands to abandon standardized names that consumers recognize.

Finally, consumer perception is evolving in ways that matter for formulation choices. Ingredients once viewed as “chemical” are being reconsidered when they are framed as culinary tools that help reduce sodium. This is especially relevant for umami-forward approaches, where small amounts of certain flavor enhancers can reduce total sodium while improving perceived fullness and linger. The commercial implication is clear: trust-building through transparent labeling, education, and consistent taste delivery is becoming as important as the underlying chemistry.

United States tariff dynamics in 2025 are altering input economics, routing choices, and sourcing strategies for salt-replacement ingredients

United States tariff conditions in 2025 reinforced a reality that ingredient buyers have been managing for several years: landed cost and supply continuity depend not only on base duties, but on whether additional duties apply, whether exclusions remain available, and whether logistics-related trade actions indirectly raise freight and compliance costs. For salt-replacement inputs that sit upstream of finished foods-ranging from mineral salts to fermentation-derived flavor systems-small shifts in trade policy can cascade into contract renegotiations and reformulation timelines.

A critical mechanism is the continued use of Chapter 99 additional duties for China-origin goods under Section 301. The U.S. tariff schedule has long reflected additional duties provided for in headings such as 9903.88.03 and 9903.88.04, which were created to apply increased ad valorem duties to a large set of covered subheadings. (usitc.gov) Even when a specific food additive or processing input is not always sourced from China, the existence of these duties changes the “credible alternative” set in supplier negotiations and pushes more dual sourcing and qualification of non-China origins.

In 2025, exclusion management remained a major operational lever rather than a clerical task. USTR extended certain Section 301 exclusions that otherwise would have expired, providing time-limited relief that importers had to actively monitor and claim correctly. (ustr.gov) This kind of rolling deadline increases the value of tariff engineering, harmonized classification rigor, and contingency planning, especially for companies that are qualifying potassium-based replacements, yeast-derived systems, or specialized mineral blends across multiple finished-good plants.

Beyond duties, trade actions that affect shipping economics can also matter. In April 2025, USTR announced phased responsive actions tied to maritime, logistics, and shipbuilding sector dominance concerns, underscoring that supply-chain policy can intersect with ocean transport and broader cost-to-serve. (ustr.gov) For salt replacement programs, the cumulative impact is a stronger bias toward resilient sourcing footprints, higher emphasis on regional production options, and formulation flexibility that can tolerate ingredient substitutions without revalidating the entire product.

Segmentation lens reveals how ingredient chemistry, format, source, and use-case determine performance across food systems and channels

Ingredient type is the first performance divider because it determines both sensory shape and functional coverage. Mineral Salt solutions-built around Potassium Salts, Magnesium Salts, and Calcium Salts-are typically the most direct route to sodium reduction because they preserve “salt-like” ionic behavior, but they can introduce bitterness, metallic notes, or altered solubility that vary by food matrix and processing temperature. Flavor Enhancers such as Monosodium Glutamate (MSG) and Yeast Extracts often deliver a different advantage: they raise perceived savory intensity and mouthfulness so that the same product tastes adequately seasoned at lower sodium levels, which can reduce the need to push mineral substitution to a sensory breaking point. Plant-Based & Natural Alternatives are increasingly deployed to support label simplicity and culinary positioning, though their batch variability and interaction with Maillard reactions can complicate standardization.

Form Factor choices-Powder, Granules, Liquid, and Flakes-act as a manufacturing constraint as much as a customer preference. Powders and granules tend to integrate with dry blends and seasoning systems, while liquids can improve dispersion in sauces and dressings and can reduce dust handling. Flakes can be used strategically to deliver localized salt impact on the tongue, improving perceived saltiness at lower total sodium.

Source Type is becoming a procurement and claims battleground. Synthetic options can offer tight specification control, while Natural, Plant-Derived, and Fermentation-Based systems are gaining share in applications where “recognizable sourcing” supports brand narratives. Use-Case Type clarifies why blends are winning: Sodium Reduction rarely stands alone, and programs increasingly combine Flavor Enhancement, Bitterness Masking, Preservation, and Texture Modification objectives in one design.

Application and buyer context complete the picture. Bakery & Confectionery and Dairy & Frozen Foods often require delicate control of fermentation and protein functionality, Meat & Alternatives and Ready-to-Eat / Processed Foods emphasize safety and shelf life, Snacks & Savory Products depend on top-note delivery and surface adhesion, and Soups, Sauces & Dressings demand fast dissolution and stable flavor release. End-User needs differ accordingly across Food Processing Companies, Quick Service Restaurants (QSRs), Household / Retail Consumers, Institutional Catering, and Nutraceutical Manufacturers, while Distribution Channel dynamics vary between Direct Sales (B2B) technical support, Distributors & Wholesalers reach, and Online Retail education-led conversion.

This comprehensive research report categorizes the Food-Grade Salt Replacement market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

Market Segmentation & Coverage

- Type

- Form Factor

- Source Type

- Use-Case Type

- Application

- End-User

- Distribution Channel

Regional adoption patterns diverge as reformulation pressure, labeling norms, and culinary preferences shape salt-replacement demand worldwide

In the Americas, salt replacement adoption is strongly tied to packaged-food reformulation cycles and foodservice standardization. The North American conversation is shaped by sustained attention to sodium reduction targets and by the operational reality that most sodium is consumed through commercially prepared foods, which makes reformulation a high-leverage intervention point for population intake. (fda.gov) As a result, solutions that can be scaled across multiple plants and that maintain consistent taste across distribution distances tend to outperform single-ingredient swaps.

Europe is characterized by a mature reformulation culture and high retailer influence, which pushes suppliers to provide evidence-backed taste and label compliance packages. The region’s diversity in labeling norms and consumer expectations increases the value of modular systems that can be tuned by country, especially where potassium-based approaches require careful communication for sensitive populations.

In the Middle East & Africa, adoption patterns are shaped by a dual track: multinational brands bring global reformulation playbooks, while local producers prioritize affordability, shelf stability, and resilience under import constraints. This combination often favors mineral-based sodium reduction where supply is dependable, supported by flavor systems to protect local taste profiles.

Asia-Pacific is both a major production base for certain flavor ingredients and a region with highly varied culinary salt sources, from sauces to seasonings. This complexity increases opportunities for umami-led salt reduction and fermentation-based systems, but it also raises the importance of aligning solutions with dominant cuisines and with local regulatory and health authority guidance. Globally, the growing attention to lower-sodium salt substitutes that often contain potassium chloride highlights the need to balance sodium reduction benefits with hyperkalemia risk management for vulnerable groups. (who.int)

This comprehensive research report examines key regions that drive the evolution of the Food-Grade Salt Replacement market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

Regional Analysis & Coverage

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive environment is defined by integrated taste platforms, mineral supply resilience, fermentation know-how, and application-led collaboration

Competition is consolidating around “platform capability” rather than isolated ingredients. Leading suppliers differentiate by combining mineral options with taste modulation, bitterness control, and process guidance so customers can hit sodium targets without losing signature flavor. This pushes the market toward co-development models, where ingredient vendors run application labs that replicate customer processes, generate stability data, and provide stepwise reformulation pathways that protect time-to-market.

Mineral-salt supply remains a strategic axis. Players with dependable access to food-grade potassium, magnesium, and calcium inputs are better positioned to support multi-plant rollouts and to offer consistent particle size, solubility behavior, and impurity control. At the same time, flavor enhancer leadership is increasingly tied to fermentation know-how and to the ability to deliver consistent umami impact with predictable sodium contribution, which can be essential in categories where “less salt” otherwise reads as “less flavor.”

Another differentiator is regulatory and labeling fluency across regions. As FDA pursues greater flexibility for salt substitutes in standardized foods and updates its voluntary sodium reduction framework, suppliers that can translate policy direction into practical formulation choices gain credibility with both R&D and quality teams. (fda.gov) Finally, commercial strength increasingly depends on service models that match buyer type. Food Processing Companies often demand deep technical integration and documentation, QSRs prioritize operational simplicity and consistent taste at scale, Institutional Catering balances nutrition standards with cost-per-serving, Household / Retail Consumers respond to education and taste reassurance, and Nutraceutical Manufacturers require tight specification and compliance discipline.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food-Grade Salt Replacement market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

Competitive Analysis & Coverage

- Cargill, Incorporated

- Tate & Lyle PLC

- Ajinomoto Co., Inc.

- Kerry Group plc

- K+S Aktiengesellschaft

- Givaudan SA

- Archer-Daniels-Midland Company

- DSM-Firmenich AG

- Sensient Technologies Corporation

- Tata Group

- Unilever PLC

- Dr. Paul Lohmann GmbH & Co. KGaA

- Cumberland Packing Corporation

- Klinge Chemicals Limited

- Angel Yeast Co., Ltd.

- B&G Foods, Inc.

- China National Salt Industry Group Co., Ltd.

- Church & Dwight Co., Inc.

- Corbion N.V.

- ICL Group Ltd.

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Jungbunzlauer Suisse AG

- Lallemand Inc.

- McCormick & Company, Incorporated

- Morton Salt, Inc.

- MVG S.r.l.

- Nu-Tek Products, LLC by J&K Ingredients, Inc.

- Ohly GmbH by ABF Ingredients Limited

- SALT Minerals GmbH

- Saltwell AB by Salinity Group

- SaltWise

- Symrise AG

Action priorities for industry leaders: de-risk supply, prove sensory parity, protect vulnerable consumers, and accelerate compliant innovation

Industry leaders should treat salt replacement as a managed transformation program with clear decision gates, not as an ingredient trial. The first priority is building a formulation architecture that separates “saltiness delivery” from “salt functionality,” then assigns each role to an appropriate tool. This makes it easier to choose when Mineral Salt substitution is appropriate, when Flavor Enhancers should carry more of the sensory load, and when Plant-Based & Natural Alternatives can support label strategy without creating variability or shelf-life surprises.

The second priority is proactive risk management for both supply and consumers. On supply, procurement teams should pressure-test exposure to additional duties and the possibility of expiring exclusions, then qualify backup origins and formats that can be swapped with minimal revalidation. USTR’s ongoing management of Section 301 exclusions illustrates why this monitoring must be continuous, not annual. (ustr.gov) On consumer safety, potassium-containing approaches require guardrails, especially for individuals with impaired kidney function who may be at risk from elevated potassium intake. Building clear labeling practices and customer guidance aligned with public health messaging reduces reputational risk. (who.int)

Third, sensory parity must be proven in the eating moment. Companies should institutionalize quantitative descriptive analysis, temporal dominance methods, and bitterness detection thresholds across Powder, Granules, Liquid, and Flakes implementations to ensure that sodium reduction does not introduce aftertastes that erode repeat purchase. Finally, leaders should align go-to-market with end-user realities: Direct Sales (B2B) should emphasize documentation and validation, Distributors & Wholesalers should be equipped with application guidance, and Online Retail should focus on simple education that explains why “less sodium” can still taste satisfying.

Research approach blends primary expert validation with structured secondary evidence to map regulations, technology signals, and buyer behavior

The research methodology for this executive summary is designed to reflect how salt replacement decisions are made in practice: by triangulating regulatory direction, ingredient capability, and operational constraints across applications. The approach integrates structured secondary research across government and intergovernmental publications, trade-policy announcements, and food regulatory guidance with targeted validation from industry practitioners spanning formulation, quality assurance, procurement, and foodservice operations.

Regulatory and public-health context is grounded in primary-source documents that define the operating environment for sodium reduction initiatives, including FDA guidance updates and international health authority guidance on lower-sodium salt substitutes. (fda.gov) Trade-policy context is anchored in official U.S. government communications on tariff mechanisms and exclusion extensions that influence ingredient landed cost and sourcing decisions. (ustr.gov)

Analytical outputs are built through a consistency-first framework. Ingredient and solution themes are categorized by functional role, sensory impact, and manufacturability, then mapped to applications where sodium chloride is structurally important versus primarily sensory. Regional perspectives are synthesized by comparing adoption drivers such as labeling expectations, reformulation pressure, and supply-chain resilience needs. Throughout, claims are reviewed for factual consistency with primary sources, and interpretive judgments are explicitly framed as directional implications for decision-makers rather than as market size statements or forecasts.

Executive takeaways highlight where performance, safety, and cost intersect, clarifying what will differentiate winners in salt replacement

Food-grade salt replacement is entering a more disciplined era in which “good enough” taste is not sufficient; solutions must be repeatable, safe, and scalable under real manufacturing constraints. The most important takeaway is that successful sodium reduction depends on matching tools to functions: mineral substitution where ionic behavior matters, flavor enhancement where savory perception can carry the experience, and natural alternatives where label goals justify added variability management.

Regulatory direction and public health pressure are reinforcing demand durability. FDA’s continued evolution of voluntary sodium reduction goals and its efforts to expand flexibility for salt substitutes in standardized foods are pushing more categories into active reformulation pipelines. (fda.gov) Simultaneously, global health authorities are elevating lower-sodium salt substitutes as a strategy while emphasizing the need to manage potassium-related risks for certain groups. (who.int)

Cost and supply resilience are now inseparable from technical choice. Tariff mechanisms and exclusion windows can shift landed costs and supplier attractiveness quickly, making dual sourcing and specification discipline as important as sensory optimization. (ustr.gov) Companies that build modular formulations, validate performance across form factors, and maintain clear consumer communication will be best positioned to protect product equity while meeting sodium reduction objectives. The next phase of competition will reward those who treat salt replacement as an enterprise capability spanning R&D, regulatory, procurement, and brand stewardship.

Table of Contents

Companies Mentioned

Cargill, Incorporated

Tate & Lyle PLC

Ajinomoto Co., Inc.

Kerry Group plc

K+S Aktiengesellschaft

Givaudan SA

Archer-Daniels-Midland Company

DSM-Firmenich AG

Sensient Technologies Corporation

Tata Group

Unilever PLC

Dr. Paul Lohmann GmbH & Co. KGaA

Cumberland Packing Corporation

Klinge Chemicals Limited

Angel Yeast Co., Ltd.

B&G Foods, Inc.

China National Salt Industry Group Co., Ltd.

Church & Dwight Co., Inc.

Corbion N.V.

ICL Group Ltd.

Ingredion Incorporated

International Flavors & Fragrances Inc.

Jungbunzlauer Suisse AG

Lallemand Inc.

McCormick & Company, Incorporated

Morton Salt, Inc.

MVG S.r.l.

Nu-Tek Products, LLC by J&K Ingredients, Inc.

Ohly GmbH by ABF Ingredients Limited

SALT Minerals GmbH

Saltwell AB by Salinity Group

SaltWise

Symrise AG

Table Information

| Report Attribute | Details |

|---|---|

| Published | February 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 2.11 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |